Ultimate Guide to State Sales Tax Audits

In brief:

- States perform sales tax audits because they expect that your company is noncompliant and owes them past due sales tax

- A large number of red flags, some of which are not even in your control, might trigger a sales tax audit

- Zamp’s tips for enduring a sales tax audit can ensure your audit is as efficient and painless as possible

If you’ve found this article, chances are you’re experiencing the pain of a sales tax audit.

If you received one of those dreaded audit notifications from a state’s department of revenue, we recommend immediately contacting a state and local tax expert (SaLT). These professionals will guide you and prevent you from making any mistakes in the audit process.

And after that, read on for what you need to know about state sales tax audits.

Why am I being audited?

States perform a sales tax audit when they think that their state and local sales tax laws are not being followed. States use sales tax revenue for budget items like ambulances and elementary schools, so they have a vested interest in closing the tax gap between what tax is owed to them and what is actually paid.

It is also understood, but not explicitly stated, that state sales tax auditors will bring in a multiple of their salary in newly found sales tax every year.

When you are the subject of a sales tax audit, the entire process can feel unfair and punitive. But in the auditor’s (and the state’s) mind, the goal is to ensure that all businesses who have been noncompliant become compliant and contribute to the state’s coffers going forward. Of course, they also want the past due sales tax that you should have collected, plus any penalties and interest owed.

States may choose to audit your business for a number of reasons, but here are the most common sales tax audit triggers:

You Made Sales Tax Filing and Payment Mistakes

Auditors are looking for taxpayers who are either careless or clueless about sales tax. These taxpayers are more prone to errors which could mean that they’re noncompliant or not complying correctly. Some mistakes auditors look for include:

- Returns filed late or not filed at all - This can lead auditors to believe that you’re careless in other ways when it comes to sales tax compliance.

- Returns filed, but with mistakes - including not filling out the entire return, not filling in local sales tax collected, sales tax amounts not balancing, etc.

- Filing and payment doesn’t follow the rules - Some states and jurisdictions require taxpayers to file electronically or pay in a certain way. If your business continues to ignore these administrative rules your business might be subject to further scrutiny.

- Zero consumer use tax reported - Many businesses, especially new businesses, have capital startup costs like buying office furniture or new machinery. If you buy those items without paying sales tax on them, you’re required to pay “consumer use tax” to your own state. Auditors will look suspiciously upon a new or growing business with no consumer use tax reported.

- Erroneously reported exempt sales - For example, you sell clothing and report exempt sales in a jurisdiction where clothing is not tax exempt. This can be a red flag to an auditor that you are not collecting sales tax correctly.

You or Your Industry is Under Scrutiny

Was there an article about your business in the local business journal? Maybe you were acquired or are raising money? A savvy auditor may be out there double checking that you are registered to collect sales tax and doing it properly.

The same goes for whole industries. Sales tax auditors pay attention to business trends. When a new trend sweeps the market, they may do an audit sweep of everyone on that bandwagon to ensure that they understand current sales tax laws as it relates to their industry. One current trend is to double check that retailers who sell digital products like videos, e-books or online courses are taxing them correctly.

Speaking of industries, auditors also look at the general range of gross sales and sales tax collected across various industries, and if yours varies too far from the norm, you may find yourself with an audit letter. For example, say most furniture stores in the jurisdiction pay about $10,000 in sales tax per taxable period while your furniture store only pays $2,000. Auditors see a potential tax fraud there.

Fair or not, auditors also love to look at businesses in industries with complicated sales tax rules. In their eyes, it’s up to your business to understand and comply, even if the industry’s sales tax law is complex enough to make your ears bleed.

You were Caught Up in Another Audit

When auditors spend the six months up to multiple years it takes to conduct a thorough audit, they look for clues as to other businesses who might also be noncompliant.

If you did business, either as a vendor or a customer, of a business that was found to be noncompliant, the auditor might also have some questions for you, too.

You were Caught Being Noncompliant

Ever had an eager sales clerk promise, “If you pay cash, I won’t charge you sales tax.” I have, and so have auditors.

