Is shipping taxable?

In brief:

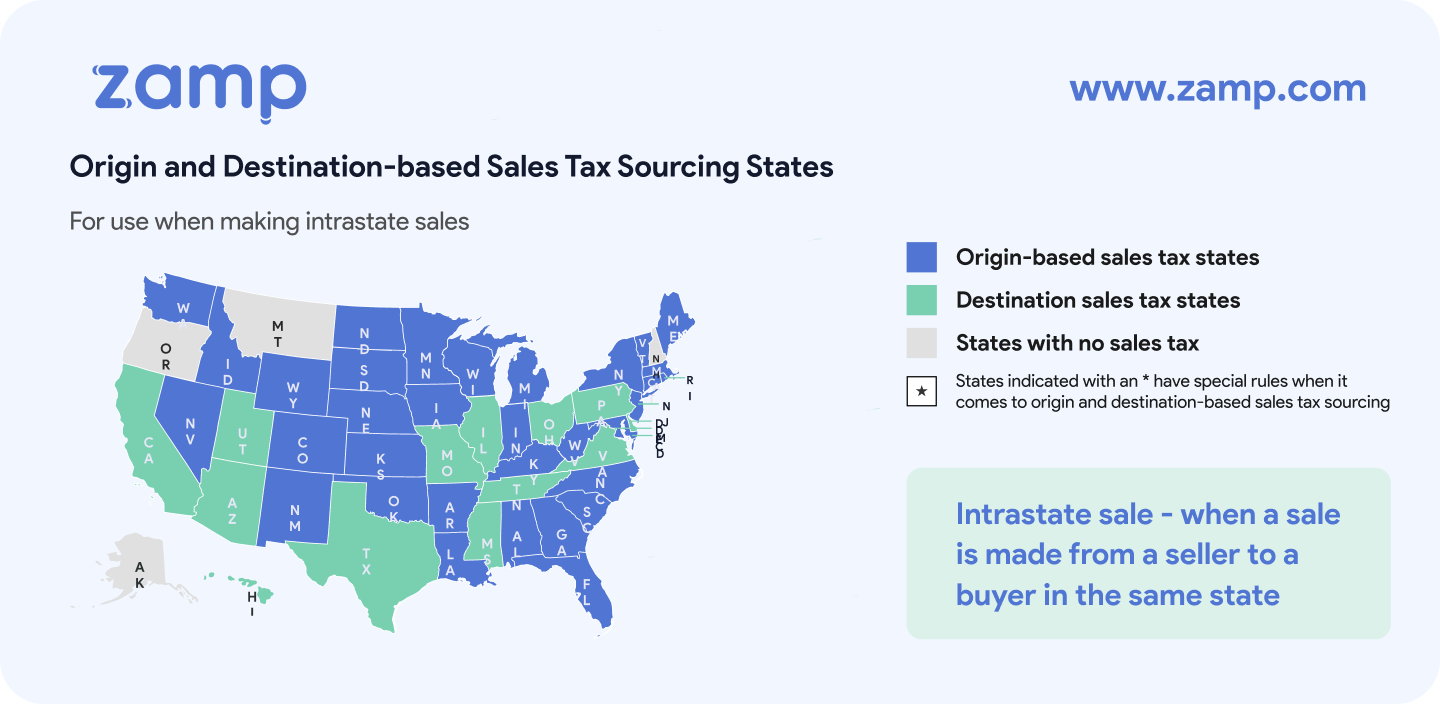

- Each state makes their own rules and laws on whether sales tax is charged on e-commerce shipping fees

- Shipping is taxable in a little over half the US states with a sales tax

- States that don’t charge tax on shipping charges generally require e-commerce sellers to separate out the shipping charge on the invoice

- Shipping charges are generally only taxable if the items being shipped are also taxable

| Further reading: • Uncover the sales tax rules in Texas and how to stay compliant when filing sales tax. • Discover how sales tax in California affects your business and which items are exempt from sales tax. |

When it comes to e-commerce, some states consider the shipping charges a necessary part of the sale and consider them taxable.

Other states say that, as long as the shipping charge is separately stated from the price of the item, then it isn’t taxable.

The trouble is that all of the forty-six states (plus Washington DC) that have a sales tax get to make their own rules and laws. So there is no uniform rule of thumb when it comes to charging sales tax on shipping charges.

Which States Charge Sales Tax on Shipping

The below two lists sum up the taxability of shipping charges on “most” e-commerce sales. The below lists of states where shipping charges are and are not taxable apply to an e-commerce transaction where:

- The item or items shipped are subject to sales tax

- The seller ships the item to the buyer using a common carrier like USPS, UPS, FedEx, etc.

- The seller pays for the postage/shipping and then charges the buyer for that exact amount.

- The seller separately states the shipping charges to the buyer (i.e. the shipping charges aren’t included in the sale price).

- There are no unusual scenarios, such as the buyer paying shipping fees directly to the carrier.

States That Charge Sales Tax on Shipping

| Alaska | Mississippi | South Carolina |

| Arkansas | Nebraska | South Dakota |

| Connecticut | New Jersey | Tennessee |

| Georgia | New Mexico | Texas |

| Hawaii | New York | Vermont |

| