Sales Tax Holidays

Sales tax holidays (aka tax-free weekends) are a break for consumers but a headache for e-commerce retailers. We’ll explain what you need to know.

Learn more- Zamp Learnings:

- What Are Sales Tax Holidays?

- Zamp Example

- Sales Tax Holidays by State for 2025

- State

- Occasion

- Dates

- Description

- What E-Commerce Sellers Need to Know about Sales Tax Holidays

- How to Handle Sales Tax Holidays

- Turn off sales tax collection item-by-item.

- Turn off all state sales tax collection over the holiday and pay sales tax out of pocket.

- Do not participate in the sales tax holiday.

- Sales Tax Holidays: Conclusion

- Need Help With Sales Tax Compliance?

Zamp Learnings:

- Sales tax holidays are short periods of time when shoppers can go to stores and buy certain items tax-free.

- They are often held in autumn at “back to school” time or in spring for severe weather season disaster preparedness.

- Sales tax holidays can present an administrative headache to e-commerce retailers because they are often mandatory. The seller needs to determine how to prevent sales tax collection on certain items in certain states over specific periods.

Sales tax holidays (also referred to as tax-free weekends) can be a boon for consumers, who essentially see them as 4-7% discounts on products like back-to-school supplies or emergency preparedness items.

However, these short tax-free periods can be a confusing disruption for retailers. This is especially true for e-commerce sellers with sales tax nexus in multiple states and have to deal with sales tax holidays state by state.

This guide will break down what you need to know about sales tax holidays, plus provide you with dates and states that are offering them in 2025.

Book a call today

30-minute call

sales tax expert

off your plate

What Are Sales Tax Holidays?

Sales tax holidays, sometimes called “tax-free weekends,” are short periods determined by a state’s Department of Revenue (DoR) when shoppers can go to stores and buy certain eligible items tax-free. In some states, items are only free from state tax, and shoppers still have to pay the local sales tax rate. (Read more about how sales tax rates work here.)

In the US, states set their own sales tax rules and laws. Many states use tax-free weekends to incentivize shoppers to shop, often for necessities.

Zamp Example

Other states use sales tax holidays to incentivize shoppers to stay in-state (or even to lure shoppers from other states). For example, Massachusetts often offers tax-free weekends at key times to keep shoppers in-state rather than crossing the border into New Hampshire, a state with no sales tax year-round.

Politicians often see short breaks from paying sales tax as politically expedient, popular, and a way to stimulate the economy.

But for retailers, especially e-commerce sellers, sales tax holidays can be difficult, unpopular and a surefire way to develop a headache.

Sales Tax Holidays by State for 2025

Several states offer sales tax holidays for the back-to-school season and for weather preparedness. The table below shows which states offer sales tax holidays for 2025 and what items may apply.

| State | Occasion | Dates | Description |

|---|---|---|---|

| Alabama | Severe Weather | February 21-23, 2025 | No state sales or use tax is charged on certain items related to severe weather. Some counties and municipalities have decided to participate. |

| Alaska | Holiday Season | November 29-30, 2025 | The Holiday Season Tax Holiday in Alaska does not apply to alcoholic beverages, tobacco products, marijuana, and fuel. |

| Connecticut | Back to School | Dates TBD | N/A |

| Florida | Energy Star | Dates TBD | Generally applies to ENERGY STAR appliances selling for $3,000 or less |

| Florida | Back to School | Dates TBD | Applies to: - School supplies ($50 or less) - Clothing ($100 or less) - Computers ($1,500 or less) |

| Florida | Disaster Preparedness | Dates TBD | Applies to various disaster preparedness items ranging from $10 to $3,000 |

| Florida | Freedom Month | July 1-31, 2025 | Applies to: - Event admissions - Recreational supplies |

| Florida | Tool Time | Dates TBD | Applies to qualifying tools and equipment |

| Iowa | Back to School | August 1-2, 2025 | Applies to clothing and footwear ($100 or less) |

| Louisiana | Second Amendment Weekend | September 5-7, 2025 | Applies to firearms, ammunition, and hunting supplies |

| Maryland | Energy Star | February 15-17, 2025 | Applies to Energy Star products |

| Maryland | Back to School | August 10-16, 2025 | Applies to clothing and footwear ($100 or less) |

| Massachusetts | Annual Sales Tax Holiday | Dates TBD | All tangible personal products costing $2,500 or less |

