What is Sales Tax Nexus?

- What business activities create sales tax nexus?

- I have sales tax nexus. What do I do now?

- Common Sales Tax Nexus Questions

- How is it legal that I have to collect sales tax in other states?

- I just discovered I’ve had sales tax nexus in a state for months or years. What do I do?

- Are sales tax nexus requirements the same in every state?

- What if I have sales tax nexus in a state, but the items I sell are non-taxable in that state?

In brief:

- Businesses with sales tax nexus in a state are required to collect sales tax from buyers in that state.

- After the 2018 South Dakota v. Wayfair Supreme Court decision, more businesses than ever are required to collect sales tax from buyers in more states.

- Nexus requirements vary from state to state but generally apply when a retailer has either a physical presence or economic nexus in the state.

Nexus means a connection or series of connections between two things. In the United States, states use the term “sales tax nexus” to mean that a retailer has some sort of connection with that state that requires them to collect sales tax from buyers in that state.

This could be an obvious connection, such as operating your store or business headquarters in the state. Or it could be less obvious, like triggering economic nexus in a state because you, as an online retailer, exceed the economic nexus sales tax threshold set by that state.

Retailers who have sales tax nexus in a state are required to collect sales tax from buyers in that state.

What business activities create sales tax nexus?

Specific sales tax laws vary from state to state, but this is a general overview of business factors that create sales tax nexus for retailers:

- Locations - This can include a store, office, home office, factory, warehouse, distribution center, or other physical presence

- Employees - This can include employees, independent contractors, sales representatives, and other people working for your company in a state

- Inventory - This includes simply storing inventory in a state, whether or not your business owns the warehouse or other location

- Click-through nexus - In many states, having a 3rd party affiliate making sales on your behalf triggers sales tax nexus once your affiliate exceeds a certain sales threshold

- Temporarily doing business in a state - Selling taxable items at a limited event such as a trade show, concert or craft fair can trigger sales tax nexus

- Exceeding economic nexus thresholds - Nearly every state requires that e-commerce sellers collect sales tax from buyers in their state once the e-commerce business exceeds a certain in-state sales threshold. In most states, this threshold is $100,000 in sales and/or 200 sales transactions.

Four US states - New Hampshire, Oregon, Montana and Delaware - do not have a sales tax.

I have sales tax nexus. What do I do now?

When you discover that you have sales tax nexus in a state, that means that you must comply with that state’s sales and use tax requirements.

In a nutshell, this means:

- Register for a state sales tax permit - This is generally done with the state’s Department of Revenue or equivalent government agency.

- Collect sales tax from buyers in that state - Once you have nexus in a state and are registered to collect sales tax, you’re legally obligated to collect sales tax from all buyers in that state. (This is with the exception of marketplaces like Amazon or Walmart, which are required in most US states to collect sales tax on your behalf.)

- File and remit sales tax - Your state will assign you a sales tax filing frequency and due dates. A state’s due date generally falls either monthly, quarterly or annually, depending on your sales volume. Be sure to file a sales tax return and remit the sales tax you’ve collected to the state.

Common Sales Tax Nexus Questions

How is it legal that I have to collect sales tax in other states?

In the United States, individual states are not allowed to regulate interstate commerce, except when a business has a substantial nexus in the state.

Until 2018, retailers generally had to have some sort of physical presence (location, employee, inventory, etc.) in a state to trigger sales tax nexus.

But the June 21, 2018 South Dakota v. Wayfair Supreme Court decision ruled that states could use economic ties as a reason to require retailers to collect sales tax from buyers within their states. Read more about economic nexus here.

I just discovered I’ve had sales tax nexus in a state for months or years. What do I do?

Because US sales tax laws are so confusing, this is not uncommon. Unfortunately, states do not consider “I didn’t know I had nexus” a defense and they want their past due sales tax. The first step when you discover that you have had historical sales tax nexus is to determine the extent of your exposure. Depending on your sales in a state, you may owe hundreds or thousands in past due sales tax.

From there, you have options. You can simply come clean and pay the past due sales tax then register for a sales tax permit and collect sales tax going forward. If your sales tax exposure is extensive, you can contact a sales tax expert to help you with a Voluntary Disclosure Agreement (VDA).

The worst thing you can do when you discover your business has sales tax nexus is ignore the problem and hope it goes away. We recommend speaking with a sales tax expert if you discover you’ve had historical sales tax nexus.

Are sales tax nexus requirements the same in every state?

