Software as a Service (SaaS) Sales Tax by State

In brief:

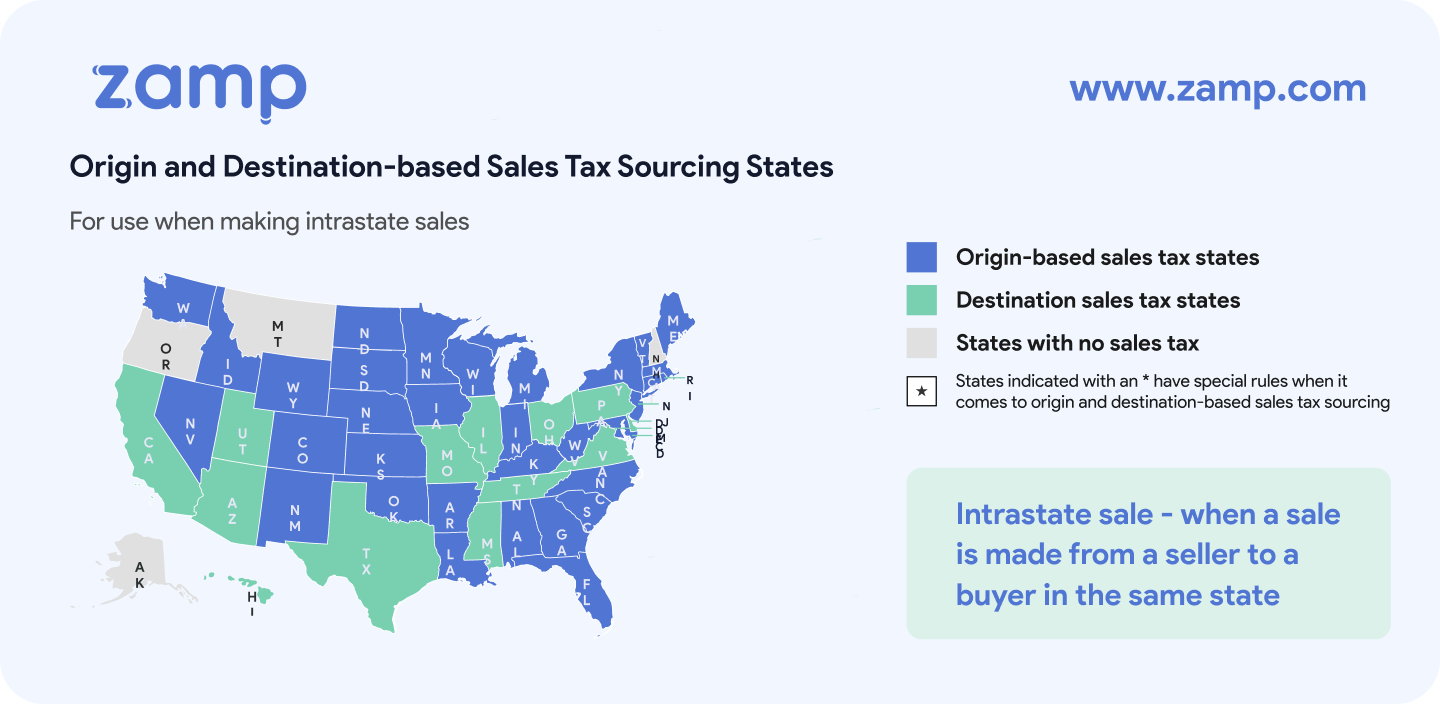

- States are split on whether they require software providers to collect sales tax on SaaS. About half the states with a sales tax consider SaaS taxable, but slightly more consider it non-taxable.

- Definitions of what constitutes SaaS varies from state to state. Some states even tax SaaS differently based on whether it is for business or personal use.

- Because SaaS is a relatively new way of doing business, some state tax authorities haven’t made a definitive ruling about sales and use tax on SaaS.

Sell digital products? See our Sales Tax on Digital Goods by State article here.

When a person or company buys a software program on a tangible disc or flash drive, states breathe easy. The item sold is “tangible personal property” and generally subject to sales tax.

But things get tricky when it comes to Software as a Service (SaaS). With SaaS, customers access their software online, generally via subscription, and if they stop paying, they no longer get access to the software. With SaaS, tangible software like a disc generally doesn't change hands.

For states, many of which tax tangible personal property but not services, SaaS is a conundrum.

This post delves into each state’s rules and laws on SaaS. We’ve included sources so that you can investigate for yourself.

But, as a SaaS company, before deciding that you should (or should not) collect sales tax on your SaaS product, there are a few important things to consider when it comes to sales tax compliance.

The Definition of “SaaS” Varies from State to State

Some states see SaaS as a tangible personal property because it is an electronic version of a “prewritten computer software” that would have, in the past, or still could be sold via disk or other tangible means.

Other states see SaaS as a non-taxable service. Still other states see SaaS as a taxable service.

What to look out for is that many states tax SaaS, which is accessed remotely, differently than a downloaded software that lives on a user’s computer or server.

