Sales Tax Software for E-Commerce

Discover how sales tax software for e-commerce simplifies tax compliance, streamlines operations, and ensures accuracy for online businesses.

Learn More- What Is E-Commerce Sales Tax Software?

- Why Should You Invest in E-Commerce Sales Tax Software?

- What Challenges Do E-Commerce Businesses Face?

- How to Choose the Right E-Commerce Sales Tax Software

- Five Best Sales Tax Software for E-Commerce

- Implementing a Sales Tax Automation Solution for Your E-Commerce Business

- E-Commerce Sales Tax: Conclusion

Zamp Learnings

- E-commerce sales tax software helps you stay compliant by tracking economic nexus thresholds in the states where you operate and giving up-to-date sales tax calculations.

- Sales tax software for e-commerce also integrates directly with APIs on your preferred platforms, like Shopify, Stripe, Amazon, and BigCommerce.

- Well-known sales tax software companies for e-commerce are Zamp, TaxJar, and Avalara.

E-commerce has revolutionized how we shop and conduct business, offering unparalleled convenience and a global marketplace. However, with this progress comes the challenge of navigating a complex web of sales tax regulations for e-commerce businesses.

Each state, county, and sometimes even city has its own tax rules, rates, and compliance requirements. This diversity creates a multifaceted puzzle for e-commerce businesses, as each transaction could potentially have different tax implications. Understanding and keeping up with these ever-changing regulations is a Herculean task, often requiring considerable resources and expertise.

This article will explain everything you need to know about sales tax software for e-commerce.

Book a call today

30-minute call

sales tax expert

off your plate

What Is E-Commerce Sales Tax Software?

Sales tax software for e-commerce can automate the most time-consuming aspects of sales tax management. Whether calculating the correct amount of tax to charge for each product, determining if different items have different tax rates, or even keeping track of the various sales tax holidays – sales tax software has it covered. It's constantly updated with the latest tax rates and regulations, meaning you'll never be caught off-guard by changes in tax laws.

Most importantly, sales tax software for e-commerce isn't a one-size-fits-all solution; it's tailored to fit the unique needs of online businesses. It understands the nuances of e-commerce transactions, from identifying whether a customer is tax-exempt to handling returns and their tax implications. This level of detail ensures that your business is compliant, efficient, and customer-friendly.

The reporting capabilities of this software are a lifesaver come tax season. With just a few clicks, you can generate detailed sales tax reports for your tax filings, making it easier to stay on top of deadlines and maintain accurate records.

The best part? You don't need to be a tax expert to use this software. It's designed for ease of use, with a straightforward interface that lets you manage your sales tax without getting bogged down in complexity. If you run into any issues, customer support is just a call or click away, ready to help you navigate any challenges.

Understanding Sales Tax Software for E-CommerceHere are the key features and functionalities of sales tax software for e-commerce:

- Automated Tax Calculations: The software calculates sales tax in real time for each transaction, ensuring accuracy.

- Up-to-date Tax Rates: It stays updated with the latest tax rates and rules, so you're always compliant.

- Integration with E-commerce Platforms: This software easily integrates with your e-commerce platform. Whether you're using Shopify, Stripe, or any other major platform, it integrates smoothly and applies the correct tax rates directly at the point of sale.

- Exemption Certificate Management: For tax-exempt customers, the software can manage and store their exemption certificates, keeping you organized.

- Multi-State Filings: If you sell in more than one state, the software can handle tax filings in multiple tax jurisdictions, saving you a significant amount of time and reducing the risk of filing errors.

Why Should You Invest in E-Commerce Sales Tax Software?

Think of sales tax software for e-commerce businesses as your shortcut to peace of mind. It streamlines your operations, reduces errors, and aligns you with state and local tax laws. Plus, accurate tax reporting makes you less likely to face penalties or audits. It's a win-win.

Expanding on these benefits:

- Time-Saving Automation: One of the most immediate benefits of sales tax software is the time you'll save. Sales tax software automates the entire process - from calculating the correct amount of tax for each transaction to filing and remitting taxes. This automation frees up work hours, allowing you and your team to focus on other critical aspects of your business.

- Reducing Errors and Increasing Accuracy: Human error in manual tax calculations can lead to significant complications, from incorrect tax charges to issues with tax authorities. Sales tax software significantly reduces this risk. By automating the calculation process, the software ensures that each transaction is assessed accurately according to the latest tax laws and rates.

