How to Verify a Resale Certificate in Every US State

- Resale Certificate Lookup for Every US State

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Virginia

- Wisconsin

- Wyoming

- Common Questions about Verifying a Resale Certificate

When a customer hands you a resale certificate claiming that they are buying your products for resale, it can be tempting to take them at their word and simply sell them their products without sales tax.

But what if that resale certificate were fraudulent? Or what if the buyer’s sales tax permit has expired? Most states hold you, the seller, accountable if you accidentally make a non-taxed sale. Penalties can include repaying the sales tax you didn’t charge, plus a fine.

Fortunately, most states give you the opportunity to easily verify a resale certificate online. Here’s how.

| Further reading: • Demystify all the sales tax rules in Texas and how to file it. • Explore sales tax in California and which goods and services are exempted from it. |

Resale Certificate Lookup for Every US State

A few important notes:

- States use different terminology when it comes to looking up a resale certificate. In most cases, they are searching for your customer’s state sales tax ID number. Some states allow you to also search by Federal Employer ID Number (FEIN) or another business ID number, but in that case you still want to ensure that they are registered to collect sales tax.

- A handful of states don’t have a public way to verify a resale certificate. In this case, be sure your buyer fills the correct sales tax exemption form out completely and accurately to avoid fines and penalties should the certificate turn out to have been fraudulent

