Sales and Use Tax Software

When it comes to sales and use tax software, a completely managed solution like Zamp can help you calculate tax rates, prepare returns, and monitor nexus thresholds.

Why Zamp?

Combining technology and help from sales tax experts is a game changer.

We do the heavy lifting, so you don’t have to.

Fully Managed Solution

Stressing over sales tax is a thing of the past. All you do is click approve, and we handle the rest. You'll always be up-to-date and sales tax compliant.

Developer Friendly Sales Tax API

Connect your existing e-commerce, marketplace & ERP systems within minutes, and use Zamp’s API for roof-top accurate sales tax calculations.

One Price

One simple price that scales with your business. No overages, no hidden fees, no surprises.

Sales and Use Tax Software

Updated: February 3, 2025- What Is Sales and Use Tax Software?

- How Does Sales Tax Work?

- Benefits of Using Sales and Use Tax Preparation Software

- How to Choose the Right Sales and Use Tax Software

- Implementing Sales and Use Tax Software

- Sales and Use Tax Software Legal and Compliance Issues

- Sales and Use Software Training and Support

- Future Trends in Sales Tax Management

- Making the Most of Sales and Use Tax Software: Conclusion

Zamp Learnings

- Transactional tax compliance, such as sales and use tax, has become increasingly complicated and demanding.

- The best way to stay in compliance with sales and use tax is to have a completely managed solution that calculates tax rates, prepares returns, and monitors nexus thresholds for your business.

- Not every company is created equal regarding sales and use tax software. Many fail to offer a completely managed sales tax solution like Zamp.

The business world is dynamic and compliance with sales and use taxes cannot be overstated. Sales tax compliance safeguards your business from legal repercussions and financial penalties arising from non-compliance.

However, taxes vary by jurisdiction at the state and city levels, making keeping up with them daunting. To manage the complexities of sales and use taxes, you need sophisticated sales and use tax software to automate and streamline the tax compliance process, offering you peace of mind and freeing up your time to focus on core business activities.

Today, we’ll cover everything you need to know about sales and use tax software.

Book a call today

30-minute call

sales tax expert

off your plate

What Is Sales and Use Tax Software?

Understanding the intricacies of sales and use taxes is critical for proper compliance. Typically, the vendor collects sales tax at the point of purchase and then remits it to the government during tax filing. On the other hand, use tax comes into play when sales tax has not been charged on a taxable item or service. This often occurs in interstate commerce, and it's generally the buyer's responsibility to report and pay to their state.

Compliance isn't just a legal mandate for businesses; it's a strategic necessity. Staying on the right side of tax authorities and laws protects your business reputation and avoids the disruption of sales tax audits and fines. In addition, robust compliance can provide insights into your sales processes, helping to identify potential areas for cost savings and process improvements.

The Need for Automation in Sales Tax Compliance

Manual compliance has several challenges. It's time-consuming, prone to human error, and almost impossible to keep up-to-date with the myriad of tax rates and rules that change frequently. For businesses operating in multiple jurisdictions, the complexity is much greater, making manual compliance an inefficient and risky approach.

This is where you need technology. Sophisticated sales and use tax software automates the entire process, from calculating the correct tax rates to filing tax returns. With a sales tax compliance solution like Zamp, the guesswork is eliminated, and accuracy is significantly increased, enabling you to focus on growth, profitability, and business needs.

Using sales tax software also reduces the time spent on tax-related tasks, minimizes the risk of errors and penalties, and often results in cost savings. Additionally, it ensures consistent tax compliance across all sales channels and jurisdictions, bolstering your business's credibility and reliability.

Key Features of Sales and Use Tax Software

Today, small businesses face the complex challenge of managing sales tax across multiple jurisdictions. Sales tax preparation software has emerged as an indispensable tool, offering features designed to streamline the tax compliance process.

- Automated Tax Calculations: One of the core features of sales tax preparation software for small businesses is its ability to calculate taxes owed across different states and multiple cities accurately. By integrating with your sales channels and product databases, the software can automatically determine the correct sales tax rates and apply them to each transaction, ensuring precision and eliminating the risk of human error.

- Nexus Determination: Determining where your business has a tax obligation, known as nexus, can be complex. Sales tax preparation software typically includes tools to help companies identify their nexus locations based on physical presence, economic presence, and specific state laws. This information is crucial for setting up accurate tax calculations and staying compliant.