- Compliance Assurance: Tax laws constantly change, and keeping up can be a full-time job. Sales tax software stays current with the latest tax laws and rates, automatically updating to reflect these changes. This feature ensures that your business remains compliant, avoiding costly fines and penalties associated with non-compliance.

- Enhanced Reporting Capabilities: Having detailed and accurate reports are invaluable during tax time. Sales tax software generates comprehensive reports that break down tax liabilities, making it easy to understand what you owe and why. These reports are essential for internal record-keeping if you ever face an audit.

- Seamless Integration with E-commerce Platforms: As mentioned, sales tax software integrates directly with most e-commerce platforms, creating a seamless bridge between your sales and tax compliance processes. This integration means that tax calculations are applied in real-time at the point of sale, ensuring that every transaction is accounted for accurately.

- Scalability for Business Growth: As your small business grows, your sales tax obligations will likely become more complex. Sales tax software is designed to scale with your business, effortlessly handling increased transaction volumes and expanding nexus obligations without missing a beat.

- Customer Satisfaction: Sales tax software indirectly contributes to a better customer experience by ensuring accurate tax charges and compliance. Transparent and correct billing builds trust and professionalism, which are key to customer retention and satisfaction.

- Reduced Risk of Audits: Non-compliance with tax laws can result in audits and hefty penalties, a risk significantly mitigated by sales tax automation. Automated systems help ensure that e-commerce businesses adhere to all applicable tax regulations, reducing the likelihood of errors that could trigger audits.

- Peace of Mind: Running a business is stressful enough without worrying about sales tax compliance. Sales tax compliance software provides peace of mind, knowing that your tax obligations are handled precisely and efficiently. You can sleep soundly at night knowing that you're in good hands.

Integration with E-Commerce Platforms

Integration is where sales tax software shines. It's designed to work seamlessly with your e-commerce platforms. When a customer makes a purchase, the software begins determining the correct tax based on the product and the buyer's location. This seamless integration means that the correct amount of tax is added to each sale without your intervention.

And this integration extends to the back end of your business operations. Your sales data is automatically synced with the software, which means all your sales tax information is in one place. This makes it easier to see what you owe and keep accurate records for your business. It's like having a tax expert working behind the scenes, ensuring that every aspect of your sales tax is handled correctly.

Free Download: Sales Tax Guide for E-Commerce

What Challenges Do E-Commerce Businesses Face?

For e-commerce businesses, especially those growing or operating nationally, sales tax laws and challenges can be overwhelming. Let’s break down some of these challenges:

| Keeping Up with Different Tax Rates | One of the biggest headaches is the sheer variety of tax rates. Every state, and sometimes even different cities within the same state, can have its own tax rates and rules. If you’re selling nationwide, that’s a lot of rates to keep track of. It's like trying to hit a moving target while blindfolded. |

| Understanding Nexus Laws | 'Nexus' is a fancy term for having a significant presence in a state. Different states have different rules about what creates nexus (like having a warehouse, employee, or a certain amount of sales in the state). Figuring out where you have nexus is crucial because it determines where you need to collect and remit sales tax. |

| Product Taxability Issues | Not all products are taxed the same way. In some places, clothing might be tax-exempt, while in others, it’s taxed differently depending on the item’s price. Keeping track of these variations can be a complex task if you have a diverse product range. |

| Exemption Certificate Management | Handling sales for tax-exempt customers, such as non-profit organizations, adds another layer of complexity. You need to manage and validate their exemption certificates, which is crucial to ensure compliance and avoid issues during audits. |

| Managing Returns and Refunds | Adjusting your sales tax liability involves handling returns and issuing refunds for online sales. This process can be complicated and time-consuming, particularly if you receive a high volume of returns through multiple sales channels. |

How to Choose the Right E-Commerce Sales Tax Software

Selecting the right software is key. You'll want to consider factors like compatibility with your current system, how well it can grow with your business, and the level of customer support. It's not just about features; it's about finding the right fit for your unique needs.