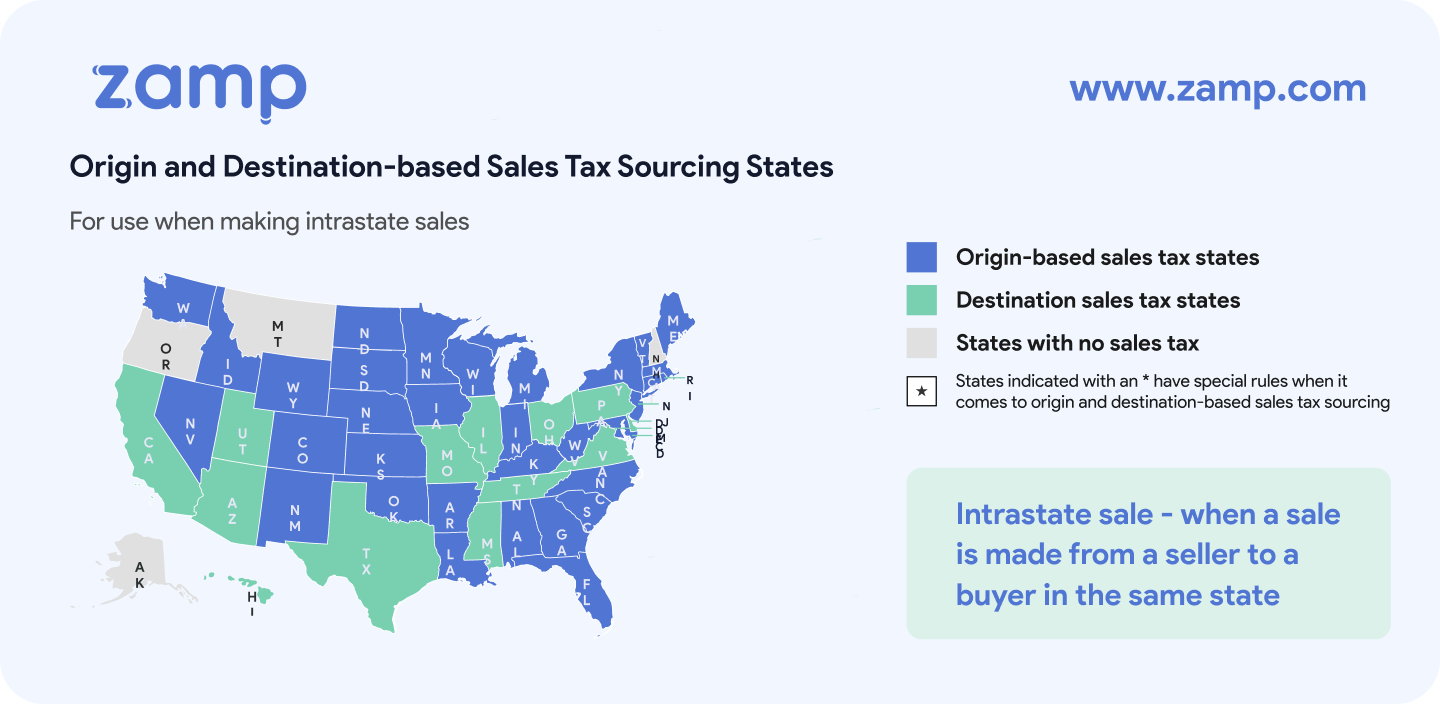

- Ten states don’t allow retailers to accept out-of-state resale certificates. If you’re located in one of those states, be sure your buyer’s resale certificate is also from your state.

Alabama

- Visit My Alabama Taxes

- Click “Verify a Resale Certificate”

- Choose whether to enter your customer’s Federal Employee ID Number (FEIN), Individual Tax ID Number (ITIN), or Social Security Number (SSN) and enter it

- Enter the customer’s Exempt Sales Account Number

Arizona

- Go to Arizona Department of Revenue License Verification page

- If it doesn’t take you directly to the page, click “License Verification” in the top navigation bar

- Enter the 8-digit Transaction Privilege Tax number provided by your buyer and click “Submit”

Arkansas

- Go to Arkansas Taxpayer Access Point

- Under "Inquiries" click "Validate Sales Tax Permit"

- Enter the Permit ID Type (usually "Sales & Use Tax")

- When the next box appears, enter the Permit ID Number

- Click "Submit"

California

- Go to California Department of Tax and Fee Administration

- Click the blue “Verify a Permit, License or Account Now” button

- On the dropdown menu select “Sellers Permit”

- Enter the Identification Number Provided to you by the buyer

Colorado

- Go to Colorado Department of Revenue

- Click “Verify a License or Exemption Certificate”

- Select the number of licenses to verify

- Select “Yes” to verify a single license

- Select “No” to verify multiple licenses

- The “Verify a License or Certificate” section will appear

- Enter either the 8-digit Colorado Account Number (CAN) or the 12-digit Location ID to be verified. Don’t include hyphens or spaces.

- If the account can’t be verified, the form will return “NOT FOUND”

Connecticut

- Go to the Connecticut License Lookup page

- Scroll down to the bottom and choose “Lookup a License”

- For resale certificates/sellers’ permits, search by License Number

- You can also search by “Business Name/DBA” or “Address” but you’ll want to be sure that that business holds a valid sales tax license

- Click Submit

Florida

- Go to the Florida Seller Certificate Verification

- In the “This request is for verification of” dropdown choose “Sales and Use Tax”

- In the “Contact Name” field, enter the seller’s contact name

- In the “Certificate Number” field, enter the seller’s 13-digit certificate number

- Click “Verify”

Georgia

- Go to the Georgia Department of Revenue

- Click “Verify Sales Tax ID(s)”

- Read the disclaimer and click “Next”

- In the box under “Enter Sales Tax Number Only” enter the buyer’s sales tax number. You can also verify more than one sales tax number.

- When ready to verify, click “Next”

- You’ll see the status of the customer’s Georgia sales tax license

Hawaii

- Go to the Hawaii Tax License Search

- Enter the “Taxpayer Name,” “DBA Name” and “Customer ID”

- Click “Search”

Idaho

- Go to the Idaho State Tax Commission

- Click “Validate a Permit”

- Under the permit type dropdown select “Sales & Use Tax”

- Enter the buyer’s 9-digit permit number with no hyphens

- Click “Next” for the Results

Illinois

- Go to My Tax Illinois

- Click “Verify a Sales Tax Exemption Number”

- Enter the customer’s exemption number

- Click “Search”

Indiana

Online verification of Indiana resale certificates is not available.