- E-Filing and Payment Capabilities: Sales tax automation software solutions directly integrate with state and local tax authorities, allowing businesses to file tax returns and make payments electronically. This streamlined process eliminates the need for manual paperwork and ensures accurate and timely filings, which reduces the risk of penalties and interest charges.

- Compliance Management: Tax laws and rates constantly evolve, making it challenging for businesses to stay current with the latest changes. Sales tax preparation software often includes compliance management features that monitor these changes and automatically update the software's tax calculations and rules, ensuring businesses remain fully compliant without manual intervention.

- Reporting and Analytics: Sales tax automation solutions typically include comprehensive reporting and analytics capabilities. These tools allow businesses to generate detailed reports on their tax liabilities, payments, and filing histories, providing valuable insights for record-keeping, financial analysis, and audit preparedness.

How Does Sales Tax Work?

After the 2018 Supreme Court decision in South Dakota v. Wayfair, more businesses than ever are required to collect sales tax from buyers in more states. Sales tax nexus refers to a retailer or company connecting with a state that requires them to collect sales tax from buyers in that state.

It could be as apparent as operating your store or business headquarters in that state. Or it could be less obvious, like triggering economic nexus in a state because, as an online retailer, you exceed that state's economic nexus sales tax threshold.

Each state has different thresholds for economic nexus. It’s generally achieved by a company that makes $100,000 in sales and 200 separate transactions in a state in a year.

After a company achieves sales tax nexus in a state, it must register for a sales tax license and begin charging, collecting, filing, and remitting sales tax. This is where sales tax management software can come in handy, as the best solutions handle all this for you.

Benefits of Using Sales and Use Tax Preparation Software

Sales tax management software benefits businesses, making tax management more straightforward and efficient. Here are some additional benefits:

- Accuracy and Compliance: Sales tax preparation software significantly reduces the risk of errors and ensures full compliance with applicable laws and regulations by automating sales tax calculations and leveraging up-to-date tax rules and rates. This minimizes the chances of costly audits, penalties, and legal issues.

- Efficiency and Time Savings: Manual tax calculation and filing processes can be incredibly time-consuming, particularly for businesses with large transactions or complex tax obligations. Sales tax preparation software automates these tasks, freeing up valuable time and resources that can be dedicated to other critical business operations.

- Scalability: As your business grows and expands into new markets or jurisdictions, the complexity of your sales tax obligations will inevitably increase. Sales tax preparation software is designed to scale seamlessly, enabling businesses to manage their tax needs efficiently without significant additional resources or personnel.

- Risk Reduction: Inaccurate tax filings or missed deadlines can lead to substantial penalties, interest charges, and legal implications. Sales tax preparation software helps businesses mitigate the risk of sales tax audits and protect their financial interests by ensuring accurate and timely tax calculations and filings.

- Cost Savings: While sales tax preparation software typically requires an upfront investment, it can lead to significant cost savings in the long run. Businesses can reduce their overall tax management expenses by eliminating the need for external tax consultants or dedicated in-house staff while maintaining sales tax compliance and accuracy.

Free Download: Sales Tax Guide for E-Commerce

How to Choose the Right Sales and Use Tax Software

Factors to Consider

Several factors should be considered when selecting the ideal sales and use tax software for your business. Consider the scale of your operations, the complexity of your tax obligations, and the level of integration required with your current systems. You should also assess the software's ease of use, the quality of customer support provided, and the overall cost of the solution.

Comparison of Leading Sales and Use Tax Software Solutions

The market offers various sales and tax software solutions, each with strengths. Avalara, for instance, provides a comprehensive suite of tax compliance tools, including real-time tax rate calculations and automatic filing. TaxJar, however, focuses on simplicity and ease of use. Both solutions integrate with popular e-commerce platforms like Shopify and WooCommerce.

However, Zamp stands out as the top choice among sales tax compliance software solutions. Its advanced features, seamless integration capabilities, and competitive pricing make it a preferred option for businesses of all sizes. With Zamp, companies can streamline tax compliance processes and ensure accurate reporting, leading to increased efficiency and cost savings.

Case Studies and Testimonials from Businesses

KAF Home Has Sales Tax Peace of Mind Throughout 30 States and Counting With Zamp

Handling sales tax became overwhelming for CFO Gavin Sclar when KAF Home ventured into online sales, which took up valuable time and energy. Seeking a solution, he discovered Zamp, which provided top-notch customer service, peace of mind regarding compliance, and significant time savings through seamless onboarding.