Unfortunately, not sticking to the letter of the law when it comes to sales tax can expose you to an audit. Disgruntled employees, competitors and even customers have been known to report a company for sales tax noncompliance.

Some auditors will go to a business’s website, put some items in the cart, enter a shipping address and see how much, if any, sales tax is charged.

Or, an auditor might become aware that you were doing business in the state for three years, but that you only applied for a sales tax permit 18 months ago.

All of these sales tax compliance discrepancies can lead to audits.

How to Prepare for a Sales Tax Audit

Before the audit begins, there are steps you can take to make the process less painful. Being organized and concise can even endear the auditor to you by proving that you take your sales tax compliance seriously and have nothing to hide.

Before the audit:

- Consult with a sales tax expert - State and Local Tax experts (SaLTs) will be able to advise you on how best to handle the audit and how to interact with the auditor.

- Determine your own sales tax liability - The auditor will be looking to determine how much sales tax plus interest and penalties that you owe to the state. And if you don’t have at least a ballpark figure in mind, you’ll have a harder time challenging the auditor’s assessment.

- Collect all resale certificates - Ensure that you have documentation of every single time you did not charge sales tax to a customer. Make sure all of these exemption certificates are on file, fully filled out, and signed by the customer.

- Make sure your sales tax returns are up-to-date and paid - Cleaning up any missing filings or payments shows good faith that you are getting your sales tax house in order.

What to do During a Sales Tax Audit

The sales tax audit process can be a fraught time, but you can make it as quick and painless as possible with these strategies.

Isolate the Auditor

But be nice about it!

When the auditor is visiting your facility, it’s best to put them in a room by themselves with the documentation they request. Be sure to instruct any employees who might interact with the auditor to be courteous and professional but also to follow the rest of the tips in this article, such as getting all requests in writing.

On one hand, there’s no need to have them wandering around your facility (and potentially discovering further avenues for inquiry into your business, such as a new machine they can wonder if you paid the use tax on.) But on the other hand, you also want to keep the auditor well-disposed toward you. No need to shove them in a closet or turn the heat up to 80 degrees and deny them water.

Plus, a happy auditor can go easier on you, or even fight on your behalf with their superiors.

Give the Auditor What They Ask For (But Nothing More)

If your books are disorganized, it can be tempting to turn all of your financials over to the auditor and let them have it. But this is also the worst thing that you can do.

It’s critical that you only give the auditor the exact information they ask for, and nothing else. Also be sure to instruct your employees on this, too. Providing the auditor with too much information can lead them down more rabbit holes where they find more noncompliance.

Be Careful What you Sign

Carefully read and understand everything you are asked to sign. The auditor is not on your side and it isn’t their job to explain to you what you are signing. We recommend having a SaLT or legal counsel overlook all documentation before signing.

Decline Statute of Limitations Waivers

The auditor might ask you to sign a waiver allowing them more time to go over your case. Your SaLT advisor will often advise you not to sign this, thus giving the state more time to audit you.

However, there may be cases where you need more time to produce the information the auditor requires. In that case, you may consider signing the waiver. Think carefully before signing, however, because this does give the auditor a longer audit period and more time to look into your business.

Be Wary of Sampling Methods

Your auditor generally does not look at every single transaction you make. Instead, they will sample your records using either random sampling or block sampling.

With random sampling, they audit your business activities at random times. With block sampling, they audit a block of time. Either way, they use these methods to determine how much you might owe.

In general, you want your auditor to use random sampling. This gives a clearer and broader picture of your business. If they use block sampling, they may inadvertently sample a block of time where your business is busiest, such as the holiday season. This could lead to the auditor concluding that you owe much more past due sales tax (with the associated interest and penalties) than you actually do.

On the other hand, if the auditor offers to use block sampling over a time period that benefits you, such as your slow season, then you may decide to take them up on their (probably unintentional) generosity.

Keep Track of Everything You Give the Auditor

The sad fact is that sales tax audits can take years. They can span employee turnover at both your business and the state’s taxing authority. Keep track of every document and piece of information you give to the auditor. Not only does this make the audit go faster, it works in your favor if you find yourself later applying for a penalty waiver.