Here are some key factors to consider:

| Compatibility with Your Current System | The software you choose should seamlessly integrate with your existing e-commerce platform and accounting systems. It’s like finding a puzzle piece that fits just right. If the software doesn’t mesh well with your current setup, you could be looking at a frustrating experience filled with technical hiccups. |

| Scalability for Business Growth | Your business isn't static; it's going to grow and change. You need sales tax automation software that can keep up with this growth. Look for a solution that meets your current needs and can handle more complex scenarios as you expand, whether it’s entering new markets or increasing your product range. |

| Level of Customer Support | This is a big one. When dealing with something as critical as sales tax, having access to prompt and knowledgeable support is a lifesaver. Ensure the software provider offers comprehensive support – this means having real people you can talk to, not just an endless loop of automated responses. |

| Ease of Use | The software should be user-friendly. You don’t want to spend hours figuring out how to use it. A good sales tax software should make your life easier, not harder. Look for intuitive interfaces and clear instructions. |

| Features That Meet Your Specific Needs | Different businesses have different needs. Maybe you deal with a lot of tax-exempt sales, or perhaps you operate in multiple states. Ensure the software you choose caters to these specific requirements. It should accurately calculate and file taxes according to the various rules and rates applicable to your business. |

| Cost-Effectiveness | While you shouldn’t compromise on quality, you must also consider your budget. Weigh the costs against the features and support offered. Remember, the cheapest option isn’t always the best, but neither is the most expensive one. It’s about value for money. |

| Compliance and Security | The software should comply with the latest tax laws and securely handle your data. With tax regulations frequently changing, the software must be agile enough to adapt quickly. Moreover, considering the sensitive nature of your financial data, security cannot be overstated. |

| Trial Periods and Demos | Before committing, check whether the software provider offers a trial period or a demo. This will allow you to determine whether the software meets your expectations and fits well with your business operations. |

Five Best Sales Tax Software for E-Commerce

The best sales tax solutions for e-commerce are ones that will grow with your business. They will handle everything you need, from registrations to sales tax nexus tracking to filing sales tax returns for your online store. Here are the top five best sales tax software for e-commerce:

Zamp

Zamp is the first managed sales tax solution in the market, allowing businesses to outsource their sales tax from start to finish. Other sales tax providers only offer software, which means you need to learn, set up, and manage yourself or hire someone to manage it for you.

This service includes:

- Hands-off onboarding: Zamp sets up and configures your account from start to finish to ensure all your tax data is set up correctly.

- Full-service sales tax compliance: Their complete service checks all the boxes: nexus tracking, tax collection, registrations, accurate calculations, product taxability research, mapping, reporting, and filing.

- Proactive account support: The Zamp team is always a phone call away if you need help or have questions.

Pricing Information

Zamp offers a competitive pricing model that’s built to scale as your company grows. Pricing details are transparently displayed on the website, allowing businesses to anticipate costs without any hidden fees.

Integration Capabilities

Zamp integrates with numerous e-commerce platforms, like QuickBooks, Shopify, Stripe, and more. This guarantees that your sales and use tax calculations remain accurate across various sales channels.

Customer Support

Many businesses have turned their tax troubles around with Zamp’s sales tax software. We've seen companies save time, reduce errors, and enjoy a smoother sales process. Real examples show real benefits.

Yumwoof Case Study

Yumwoof, an Austin, Texas-based e-commerce pet food brand, faced significant challenges in managing sales tax across multiple states. With a growing customer base, the complexities of handling sales tax in 17 states became increasingly demanding. The company's COO, Ana Padilla, found the process of registering and staying compliant in each state time-consuming and stressful, detracting from her focus on business growth.

Turning to Zamp for a solution, Yumwoof experienced a transformative change in managing its sales tax obligations. Zamp provided a comprehensive, team-oriented approach to handle all aspects of sales tax, from registrations to compliance. The personalized support and expertise offered by Zamp's team played a crucial role in simplifying the process.

Key benefits Yumwoof gained from Zamp's service included:

- Effortless Multi-State Tax Compliance: Zamp took over the daunting task of managing sales tax across numerous states. This was a game-changer for Yumwoof, as it relieved the company from the complexities of staying compliant with diverse state tax laws. Zamp's expertise in dealing with multi-state tax issues ensured that Yumwoof could expand its business without the added worry of sales tax compliance.

- Personalized Customer Support: Zamp provided Yumwoof with dedicated customer support. This meant that any time Yumwoof needed assistance or had questions about sales tax, they had direct access to knowledgeable professionals. This level of personalized support gave the company the confidence and assurance that they could tackle any sales tax-related challenge that came their way.

- A Clear and Secure Onboarding Process: Transitioning to Zamp's sales tax system was smooth and hassle-free for Yumwoof. The onboarding process was designed to be transparent and secure, ensuring that all of Yumwoof's sales tax needs were understood and appropriately set up in the system. This streamlined onboarding process made it easy for Yumwoof to integrate Zamp's services into their operations without any disruption to their business.