With Zamp's assistance, Gavin no longer spends days navigating complex tax regulations but instead focuses on business growth. Zamp's efficient management resulted in six months of accurate filings, 70 completed filings, and 30 state registrations, ensuring KAF Home can thrive in the home textiles and kitchenware industry without the burden of sales tax complexities. You can read the entire case study here.

How Little Hunter Registered and Filed in 15+ States With Zamp

As a new and rapidly expanding company, Little Hunter found itself overwhelmed with the complexities of sales tax compliance, detracting from its focus on growth. CEO Annie Wasserman faced time-consuming and expensive challenges navigating tax requirements until discovering Zamp.

With Zamp's comprehensive solution, Annie enjoys the benefits of sales tax on autopilot, quick and responsive customer support, and seamless onboarding and implementation. Now, instead of fretting over tax intricacies, Annie concentrates on expanding the company's offerings.

Zamp's efficient management has resulted in six months of accurate filings, 18 state registrations, and improved tiering to accommodate the company's growth trajectory. You can read the entire case study here.

See Zamp in action

Implementing Sales and Use Tax Software

Integrating sales and use tax software into your business processes doesn't have to be daunting.

The process of automating sales tax begins with planning and continues through testing, deployment, and review. Throughout this process, it's essential to maintain clear communication with your team and to provide the necessary resources for a smooth transition.

To ensure a successful implementation, follow best practices such as setting clear objectives, involving key stakeholders early on, and allowing for adequate training time.

Lastly, adopting new technology can bring significant benefits, but it's essential to be aware of common pitfalls. These may include underestimating the time required for implementation, neglecting to cleanse and migrate data properly, or failing to test the system thoroughly before going live. It's vital to stay aware of these potential obstacles and take proactive steps to mitigate them.

Sales and Use Tax Software Legal and Compliance Issues

Sales and use tax laws and regulations are complex and vary widely by jurisdiction. They can involve different tax rates, product taxability rules, and filing requirements by your state's taxing authority. It's imperative to clearly understand these laws as they apply to your business to ensure full compliance and avoid penalties.

Keeping Up with Changes in Tax Laws

The right software plays a pivotal role in your compliance strategy. It automates sales tax calculations, filings, and record-keeping, helps prevent costly errors, and ensures you meet all filing deadlines. This level of diligence is your best defense against audits and penalties, allowing you to operate your business confidently.

Role of Software in Ensuring Compliance and Avoiding Penalties

The right software plays a pivotal role in your compliance strategy. It automates sales tax calculations, filings, and record-keeping, helps prevent costly errors, and ensures that you meet all filing deadlines. This level of diligence is your best defense against audits and penalties, allowing you to operate your business confidently.

Sales and Use Software Training and Support

Comprehensive training is essential to get the most out of your sales and use tax software. This training should cover all aspects of the software, from basic essentials to more advanced features. With a well-trained team, you can maximize the benefits of the software and ensure that your tax processes are managed efficiently and accurately.

Quality support services are a hallmark of any reputable software provider. This support can take many forms, including extensive documentation, responsive customer service, and proactive technical assistance.

Zamp offers reliable support and ensures that any issues you encounter can be resolved quickly, minimizing disruption to your tax compliance activities. Contact us today to ensure that your tax processes are managed efficiently and effectively.

Future Trends in Sales Tax Management

The future of managing sales tax is poised for some significant changes, with AI and machine learning gearing up to lead the revolution. Cloud-based solutions are quickly becoming the go-to, providing flexible and easy-to-access tools for companies big and small. Plus, combining enhanced data analytics with tax management is about to open up a treasure trove of valuable insights, making strategic decisions a whole lot smarter.

- Artificial Intelligence and Machine Learning: Integrating AI and machine learning into sales tax management is set to automate and enhance the efficiency of tax processes dramatically. These technologies bring several advantages:

- Advanced AI algorithms process extensive data sets to refine tax calculation accuracy.

- Machine learning adapts seamlessly to new tax regulations, ensuring continuous compliance.

- Predictive analytics utilize historical data to anticipate future tax liabilities, aiding in strategic planning.

- Adopting AI streamlines business operations, leading to significant cost savings and heightened compliance.

- Increased Regulatory Complexity: As regulatory environments become more complex, the challenges for software developers and businesses intensify. This complexity necessitates the development of more sophisticated sales tax management tools capable of navigating real-time regulatory changes and ensuring compliance.

- Cloud-Based Solutions: The shift towards cloud-based sales tax management solutions marks a significant turn in how businesses approach tax compliance. Key benefits include:

- Scalable resources that grow with your business needs.

