Origin-Based and Destination-Based Sales Tax Sourcing

In brief:

- “Sales tax sourcing” refers to the location at which a sale is taxed. This gets complicated for e-commerce sellers.

- Most sales are destination-based. This means the seller is required to charge sales tax at the sales tax rate at the buyer’s ship-to location.

- However, some intrastate sales are origin-based. That means that if an e-commerce sale in one of these states originates in the state and ships to a buyer in that same state, the e-commerce seller is required to charge sales tax at the origination point of the sale, and not the buyer’s ship-to address.

- Arizona, California, and New Mexico all have special rules when it comes to how to source and collect sales tax.

One of the more complicated aspects of charging sales tax as an e-commerce seller comes from the concept of “sales tax sourcing.” The term “sourcing” in sales tax refers to the location where the sale is taxed.

The good news is that for nearly all interstate (i.e. between two states) online sales, the sale is taxed at the buyer’s ship-to address. This is called “destination-based sales tax sourcing.”

But a handful of states have “origin-based sales tax sourcing” where they require that e-commerce sellers charge sales tax at the rate where the sale originates. Hence the name “origin-based.”

We’ll explain both origin-based and destination-based sales tax sourcing in detail in the sections below.

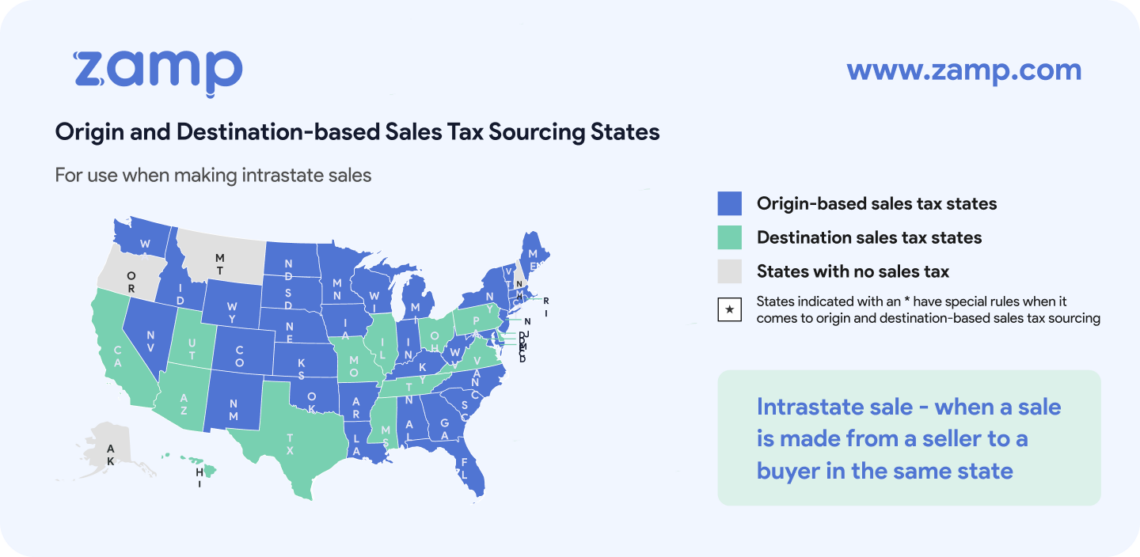

List of Origin-Based Sales Tax States

Here is the complete list of origin-based sales tax states when it comes to intrastate sales (i.e. sales where the buyer and seller are located in the same state). If your business operates and is headquartered in one of these states, you should be charging everyone in your state the rate where your business is located.

- Arizona*

- California*

- Illinois

- Mississippi

- Missouri

- New Mexico

- Ohio

- Pennsylvania

- Tennessee

- Texas

- Utah

- Virginia

The states above marked with an * also have special rules regarding sales tax sourcing for interstate sales.

