Ultimate Guide to US Sales Tax

Looking for a specific sales tax topic?

| In which states is my business required to collect sales tax? | Go to Sales Tax Nexus |

| How do I register for a sales tax permit? | Go to Registrations |

| How do I charge every customer the right amount of sales tax, every time? | Go to Charging Sales Tax |

| Is what I sell subject to sales tax? | Go to Product Taxability |

| How do I remit this sales tax I collect to the state? | Go to File and Pay Sales Tax |

| I want to use a resale certificate to buy products tax free for resale. How does that work? | Go to Resale Certificates |

| I’m not even in the US. Do I need to collect sales tax? | Go to International Sellers |

The US has one of the most complicated sales tax systems in the entire world.

For retailers, especially e-commerce sellers, this can mean you end up spending your valuable time trying to solve sales tax problems rather than doing what you do best: running your business.

Ever scratched your head trying to figure out in which states you’re required to collect sales tax? Are you still confused about how much to collect from each customer?

Then you’re in the right place. This comprehensive sales tax resource covers everything from what this ubiquitous tax is to how to file a return in California (and every other state).

Read the whole thing, or click the links to solve your particular sales tax problem.

| Further reading: • Find out how to calculate sales tax in Texas (by county and city) in 2023. • Take a closer look at the rules for sales tax in California and how to pay it easily. |

What is sales tax?

Sales tax is an indirect tax on goods and sometimes services. The sales tax is a percentage of the sales price, generally between 4 and 8%.

In the US, sales tax is paid by the buyer, collected at the point of sale by the seller, and later remitted to the state by the seller to be spent toward budget items like roads or public safety.

Sales tax is also sometimes referred to as a “pass through tax” since it is collected by a retailer but then passed on to the state. It's also a "consumption tax" since a buyer only has to pay sales tax on items they buy.

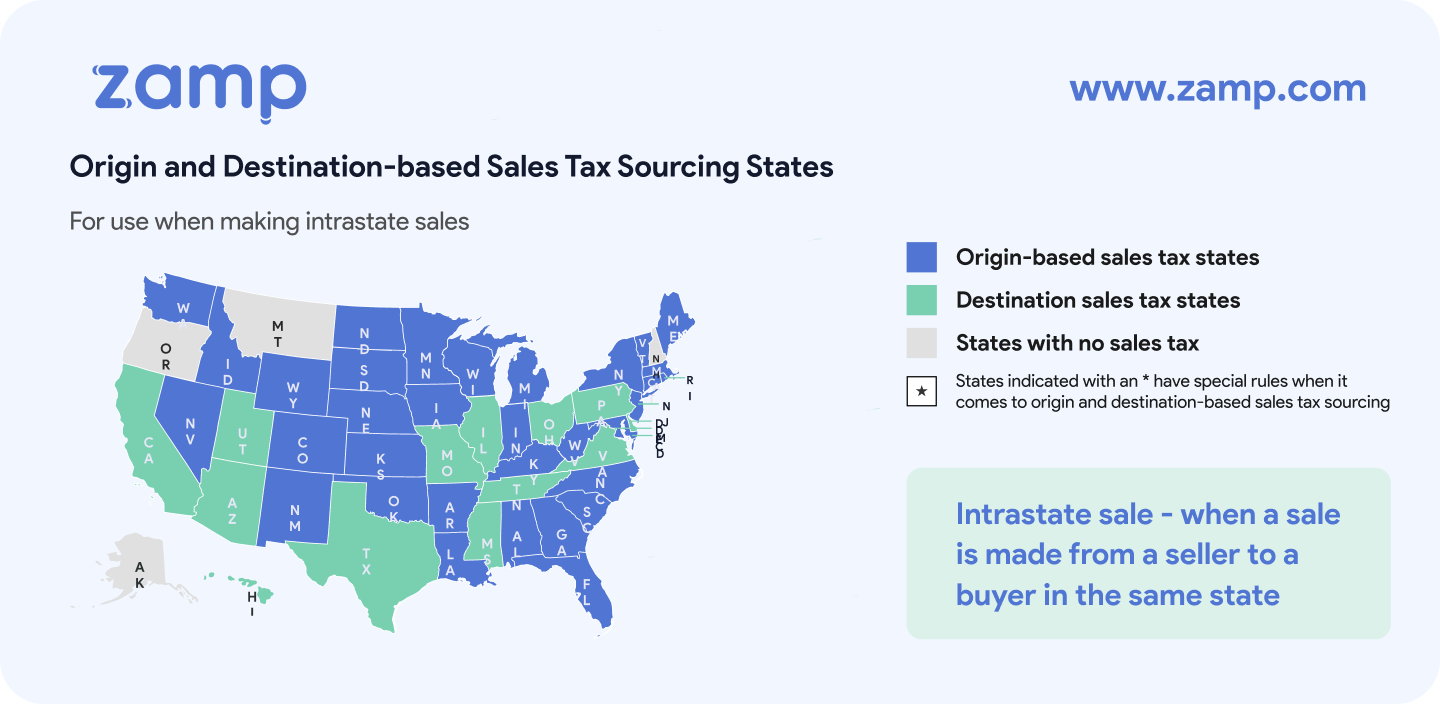

Forty-six US states and Washington DC all have a sales tax. And because of the way the US works, each state gets to make their own laws, rules and regulations when it comes to things like how much sales tax to charge, what products are taxable, and how merchants should collect and remit sales tax.

What is use tax?

You’ll often hear the phrase “sales and use tax.” This is because sales and use taxes are two sides of the same coin.