Indiana buyers should provide you with a completely and accurately filled out General Sales Tax Exemption certificate (Form ST-105) (link downloads a PDF) and should follow all instructions for filing it out accurately and completely.

You can contact the Indiana Department of Revenue through phone, email, or mail with questions.

Iowa

A dedicated Iowa resale certificate lookup is not available, but as a workaround you can:

- Go to the Iowa Data page

- Search within the “Find a Dataset” search bar to find your buyer’s business name, address, etc. and verify that their business registration is listed as “Active” in the far left “Active or Inactive” column

Kansas

- Go to Kansas Exemption Certificate lookup page

- Enter the buyer’s Kansas Tax Registration Number

- Click “Search”

Kentucky

Online verification of Kentucky resale certificates is not available.

Kentucky buyers should provide you with a completely and accurately filled out Kentucky resale certificate.

You can contact the Kentucky Department of Revenue through phone or online contact form with questions.

Louisiana

To verify a Louisiana resale certificate online you must also hold a valid Louisiana sales tax registration.

- Go to the Louisiana Department of Revenue Resale Certificate page and scroll down to “Resale Certificate Validation”

- Enter your own resale certificate number and business name then click “Verify”

- On the next page, enter the “Purchaser's Louisiana Account Number” and the “Purchaser’s Business Name” in the indicated boxes

- Press Enter to validate

For more information, you can contact the Louisiana Department of Revenue through phone, mail or email.

Maine

- Go to Maine Tax Portal

- Under “Additional Services” click “Sales and Service Provider Tax Resale and Exemption Lookup”

- On the Certificate Lookup Page, enter “Resale Certificate” and the buyer’s certificate number

- Click “Search”

Maryland

- Go to the Online Verification of Maryland Tax Account Numbers page

- Enter the buyer’s Maryland Sales & Use Tax Number

- Click “Check Exempt Status”

Massachusetts

- Go to the Massachusetts Sales Tax Resale Certification page

- Under ID Type choose “Sales Tax Account ID”

- Next to “Seller Acct ID” enter your tax Massachusetts sales tax ID

- Next to “Buyer Account ID” enter the buyer’s Massachusetts sales tax ID

- Click Next to get the results

Michigan

Online verification of Michigan resale certificates is not available.

To verify the validity of a Michigan business you can request the buyer’s FEIN or state business registration ID number and contact the Michigan Department of Treasury via phone to verify.

Minnesota

Online verification of Minnesota resale certificates is not available.

Minnesota buyers should provide you with a completely and accurately filled out Minnesota resale certificate (Form ST-3).

You can contact the Minnesota Department of Revenue through phone or email with questions. (If not taken directly to a page with phone and email info, click “Licensing Contact.”)

Mississippi

- Go to the Mississippi Department of Revenue website

- Under “Tools” select “Verify a Permit Number”

- Under “Permit Type” select “Sales Permit”

- Enter the buyer’s permit ID

- Click “Search Permit”

Missouri

Online verification of Minnesota resale certificates is not available.

Missouri buyers should provide you with a completely and accurately filled out Missouri Resale Certificate (Form 149).

Missouri also has an option to look up businesses with revoked sales tax licenses here. This should not be used as a substitute for verifying that the Missouri Resale Certificate is accurate because there’s still a chance for sales tax ID falsification.

You can contact the Missouri Department of Revenue via phone or email or live chat with questions.

Nebraska

Online verification of Nebraska resale certificates is not available.

Nebraska buyers should provide you with a completely and accurately filled out Nebraska resale certificate (Form 13).

You can contact the Nebraska Department of Revenue via phone or email with questions.

Nevada

- Go to Nevada Reseller Permit Search

- Under “Reseller Permit Search” click how you want to search for the reseller. (We recommend “Search by Business Permit Number (TID)”.)