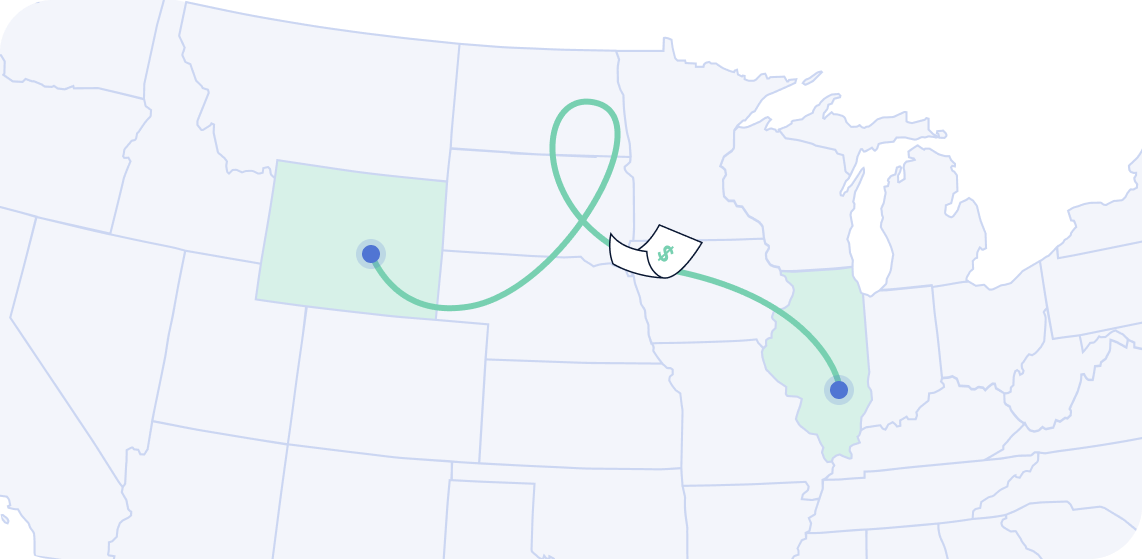

Origin-Based Sales Tax States Example

You run your e-commerce business from a warehouse in Abingdon, Virginia. You make a sale to a buyer in Virginia Beach, Virginia. Since Virginia is an origin-based sourcing state for intrastate sales, you’d charge the sales tax rate based on your location to your customer.

But keep in mind this only applies to Virginia-based customers. If you run your business out of a location in Virginia but also have sales tax nexus in neighboring North Carolina, you’d be required to collect sales tax.

List of Destination-Based Sales Tax States

This is a list of destination-based states when it comes to intrastate sales (i.e. sales where the buyer and seller are located in the same state). In most, but not all, cases, e-commerce sellers should charge sales tax at the buyer’s destination when it comes to interstate (between two states) sales.

- Alabama

- Arkansas

- Colorado

- Connecticut

- Florida

- Georgia

- Hawaii

- Idaho

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Oklahoma

- Rhode Island

- South Carolina

- South Dakota

- Vermont

- Washington

- Washington DC

- West Virginia

- Wisconsin

- Wyoming

Destination-Based Sales Tax States Example

You operate your business in Abingdon, Virginia but also have sales tax nexus in North Carolina. You make a sale to a buyer in Elizabeth City, North Carolina. In this case, you would charge sales tax at the rate of your buyer’s address in Elizabeth City.

Sales Tax Sourcing for Remote Sellers

As mentioned above, one of the few times an e-commerce seller is required to collect origin-based sales tax is when they are located in an origin-based state and make a sale to a buyer in that same state.

Sales tax is slightly different for “remote sellers.”

Remote sellers are online sellers who are not based in a state, but have sales tax nexus there through other means such as physical presence (an employee, inventory) or economic nexus.

In this case, you’re almost always required to collect sales tax at the buyer’s ship-to location. That is even if the buyer is located in an origin-based state.

There are a few exceptions, however. Some states, like Alabama, Louisiana and Texas allow qualified remote sellers to collect sales tax at a flat rate from all buyers in the state. These allowances are designed to make it simpler for remote sellers to comply with that state’s sales tax law and encourage them to collect and remit.

Some states may also allow remote sellers to collect just the statewide sales tax rate from buyers. This means the sellers are not required to calculate local tax for each jurisdiction where their buyer is located.

Origin-Based and Destination-Based Sales Tax Sourcing: FAQ

As an e-commerce seller, can I just charge the same sales tax rate to every customer?

That would make e-commerce so much easier! But unfortunately, the answer is generally no. Most e-commerce sales require that you charge sales tax at the rate at your buyer’s ship-to location.

However, if you happen to live in an origin-based state, only have nexus in that state and/or only make intrastate sales (i.e. sales to buyers in your same state) then you are only required to charge the sales tax rate at your location. This scenario, though, is fairly rare for e-commerce sellers of any size.

I operate my e-commerce business in an origin-based state. Does this mean that I can charge my local sales tax rate to all of my customers in every state?

Similar to the above, the answer here is no. Sales tax is governed at the state level. This means that California governs sales tax rates collected in California and Georgia governs sales tax rates collected in Georgia.

You would never charge a Georgia sales tax rate to a California customer and vice versa. In most cases, when you are a remote seller, you would charge your buyer the sales tax rate at their ship-to location.