Get Everything in Writing

Speaking of tracking everything, ask the auditor to send you requests or instructions in writing. This is just good business practice, plus a tricky auditor might ask for an unreasonable piece of information. They are unlikely to want to put this type of request in writing and thus create a paper trail.

Be Timely and Meet all Deadlines

Failing to get information to the auditor by the due date can drag the audit process out. While that might, at first, sound like a good thing, this actually means that you can lose the right to appeal the results of the audit. If you do end up with fines and penalties, you can also lose the chance at a waiver of penalties because you are deemed noncompliant with the audit.

Issues a Sales Tax Auditor Might Find

If an audit finds unpaid or underpaid sales tax, the auditor will likely look to state sales tax laws and regulations to assess interest and penalties.

These are the most common issues that sales tax auditors find. Use this as a checklist to ensure that your sales tax house is in order before the auditor arrives.

Failure to Charge the Right Amount of Sales Tax

With more than 11,000 taxing jurisdictions in the US, pinpointing the exact combined sales tax rate at your customer’s address can be a challenge. (Unless you use Zamp, of course.) These common sales tax charging mistakes often come up in audits?

- You charged sales tax for the wrong jurisdiction (ex: you charged the wrong county’s sales tax to your customer)

- You failed to collect some taxes (ex: you charged county tax to a customer, but didn’t charge the applicable city tax)