- Time and Resource Savings: By entrusting sales tax management to Zamp, Yumwoof saved significant amounts of time and resources. This allowed the company to redirect its focus and energy towards core business activities, like product development and customer engagement, rather than being bogged down by tax compliance tasks.

- Scalable Solutions for Growth: As Yumwoof continued to expand, Zamp's services scaled with them. This adaptability meant that as the company grew and entered new markets, Zamp was able to handle the increasing complexity of their sales tax requirements. This scalability was key for Yumwoof’s growing business, ensuring that they were always ahead of their tax obligations.

Beeya Case Study

Beeya, a women’s health and wellness brand, faced the challenge of expanding its operations across multiple states. With a growing customer base and increasing sales, the need for an efficient sales tax management system and available customer service team became crucial.

The primary challenge for Beeya was ensuring the accuracy of each month's filings and having access to a team of sales tax experts who could answer questions as needed. Each state has its own set of rules, rates, and filing requirements, making the sales tax compliance process challenging.

Beeya turned to Zamp, a leading sales tax automation software, to address its concerns.

Yasmin Nouri, CEO of Beeya, expressed immense satisfaction with our solution compared with her previous sales tax provider, stating:

“There was always some issue that was happening and I could never find someone to just have a conversation with one-on-one to rectify it. Finding somebody who could grow with us was huge.”

Beeya’s sales tax case study is a testament to how sales tax automation can significantly benefit e-commerce businesses facing the challenges of multi-state expansion and compliance. Zamp's comprehensive solution provided the necessary tools for efficient tax management, enabling Yasmin and her team to focus on what matters most—growing the business.

TaxJar

TaxJar is a sales tax automation platform that is geared toward e-commerce brands. Its services are designed to help streamline sales tax processes and help companies manage compliance.

The company’s main benefits include:

- Automated tax calculations: TaxJar offers sales tax calculations in real-time across varying states and taxing jurisdictions.

- AutoFile feature: The company’s AutoFile feature submits sales tax returns and payments, eliminating manual efforts and helping businesses meet filing deadlines.

Pricing Information

TaxJar offers two different plan options — Starter and Professional. The pricing for these plans is not listed on their website but is based on the number of transactions each month. Basic plans cover essential features like tax calculation and reporting, while the higher-tiered plan includes additional services, more integration options, and customer support.

Integration Capabilities

TaxJar supports a wide range of integrations, but not all are free. The Starter plan only allows up to three data import integrations, while the Professional plan allows up to ten. However, the company connects with major e-commerce platforms like Shopify, Magento, and WooCommerce, as well as marketplaces like Amazon, eBay, and Etsy.

Customer Reviews

TaxJar reviews are mixed. Some reviews discuss the company’s user-friendly interface, ease of automating tax calculations and filings, and responsive customer support. However, some commenters express issues around costs and integration challenges with certain platforms.

Avalara

Avalara currently offers sales tax software, known as Avalara Avatax, that automates tax calculations and the filing process. The company calculates tax based on product type, where the customer is based, and across other states or countries. It also handles filings and remittances for your company as needed and sends sales tax payments to the correct tax authorities when due.

Pricing Information

Avalara does not include everything in one price for its customers. However, its general service for online stores and retailers includes automated sales tax calculations, compliance reporting, and tax filing capabilities.

Integration Capabilities

Avalara currently has a wide range of integration capabilities, including Shopify, WooCommerce, and Stripe.

Customer Support

Avalara provides support resources, including a knowledge base, step-by-step guides, and webinars. The company also has email assistance and a community forum for questions. According to reviews, receiving dedicated customer support can be cumbersome.

Numeral

Numeral is a newcomer to the sales tax compliance industry. It’s designed to help make sales tax management straightforward for small to medium-sized businesses. It emphasizes user-friendliness and accuracy. Here are some key features we found with Numeral:

- Automated sales tax compliance: Numeral automates the process of sales tax calculations, charging, and remitting to the states.

- Tax filing: The company offers a streamlined tax filing process with automated returns and filings.

Pricing Information

Numeral’s pricing begins at $75 per filing, with rates that scale according to transaction volume. Additionally, the company charges $150 per state registration. They’ve labeled their payment method as “Pay as you go.”

Integration Capabilities

Numeral integrates with e-commerce platforms like Shopify, WooCommerce, and Magento. This helps ensure accurate tax calculations and applications during checkout and point of sale.

Customer Reviews

Numeral has mixed reviews online. Some customers are happy with the service, while others are upset over hidden and raised fees for sales tax filings.