| Mississippi | Back to School | July 11-13, 2025 | Applies to articles of clothing, footwear, or school supplies if the item is $100 or less |

| Mississippi | 2nd Amendment Holiday | Dates TBD | Applies to hunting supplies, including archery equipment, firearm and archery accessories, etc. |

| Missouri | Back to School | August 1-3, 2025 | Applies to: - Clothing ($100 or less) - School supplies ($50 or less) - Computers ($1,500 or less) |

| Missouri | Energy Star | April 19-25, 2025 | Applies to retail sales of Energy-Star products |

| Nevada | National Guard Member Holiday | October 31-November 2, 2025 | Applies to purchases made by National Guard members |

| New Mexico | Back to School | August 1-3, 2025 | Applies to: - Clothing ($100 or less) - Computers ($1,000 or less) - Computer equipment ($500 or less) - School supplies ($30 or less) |

| New Mexico | Small Business Saturday Gross Receipts Tax Holiday | Dates TBD | Receipts from the retail sale of tangible personal property |

| Ohio | Annual Sales Tax Holiday | August 1-3, 2025 | All tangible personal property $500 or less (with some exceptions) |

| Oklahoma | Back to School | August 1-3, 2025 | Applies to clothing and footwear ($100 or less) |

| South Carolina | Back to School | August 1-3, 2025 | Applies to clothing, school supplies, and computers |

| Tennessee | Back to School | July 25-27, 2025 | Applies to: - Clothing ($100 or less) - School supplies ($100 or less) - Computers ($1,500 or less) |

| Texas | Emergency Preparation Supplies Holiday | April 26-28, 2025 | Applies to: - Portable generators ($3,000 or less) - Hurricane shutters and ladders ($300 or less) - Supplies ($75 per item or less) |

| Texas | Energy Star | May 24-26, 2025 | Applies to Energy-Star products like air conditioners (priced at $6,000 or less) and refrigerators (priced at $2,000 or less) |

| Texas | Water Efficient Products Sales Tax Holiday | May 24-26, 2025 | Applies to any product with a WaterSense logo or label, etc. |

| Texas | Back to School | August 8-10, 2025 | Applies to: - Clothing and footwear ($100 or less per item) - Supplies (less than $100 per item) |

| Virginia | Three-Day Sales Tax Holiday | Dates TBD | Applies to: - Clothing and footwear ($100 or less) - School supplies ($20 or less) - Portable generators ($1,000 or less) - Hurricane preparedness ($60 or less per item) |

| West Virginia | Back to School | August 1-4, 2025 | Applies to: - Clothing ($125 or less) - Supplies ($20 or less) - Sports equipment ($150 or less) - Computer/tablet ($500 or less) |

Free Download: 2025 Sales Tax Outlook

Sales tax is difficult to juggle with new changes made every year. That’s why we put together a 2025 Sales Tax Outlook with all the changes you need to ensure your business stays compliant.

What E-Commerce Sellers Need to Know about Sales Tax Holidays

The trouble with sales tax holidays for e-commerce sales is that you must be able to turn off sales tax collection on certain items when shipping to individual states over a limited period.

If you don’t manage to turn off sales tax collection on items that are subject to the holiday, your customers may complain or, worse, turn to a competitor who does support the sales tax holiday.

However, supporting the sales tax holiday is also difficult for e-commerce sellers.

You’re required to know each state’s special sales tax rules.

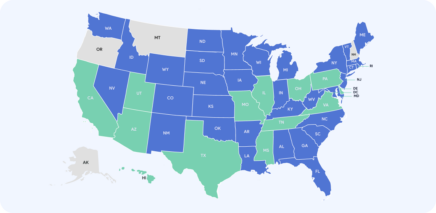

- Does a state even have a sales tax holiday? Generally, around 20 states have at least one sales tax holiday each year. Some states have the same holiday(s) every year, while other states are required to approve a new tax-free holiday each year and sometimes do not hold one. Some states also approve sales tax holidays at the last minute.

- Is a sales tax holiday only on state sales tax? If the holiday only excludes state tax, this means you’re still required to collect local sales tax (city, county, etc.) from your buyer. Worse, some states allow local areas to opt in or out of a sales tax holiday. This might mean you need to collect one county’s sales tax but not the county sales tax rate in the county just next door.

- What dates do the sales tax holidays cover? Each state’s schedule is different. Even “back to school” sales tax holidays, though they happen in the fall, can vary by date and length.