A merchant charges sales tax on items that they sell. But in some cases the merchant isn’t required to charge tax. This doesn’t mean that the item isn’t taxable. Instead, it means the consumer is required to pay a “use tax” on the item they bought and didn’t pay sales tax on.

The use tax due is generally the same as the amount of sales tax the consumer would have paid had a tax been charged.

It’s literally called “use tax” because they are paying the tax on an item they are using in the state.

Use tax, though, is very difficult to enforce on consumers. While state income tax returns generally have a field for consumers to report the use tax they should have paid, few taxpayers understand the concept of paying use tax.

Because of this, failure to pay use tax might go undetected unless the use tax is due on a large purchase such as a car.

Businesses, however, are another matter. The state expects businesses to keep up with your use tax obligations. In fact, if you don’t report any use tax this may flag you for a sales tax audit.

States wanting their fair share of use tax is also a big reason that regulations such as “economic nexus” laws passed that require that high-volume e-commerce sellers charge sales tax on purchases to buyers in states where they make a significant volume or number of sales, even when the merchant doesn’t have nexus in that state.

Who has to collect sales tax?

US sales tax is collected by businesses and remitted to the state taxing authority.

You are required to collect if:

- Your business has sales tax nexus in a state

- The products or services you sell are taxable in that state

- You’re not a third-party marketplace seller (such as selling on Amazon or Walmart) where the marketplace is required to collect sales tax on your behalf

We explain who is required to collect sales tax in our ultimate guide to sales tax nexus.

What products and services are taxable?

In most cases, tangible personal property like a bookshelf or a toothbrush are subject to sales tax.

States get to decide which items are considered taxable in the state. For this reason, some items that are considered necessities, like groceries or medication, are non-taxable in many states. Other states consider items non-taxable due to economic considerations. For example, Mississippi changed the law to make Christmas trees cut and sold on the premises non-taxable in order to assist tree farmers.

In most cases, services are not taxable, but that is also starting to change. A service like graphic design is generally not taxable, but can be taxable if the service also includes a tangible product, such as a t-shirt.

As we buy more digitally, states are also considering the taxability of things like digital books and music. Some states say these are non-taxable since they’re not something you can pick up or touch. But other states say they are taxable because they are simply digital copies of something that also comes in tangible format. (i.e. How an e-book is related to a paper book, etc.)

Quick product taxability links:

- Are groceries taxable?

- Is clothing taxable?

- Are digital goods taxable?

- Is Software as a Service (SaaS) taxable?

How to Get Compliant with States

States require that companies who need to collect sales tax first register for a seller's permit.

When you register, the state will assign you a filing frequency depending on your sales volume. In most states, you’ll be required to file and pay monthly, quarterly or annually.

States generally consider it unlawful to start doing business selling taxable property without registering first, so be sure to sign up for a sales tax permit right away.

Read about registering for a seller's permit here.

How to Collect the Right Amount of Sales Tax

This can get immensely tricky for e-commerce companies.

Sales tax is collected based on the combined tax rate at the point of sale. For e-commerce sales, the point of sale is the buyer’s ship-to address.

And the tax rate at the point of sale consists of a state rate, plus county, city and other “special taxing district” rates.

Because of the wonky way boundaries and jurisdictions are drawn, two addresses on either end of the very same street might have two different tax rates.

Read our guide to charging the right amount of sales tax here.

How to File and Pay Sales Tax

Once registered, the state assigns you a filing frequency and due dates. Once your filing due date rolls around, you’re required to file a sales tax return and remit all tax collected to the state (and sometimes local areas, too.)

Read all about how to file and pay sales tax here.

Common Questions about US Sales Tax

What are the US states with no sales tax?

Currently Delaware, Montana, New Hampshire, and Oregon do not have a sales tax.

Alaska has no statewide sales tax, but some Alaska local areas have a sales tax.

Why is there a sales tax on used items?

Because sales tax is levied at the time of the transaction rather than on the particular item. If other taxability requirements are met, the transaction is taxable even if the item is being sold is used.

Why doesn’t the US include sales tax in the price of items?

This is generally due to transparency. Including tax would make it difficult for the buyer and seller to see how much sales tax is actually paid. Also, since sales tax varies from place to place it would be difficult to price items accordingly, especially on a website where sales tax is charged at the buyer’s ship to address.

Many states also specifically require that the seller show the buyer the tax amount separately from the price of the items being purchased.

Are small or seasonal businesses required to collect and pay sales tax?

This question often stems from a misconception.

Essentially, even though a business is small or seasonal, it's still required to be sales tax compliant.

Small Seller Exemption

Some businesses may be wondering then what is the “small seller exemption” when it comes to economic nexus laws.

This is when a state exempts smaller sellers from their state’s economic nexus law by setting a threshold that most very small businesses do not meet. While thresholds vary, they are most often $100,000 in sales into the state per year or 200 separate sales into the state in a year. If your business’s sales volume in the state is lower than that, then it is part of the small seller exemption.

We cover economic nexus and the small seller exemption in detail in our economic nexus overview here.

Buying Products for Resale

One instance where a business (small or otherwise) won’t need to pay sales tax at the point of sale is if you are buying products for resale.

As long as you have a valid resale certificate (AKA exemption certificate, which is often the same as a state sales tax permit) and you are truly buying products to sell for resale then your vendor may not require that you pay sales tax on those items. And even if the vendor refuses your resale certificate, you can often claim a credit on that state’s tax return.

Just keep in mind that you should only use resale certificates to buy goods that you intend to either sell for resale or use in the making of products that you are selling for resale. It is unlawful to use a resale certificate for any other purpose, such as buying office supplies or items you intend for other personal or business uses.

We cover resale certificates in detail here.