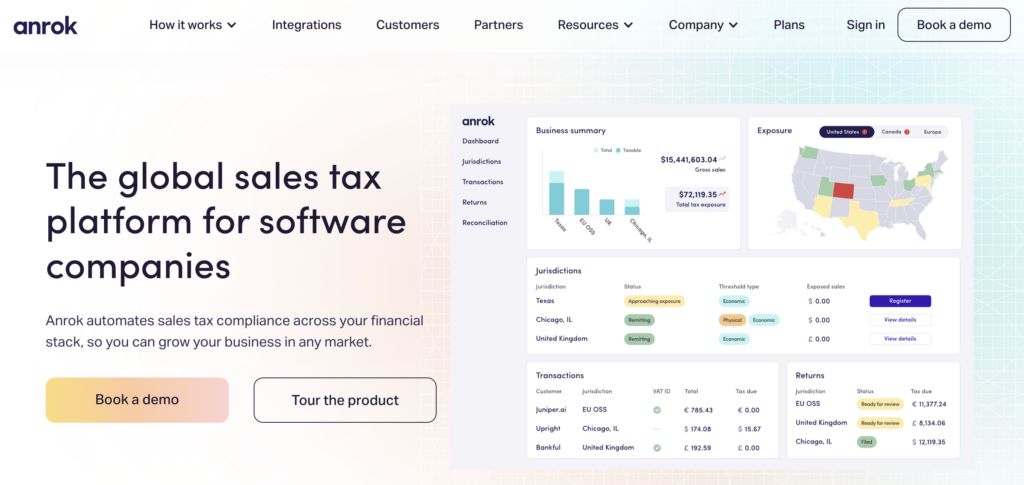

Anrok

Anrok is a sales tax compliance software that handles US sales tax in addition to VAT and GST. The company is specifically designed to assist SaaS businesses in managing sales tax.

Here are a few standout features of Anrok:

- Automated nexus determination: Anrok automates nexus determinations in different states, which benefits companies with a broad customer base. This will let you know when you need to register for taxes in a particular state.

- Data security: Anrok uses robust security protocols to protect against potential cyber threats.

Pricing Information

Anrok offers three plans: Starter, Core, and Growth. However, prices are not listed on its website for any of the plans. All plans include global exposure monitoring, calculation, filing and remittance, exemption certificates, and a sales tax calculator.

Integration Capabilities

Anrok integrates with e-commerce platforms like Shopify and BigCommerce so businesses can manage sales tax efficiently.

Customer Reviews

Customer reviews from Anrok highlight its interface and customer support. Some also mention the ease of having real-time updates and precise tax calculations.

Implementing a Sales Tax Automation Solution for Your E-Commerce Business

Integrating sales tax software into your e-commerce operations is a strategic move that can streamline your processes and ensure compliance. Here's how to do it right:

- Assess Your Needs: Before integrating, assess your business's specific sales tax requirements. Consider factors like your sales volume, the number of states you operate in, and any unique tax obligations you may have.

- Choose the Right Software: Select a sales tax software provider that aligns with your business needs and goals. Look for features like automatic rate calculation, multi-state functionality, and integration capabilities with your e-commerce platform.

- Sync with Your E-commerce Platform: Once you've chosen your software, it's time to integrate it with your e-commerce platform. Most sales tax software solutions offer seamless integrations with popular platforms like Shopify, BigCommerce, and Stripe. By syncing your software with your platform, you can ensure that sales tax calculations are accurate and up-to-date in real time.

- Customize Settings: Take advantage of any customization options your sales tax software offers. Set up tax rules specific to your products and jurisdictions to ensure accurate calculations. Additionally, configure settings for automatic tax rate updates and tax-exempt transactions to streamline the process further.

- Train Your Team: Ensure your team is trained on using the sales tax software effectively. Provide comprehensive training on how to input data, generate reports, and troubleshoot any issues that may arise. By empowering your team with the knowledge and skills they need, you can maximize the benefits of your sales tax software. Signing your team up for Zamp’s sales tax newsletter will keep everyone up-to-date on the most recent sales tax news.

- Monitor Performance: Monitor the performance of your sales tax software after integration. Monitor tax calculations, filings, and potential issues. Review reports and analytics regularly to ensure accuracy and compliance.

- Optimize Over Time: As your business grows and evolves, optimize your sales tax software integration. Stay informed about tax laws and regulations changes and update your software settings accordingly. Review your processes and workflows regularly to identify areas for improvement and optimization.