When making a determination about whether or not you should charge sales tax on your SaaS product, look closely at how the state defines SaaS.

Since SaaS is still a fairly new way of doing business, some states have only obliquely referred to SaaS in their rules and laws. We always recommend that you consult a state and local tax expert (SaLT) about your business’s specific use case when it comes to SaaS taxability.

Some States Tax SaaS Differently Based on Usage

Maryland considers SaaS for “personal use” to be taxable, but SaaS for “business use” to be non-taxable. Ohio is the direct opposite, taxing SaaS for business use but not personal use.

SaaS Taxability Can Blend Old and New Sales Tax Laws

In Mississippi, SaaS is only taxed if the server where the app is hosted is located in-state. This is a callback to a time before South Dakota v. Wayfair when a business had to have some sort of physical presence in a state before being required to collect sales tax in that state.

While some states have changed their rules and laws to accommodate the particular set of circumstances around SaaS, other states have applied existing laws to SaaS, sometimes with unpredictable results.

In which states is SaaS taxable?

The chart below details states where SaaS is and is not taxable along with a source from the state’s department of revenue or code of laws.

As always, keep in mind that each state might define SaaS differently and these laws are changing rapidly.

We recommend speaking with a SaLT about your specific SaaS taxability use case.

(Some of our sources link to pages full of legalese. To find the relevant portions on SaaS, search for “software,” “electronic” or variations of the word “compute.”)

| State | Is SaaS taxable? | Source |

| Alabama | Yes | Alabama Department of Revenue |

| Alaska | Yes (Alaska has no statewide sales tax, so this is only applicable in jurisdictions that levy a sales tax) | Alaska Remote Sellers Sales Tax Commission |

| Arizona | Yes | Arizona Department of Revenue Letter Ruling |

| Arkansas | No | Arkansas Tax Code |

| California | No | California Regulation 1502 |

| Colorado | No, however some Home Rule Cities tax SaaS. Check with individual cities which which you are registered to collect sales tax | Colorado Department of Revenue |

| Connecticut | Yes,but taxed at different rates depending on usage; Saas for personal use is taxable at the full Connecticut state rate; SaaS for commercial use is taxed at 1% | Connecticut Department of Revenue Services |

| Florida | No | Florida Department of Revenue |

| Georgia | No | Georgia Department of Revenue (Link opens in PDF) |

| Hawaii | Yes | Hawaii Department of Taxation |

| Idaho | No | Idaho State Tax Commission |

| Illinois | No, but the Chicago Personal Property Lease Transaction Tax does apply to SaaS | Illinois Administrative Code |

| Indiana | No | Indiana Department of Revenue |

| Iowa | Yes for personal use, but SaaS is not taxable when used for “commercial purposes” (i.e. business purposes) | Iowa Department of Revenue |

| Kansas | No | Kansas Department of Revenue |

| Kentucky | Yes | Kentucky House Bill 8 |

| Louisiana | No | Louisiana Department of Revenue |

| Maine | No | Maine Revised Statutes |

| Maryland | Yes for personal use, but SaaS is not taxable when used for “commercial purposes” (i.e. business purposes) | Comptroller of Maryland (p. 6) |

| Massachusetts | Yes | Massachusetts Department of Revenue |

| Michigan | No | Michigan Department of Treasury |

| Minnesota | No | Minnesota Department of Revenue |

| Mississippi | No, though if the software is stored on a server in the state it is considered taxable | Mississippi Department of Revenue |

| Missouri | No | Missouri Department of Revenue |

| Nebraska | No | Nebraska Department of Revenue |

| Nevada | No | Nevada Department of Taxation |

| New Jersey | No | New Jersey Division of Taxation |

| New Mexico | Yes, many services, including SaaS, are taxable in New Mexico | New Mexico Taxation and Revenue Department |

| New York | Yes | New York Department of Taxation and Finance |

| North Carolina | No | North Carolina Department of Revenue (p. 75) |

| North Dakota | No | North Dakota Office of State Tax Commissioner |

| Ohio | Yes SaaS for business use is taxable in Ohio, but SaaS for personal use is non-taxable | Ohio Department of Taxation |

| Oklahoma | No | Oklahoma State Tax Commission Amended Code |

| Pennsylvania | Yes | Pennsylvania Department of Revenue |

| Rhode Island | Yes | Rhode Island Division of Taxation |

| South Carolina | Yes | South Carolina Department of Revenue |

| South Dakota | Yes | South Dakota Legislature |

| Tennessee | Yes | Tennessee Code |

| Texas | Yes, but at a rate of 80% of the full tax rate; (20% of the total tax charged for “data processing services” is tax exempt in Texas). | Texas Comptroller |

| Utah | Yes | Utah State Tax Commission |

| Vermont | No | Vermont Department of Taxes |

| Virginia | No | Virginia Tax |

| Washington | Yes | Washington Legislature |

| Washington DC | Yes | Washington DC Office of Tax and Revenue |

| West Virginia | Yes | West Virginia Code |

| Wisconsin | No | Wisconsin Department of Revenue |

| Wyoming | No | Wyoming Code |