- On the next page, enter the requested information and click the “I’m not a robot” option

- Click “Search”

New Jersey

- Go to the New Jersey On-Line Business Registration Certificate Service

- Enter the “Name Control” (the first four letters of the business name) AND

- Enter Business Entity ID (EIN, TIN, etc.) OR the Certificate Number (the buyer’s sales tax registration number)

- Click “Submit”

New Mexico

- Go to the New Mexico Taxation & Revenue Website

- Under “Businesses” click “Check New Mexico Business Tax ID Status”

- Enter the buyer’s New Mexico Tax ID

- Enter the buyer’s 5-digit zip code

- Enter the last 4 digits of the buyer’s FEIN, SSN or ITIN

- Click “Next”

New York

- Go to the New York Registered Sales Tax Vendor Lookup site

- Enter the security check

- Under “Vendor Information” enter the buyer’s sales tax identification number

- Click “Continue”

North Carolina

- Visit the North Carolina Registry of Sales and Use Tax Numbers

- In Account ID/SST ID# enter the the buyer’s sales tax ID number

- Click “Submit”

North Dakota

- Go to the North Dakota Taxpayer Access Point

- Under “Lookups and Inquiries” click “Sales & Use Permit Inquiry”

- Enter the buyer’s sales tax permit number

- Click “Search”

Ohio

- Go to the Ohio Department of Taxation’s Sales & Use Tax page

- Scroll down to “List of Active Vendors”, clicking this will download a spreadsheet of active Ohio vendors

- Open the spreadsheet and using ctrl-F (Windows) or cmd-F (Mac) search within the spreadsheet for the buyer’s sales tax ID number or other identifying information

Questions? Read the instructions for using the Ohio List of Active vendors here

Oklahoma

- Go to OKTAP

- Under “Help” click “Search”

- On the next page click “Sales Permits”

- You’ll be taken to another page where you also select “Sales Permits”

- Enter the type of ID number your buyer gave you (this will either be Exemption Account ID, Permit Number, or Sales Tax Account ID)

- In the “Search Text” field enter the ID number the buyer provided

- Click “Search”

Pennsylvania

Online verification of Pennsylvania resale certificates is not available.

Pennsylvania buyers should provide you with a Pennsylvania resale certificate and should follow all instructions for filing it out accurately and completely.

You can contact the Pennsylvania Department of Revenue via phone with questions.

Rhode Island

Online verification of Rhode Island resale certificates is not available.

Rhode Island buyers should provide you with a Rhode Island resale certificate and should follow all instructions for filing it out accurately and completely.

You can contact the Rhode Island Division of Taxation via phone or email with questions.

South Carolina

Online verification of South Carolina resale certificates is not available.

South Carolina buyers should provide you with a South Carolina resale certificate and should follow all instructions for filing it out accurately and completely.

You can contact the South Carolina Department of Revenue via phone or email with questions.

South Dakota

Online verification of South Dakota resale certificates is not available.

South Dakota buyers should provide you with a South Dakota resale certificate and should follow all instructions for filing it out accurately and completely.

You can contact the South Dakota Department of Revenue via phone, chat or email with questions.

Tennessee

- Go to the Tennessee Department of Revenue

- Under “Information and Inquiries” click “View Options”

- Under “Other” click “Sales & Use Tax Certificate Lookup”

- On the “Verify a Certificate” page choose the certificate type. This will either be “Blanket Sales and Use Tax Certificate of Resale” or “Streamline (sic) Sales Tax ID” depending on the type of resale certificate you received from your customer

- Enter the customer’s Exemption Number

- Click “Submit”

Texas

- Go to the Texas Comptroller Sales Taxpayer Search

- You can search by various factors like Taxpayer ID, location and zip code or name. We recommend entering the buyer’s Taxpayer ID number in the “Taxpayer ID” field

- Click “Search” next to the field you chose to search by

Utah

Online verification of Utah resale certificates is not available.

Utah buyers should provide you with a Utah resale certificate (Form TC-721) and should follow all instructions for filing it out accurately and completely.