Following these steps will allow you to seamlessly integrate sales tax software into your e-commerce operations, ensuring accurate tax calculations, compliance with regulations, and streamlined business processes.

E-Commerce Sales Tax: Conclusion

A sales tax automation solution can transform how your e-commerce business handles tax compliance. When choosing the right sales tax software provider, Zamp stands head and shoulders above the rest. Here's why:

- Proven Track Record: Zamp boasts a stellar reputation in the industry, with a long history of helping businesses like yours navigate the complexities of sales tax compliance. With a track record of success, you can trust Zamp to deliver results.

- Comprehensive Solutions: From registration assistance to audit defense support, Zamp offers a comprehensive suite of sales tax solutions tailored to your needs. Whatever challenges you face in managing sales tax, Zamp has you covered.

- Cutting-Edge Technology: Zamp leverages the latest technological advancements to provide best-in-class sales tax software. With powerful features like real-time tax rate updates, seamless integrations, and intuitive user interfaces, Zamp makes sales tax management a breeze.

- Exceptional Support: At Zamp, customer satisfaction is paramount. Their team of sales tax experts is dedicated to providing top-notch support every step of the way, ensuring that you have the guidance and assistance you need to succeed.

- Affordability: While other providers may break the bank, Zamp offers competitive pricing plans designed to fit businesses of all sizes. With transparent pricing and no hidden fees, you can trust that you're getting the most bang for your buck with Zamp.

Book a call today

30-minute call

sales tax expert

off your plate

Sales Tax Software for E-Commerce: FAQ

Generally, yes. If you have a physical or economic presence in a state, you’re likely required to collect sales tax on transactions made to customers within that state.

The sales tax rate varies depending on the location of the buyer. You can use sales tax software to automatically calculate the correct rate based on the buyer’s address.

Handling e-commerce sales tax involves determining if you have nexus in the states where your customers are located, calculating the correct sales tax rates for each transaction, collecting the tax, and then reporting and remitting it to the respective state authorities. Sales tax software can automate these steps, ensuring accuracy and compliance.

Sales tax management is challenging for e-commerce businesses due to the complexity of tax laws that vary by state and sometimes by city or county. Additionally, understanding and keeping up with nexus criteria, varying product taxability rules, and constantly changing tax rates and regulations add to the complexity.

Key features to look for include automated tax rate calculation, integration with your e-commerce platform, accurate reporting and filing capabilities, support for multiple states’ tax laws, and efficient management of customer exemption certificates. User-friendliness and quality customer support are also important.

Sales tax software automates the process of calculating the correct tax rates for each sale, based on the latest tax laws. It reduces the manual workload and minimizes the chances of errors in tax calculations. This not only streamlines operations but also ensures more accurate and compliant tax handling.

The compliance benefits include accurate calculation of sales taxes, timely filing and remittance of taxes, maintaining up-to-date records for audits, and staying compliant with ever-changing tax laws. It reduces the risk of penalties and fines due to non-compliance or errors in tax processing.

E-commerce businesses should assess their specific needs based on their size, the complexity of their operations, and the states where they have nexus. They should look for software that integrates seamlessly with their existing e-commerce platform, offers scalability, provides strong customer support, and fits within their budget. It’s also beneficial to choose software that offers a trial period or demo to ensure it meets the business’s specific requirements.

Yes, Shopify allows you to set up sales tax calculations. You can also set up tax overrides to address specific tax laws and situations that may arise based on your customer’s location.

Yes, there are several types of sales tax software that can calculate sales tax in the US. Zamp is an automated sales tax solution that offers rooftop accurate calculations for customers, along with managing the complete sales tax lifecycle.

Failing to collect sales tax can result in penalties, fines, and back taxes. It’s crucial to comply with sales tax laws to avoid legal trouble and financial consequences.

You’re generally required to register for sales tax in states where you have nexus, which can include having a physical presence, significant sales volume, or engaging in certain activities like affiliate marketing.

Keeping track of changing sales tax laws and regulations can be challenging. Consider using sales tax software to automate compliance processes and ensure accurate tax collection and reporting. Additionally, staying informed about sales tax updates and consulting with tax professionals can help you stay compliant.

- What Is E-Commerce Sales Tax Software?

- Why Should You Invest in E-Commerce Sales Tax Software?

- What Challenges Do E-Commerce Businesses Face?

- How to Choose the Right E-Commerce Sales Tax Software

- Five Best Sales Tax Software for E-Commerce

- Implementing a Sales Tax Automation Solution for Your E-Commerce Business

- E-Commerce Sales Tax: Conclusion