- What specific items does the sales tax holiday include? One state might include computers in a “Back to School” sales tax holiday, while other states only include clothing and footwear. And many states are vague about which specific items count as “school supplies.”

- Are you required to honor the holiday? Some states require retailers, even out-of-state e-commerce retailers, to honor the sales tax holiday, while others allow you to opt-out. This decision is up to you. Honoring the holiday might lead to more sales, but opting out would be much easier administratively.

How to Handle Sales Tax Holidays

Here are a few tips on handling sales tax holidays as an e-commerce seller or business owner.

Turn off sales tax collection item-by-item.

If your sales tax engine allows it, you can go in manually and turn off sales tax collection on each item that is subject to the sales tax holiday.

The downside here is that this is a tedious manual process, especially if your store sells a large catalog of items. You also need to remember to turn sales tax collection back on after the holiday is over. This may also mean you need to take care of edge cases, such as sales you made overnight after the sales tax holiday officially ended.

Unfortunately, most sales tax collection engines do not allow for this level of granularity, so this simply isn’t an option.

Turn off all state sales tax collection over the holiday and pay sales tax out of pocket.

You can also just turn off sales tax collection completely for a state over the holiday weekend and then pay any uncollected sales tax out of pocket.

This is an option if you wish to honor the tax-free weekend but have no way to turn off sales tax collection for individual items. However, this will mean you’ll need to determine how much sales tax you should have collected on items you sold that were not subject to the sales tax holiday.

Again, this is a tedious, manual process. And if you get this wrong, you can be subject to interest and penalties from the state.

Do not participate in the sales tax holiday.

Sales tax holidays are mandatory in some states (such as South Carolina), but other states allow retailers to opt in or out. The good news is that most state taxing authorities will generally not penalize you for collecting sales tax. After all, they want tax money to pay for budget items like schools and hospitals!

The worst case scenario here, if you are allowed to opt out of the sales tax holiday, is that you lose sales over the holiday because customers choose to shop with competitors who are honoring the sales tax holiday. However, in a slim-margin business like e-commerce, losing a weekend’s sales to competitors can be a heavy blow to the bottom line, so that business decision is up to you.

Sales Tax Holidays: Conclusion

Each state has the right to declare a sales tax holiday, whether for hurricane preparedness items or back-to-school items. Regardless of the case, businesses in most states are required to participate. The best way to ensure you handle sales tax right is by working with an automated sales tax solution like Zamp.

Need Help With Sales Tax Compliance?

Zamp isn’t just another automated sales tax solution; we’re shaking up the industry by putting our customers first. We’ve been named a Major Player in the Small, Mid, and Enterprise SUT markets in IDC’s 2024 IDC MarketScape for Worldwide SaaS and Cloud-enabled Tax Automation Software, along with being featured in the top ten best sales tax software companies by taxtech500.

We help businesses outsource their sales tax from start to finish. Our platform manages the complete sales tax lifecycle by offering:

- Hands-off onboarding: We set up everything for you and ensure it’s done right.

- Full sales tax compliance service: We offer nexus tracking, registrations, roof-top accurate calculations, product taxability research, mapping, reporting, and filing. All this is included in our pricing model — one fee for everything.

- Proactive account support: We are always looking for any changes in sales tax requirements, and our team is happy to answer any questions you may have.

And if you’re stuck in a contract with another company, see how we can help you through our Buyout Program. Book a call below!

Book a call today

30-minute call

sales tax expert

off your plate

State Sales Tax Holiday: FAQ

A sales tax holiday is a period of time when a state allows sales tax to be waived on certain purchases or items. These typically include back-to-school sales or emergency preparation.

The goal of a sales tax holiday is to encourage taxpayers to purchase tax-free items that are much needed and to foster growth.

No, the tax-free weekends are not in all states. You can check the list above to see what states had sales tax holidays in 2025.

- Zamp Learnings:

- What Are Sales Tax Holidays?

- Zamp Example

- Sales Tax Holidays by State for 2025

- State

- Occasion

- Dates

- Description

- What E-Commerce Sellers Need to Know about Sales Tax Holidays

- How to Handle Sales Tax Holidays

- Turn off sales tax collection item-by-item.

- Turn off all state sales tax collection over the holiday and pay sales tax out of pocket.

- Do not participate in the sales tax holiday.

- Sales Tax Holidays: Conclusion

- Need Help With Sales Tax Compliance?