You can contact the Utah State Tax Commission via phone, chat or email with questions.

Vermont

Online verification of Vermont resale certificates is not available.

Vermont buyers should provide you with a Vermont resale certificate (Form S-3) and should follow all instructions for filing it out accurately and completely.

You can contact the Vermont Department of Taxes via phone or contact form with questions.

Virginia

Online verification of Virginia resale certificates is not available.

Virginia buyers should provide you with a completely and accurately filled out Virginia resale certificate (ST-10).

You can contact Virginia Tax via phone or contact form with questions.

Washington

- Go to the Washington State Department of Revenue Business Lookup

- Choose the “Reseller Permit” slide button

- Enter the buyer’s “Reseller permit #”

- Verify that you are not a robot

- Click Search

Washington DC

- Go to MyTaxDC

- Under “More…” click “Search for Certificate/License Exemptions”

- In the dropdown, choose “Resale Certificate”

- In the “Account ID” field, enter the customer’s DC Sales and Use Tax Account ID Number.

- In the “Certificate/License ID” field enter enter the buyer’s resale certificate number

West Virginia

Online verification of West Virginia resale certificates is not available.

West Virginia buyers should provide you with a completely and accurately filled out Streamlined Sales Tax Certificate of Exemption.

You can contact the West Virginia Department of Revenue via phone or email with questions.

Wisconsin

- Go to the Wisconsin DOR My Tax Account page

- Under “Businesses” click “Search account number/filing frequency”

- On the next page, choose “Sales and Use Tax”

- Choose the type of ID number your buyer provided (Usually “Wisconsin Tax ID Number” but may be Federal Employer ID Number (FEIN) or Social Security Number)

- Next to “ID” enter the corresponding ID number

- Enter the business’s name or buyer’s last name

- Enter the buyer’s zip code

- Click “Next”

Wyoming

Online verification of Wyoming resale certificates is not available.

Wyoming buyers should provide you with a completely and accurately filled out Streamlined Sales Tax Certificate of Exemption.

You can contact the Wyoming Department of Revenue via phone or email with questions.

Common Questions about Verifying a Resale Certificate

What if my customer’s resale certificate is “not found” or “inactive”?

Your buyer’s business is “not found”

While you don’t want to accidentally accept a fraudulent resale certificate, there are many non-fraud reasons why a buyer’s tax ID might come up as “not found” when performing a resale certificate lookup. They may have given you their Federal Employer Identification Number (FEIN) rather than their sales tax ID number. Also, many online sales tax lookups allow you to search by different ID numbers, so you may have simply searched for the wrong number.

In this case, double check that you are searching for the right ID number on the state's website. If this doesn’t work, ask the customer to verify that they gave you the correct ID number. If you still can’t verify your customer, you’re likely better off charging sales tax on the sale.

Your buyer’s business is “inactive” or “expired”

This generally indicates that your buyer’s sales tax license has expired or been canceled by either the buyer or the state. Again, check with the buyer to ensure that they gave you the correct number. They may have changed license types or opened a new business. But if the buyer can’t provide an active sales tax ID number or business registration, we don’t recommend accepting the resale certificate.

I accidentally accepted an invalid resale certificate. What happens now?

In some states, you, the vendor, are on the hook for fines and penalties if you accepted a fraudulent resale certificate. In the state’s eyes, they gave you the tools to verify the buyer’s resale certificate and determine if it was valid. Penalties for accepting a fraudulent resale certificate might include paying back the sales tax you didn’t charge and/or a fine.

In other states, including many of those that don’t provide an online resale certificate lookup, the buyer is considered the responsible party when it comes to providing a resale certificate. If you, the seller, can prove that you accepted a fully and accurately completed resale certificate “in good faith,” then the buyer will face the penalties for the fraudulent sale.

- Resale Certificate Lookup for Every US State

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Virginia

- Wisconsin

- Wyoming

- Common Questions about Verifying a Resale Certificate