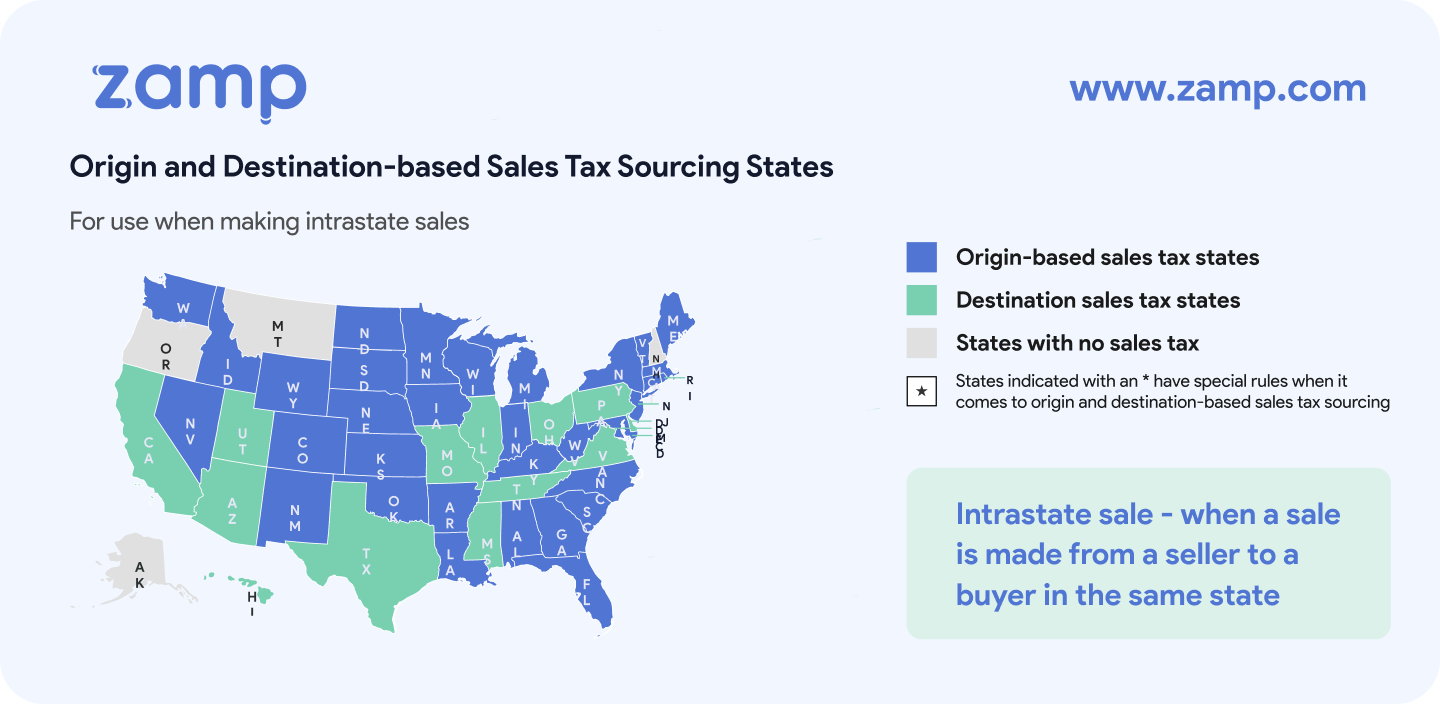

- You charged sales tax based on the wrong sales tax sourcing (ex: you charged everyone sales tax at your business’s combined sales tax rate rather than the rate at your customers’ ship-to addresses)

Failure to Charge Sales Tax on Taxable Transactions

Since sales tax varies from state to state, it’s easy for retailers to fail to realize that some transactions are taxable. Common errors here include:

- Failure to charge tax on sales made to non-profit organizations that seller believed to be exempt but are not

- No sales tax collected on shipping charges in states where that is required

- No sales tax collected on services in states where that is required

- Failure to tax bundled transactions (such as a product plus a service) according to state law

Missing Resale Certificates

One of the most common mistakes auditors find is that you are missing exemption certificates (AKA resale certificates) for untaxed sales.

If you did not charge sales tax to a customer but don’t have that customer’s resale certificate to back this up, then the onus is on you to pay that uncharged sales tax.

Every time your business does something out of the ordinary when it comes to sales and use tax, it’s vital to have documentation to back up your decision.

Use Tax Mistakes

When you buy an item without paying sales on it, you are required to document why. If the item is for use in your business, such as a desk or a piece of machinery, and you didn’t pay sales tax at purchase, you are required to pay use tax on that item.

Auditors will look for instances where you did not pay use tax. These include:

- Failure to pay use tax on untaxed purchases used by your business and not resold

- Failure to pay additional local tax when purchases are consumed in multiple local jurisdictions (i.e. you paid the use tax for a purchase)

- Failure to have proper documentation to support non-taxable purchases such as downloaded software and other digital products

- Failure to have receipts to support charges made on credit cards to show where purchase occurred and that tax was charged

- Improper or unclear invoices that don’t accurately portray the sales transaction

- Operating and capital leases that are not taxed properly

- Intercompany transactions that are not properly taxed or documented

- Asset sales or business disposition that are not properly taxed

What to do After a Sales Tax Audit

When the audit is complete, your auditor will provide you a Notice of Assessment that informs you of interest and penalties that your business may be subject to.

Penalties vary from state to state and depending on other factors, but they are generally around 30% of the underpaid sales tax.

We recommend always applying for a penalty waiver. While state law often dictates how much you must pay in interest, the state taxing authorities often have some discretion over how much they levy in additional penalties.

You can also protest an audit. States have different rules when it comes to how long you have to appeal, but sometimes this can be as short as 30 days. We again recommend consulting a SaLT when it comes to protesting the results of an audit.

On the other hand, if you are certain the audit was fair and square, it may be worthwhile to simply pay your penalties and get sales tax compliant.

In rare cases, sales tax audits can also result in criminal penalties. Criminal penalties generally only result in cases of fraud. The most common type of which is a merchant purporting to collect sales tax from customers but keeping it in their own pocket instead of remitting it to the state.

How do I avoid another audit?

An audit can be a startling wake up call for a business.

To avoid suffering another audit, the #1 thing you can do is get and stay sales tax compliant. And that’s where Zamp comes in! Zamp connects with your e-commerce platforms and ensures you collect and file the right amount of sales tax, every time. Contact Zamp today!

Common Sales Tax Audit Questions

How long do sales tax audits last?

A typical sales tax audit lasts around six months, but in worst case scenarios, they can stretch on for years.

How far back can a state perform a sales tax audit on my business?

This length of time varies by state, with the typical sales tax audit can look back at your business for 3 years. However, if the state finds incidences of tax fraud or gross negligence, the statute of limitations does not apply and they can audit your books for the life of the business.