- Anytime, anywhere access to tax data, facilitating swift decision-making.

- Instantaneous updates on tax law changes, ensuring ongoing compliance.

- Reduced costs through streamlined operations and minimized manual tasks.

Cloud-based platforms offer a flexible, efficient approach to managing sales tax. They allow businesses to stay agile and informed about changing tax regulations.

- Enhanced Data Analytics: The strategic use of tax data analytics within sales tax management systems can unveil deep insights into business operations, customer behaviors, and market trends. These insights support:

- Refined pricing strategies and identification of growth opportunities.

- Improved understanding of sales patterns and tax compliance risks.

- Informed decision-making to enhance financial health and strategic direction.

By leveraging enhanced data analytics, businesses can gain a competitive edge, optimize their tax management strategies, and foster growth and profitability.

Making the Most of Sales and Use Tax Software: Conclusion

Sales and use tax software is more than just a tool—it's an investment in your business's operational excellence. By automating complex tax processes, it allows you to focus on growing and managing your business.

The role of sales tax automation software in simplifying tax compliance cannot be overstated, and as tax laws continue to evolve, their value will only increase.

Why Zamp?

Zamp is shaking up the industry by putting customers first. And it shows — we’ve been named a Major Player in the Small, Mid, and Enterprise SUT markets in IDC’s 2024 IDC MarketScape for Worldwide SaaS and Cloud-enabled Tax Automation Software, along with being featured in the top ten best sales tax software companies by taxtech500.

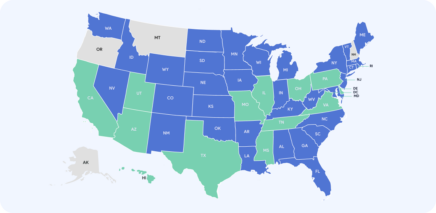

Our full-service platform allows businesses to outsource their sales tax from start to finish. Our platform manages the complete sales tax lifecycle by offering:

- Hands-off onboarding: We set up everything for you and ensure it’s done right.

- Full sales tax compliance service: We offer nexus tracking, registrations, roof-top accurate calculations, product taxability research, mapping, reporting, and filing. All this is included in our pricing model — one fee for everything.

- Proactive account support: We are always looking for any changes in requirements, and our team is happy to answer any questions you may have.

See how you can save time and stay sales tax compliant with Zamp. Book a call below!

Book a call today

30-minute call

sales tax expert

off your plate

Sales and Use Tax Software: FAQ

Sales and use tax software is a digital solution designed to automate the process of calculating, collecting, reporting, and remitting sales and use taxes for businesses. It works by integrating with your sales and accounting systems to apply the correct tax rates to each transaction based on the latest tax laws and regulations.

Sales and use tax software can benefit your business by improving accuracy in tax calculations, saving time on tax-related tasks, reducing the risk of non-compliance penalties, and providing valuable insights through reporting and analytics. It also streamlines the tax compliance process across multiple tax jurisdictions, making it easier for businesses of all sizes to manage.

When choosing sales and use tax software, consider features such as automated tax calculation and remittance, real-time tax rate updates, seamless integration with your existing systems, comprehensive reporting and analytics capabilities, and reliable customer support.

Sales and use tax software streamlines tax compliance processes by automating calculations, filings, and record-keeping. This reduces the manual effort involved in managing taxes and ensures that your business stays compliant with the latest tax laws and regulations.

Absolutely, sales and use tax software is suitable for small businesses. Solutions are available that cater to the needs and budgets of smaller operations, providing them with the same level of tax compliance management as larger enterprises.

Sales tax preparation software includes tools to help businesses identify their nexus locations — where they have a tax obligation — by analyzing factors like physical and economic presence, ensuring accurate tax setup and compliance.

Yes, these software solutions are designed to integrate seamlessly with various business systems, including accounting software, e-commerce platforms, and ERP systems, facilitating efficient data exchange and streamlined operations.

Indeed, it offers direct integration with state and local tax authorities for electronic tax return filing and payments, streamlining the process and reducing the risk of penalties and interest charges.

- What Is Sales and Use Tax Software?

- How Does Sales Tax Work?

- Benefits of Using Sales and Use Tax Preparation Software

- How to Choose the Right Sales and Use Tax Software

- Implementing Sales and Use Tax Software

- Sales and Use Tax Software Legal and Compliance Issues

- Sales and Use Software Training and Support

- Future Trends in Sales Tax Management

- Making the Most of Sales and Use Tax Software: Conclusion