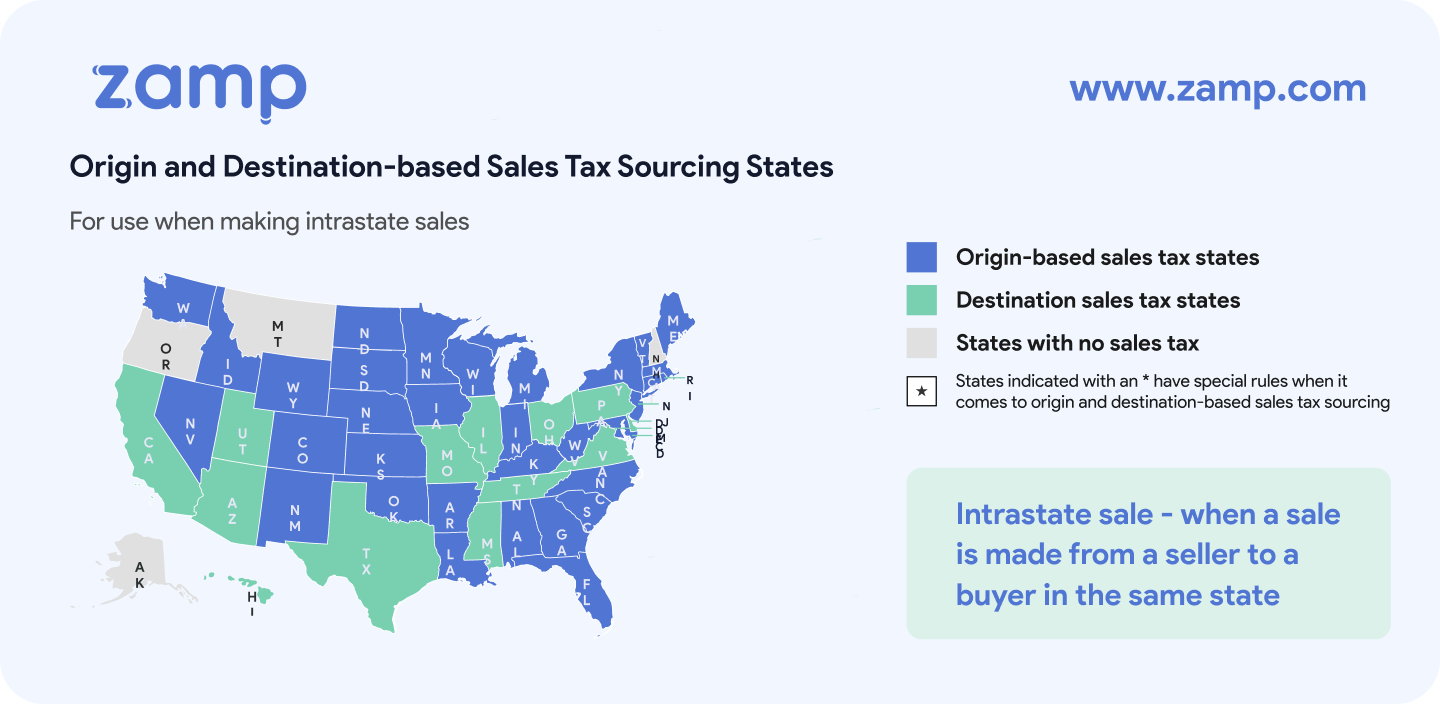

No. Each state is allowed to make their own sales tax laws, rules and regulations as long as they stay within the bounds of the US Constitution.

For example, Michigan states that an online retailer has economic nexus if they make more than $100,000 or more than 200 separate transactions to buyers in the state in a calendar year. But California states that an online seller has economic nexus if they make $500,000 in sales to buyers in the state in the previous or current calendar year.

Check with a sales tax expert or each state’s taxing division to determine if your business activities give you sales tax nexus in a state.

What if I have sales tax nexus in a state, but the items I sell are non-taxable in that state?

Some states consider some items completely non-taxable. For example, clothing is not taxable in Pennsylvania and a handful of other states, and grocery items (i.e. non-prepared food) are not taxable in more than half of US states.

In the broadest sense, if you only sell non-taxable items to buyers in your nexus state, you are not required to register for a sales tax permit in that state. However, some states require all retailers to register for a sales tax permit. A sales tax permit may also be required to purchase goods for resale.

Check with your individual state’s taxing division for more information on whether you should collect sales tax if you only sell non-taxable items.

- What business activities create sales tax nexus?

- I have sales tax nexus. What do I do now?

- Common Sales Tax Nexus Questions

- How is it legal that I have to collect sales tax in other states?

- I just discovered I’ve had sales tax nexus in a state for months or years. What do I do?

- Are sales tax nexus requirements the same in every state?

- What if I have sales tax nexus in a state, but the items I sell are non-taxable in that state?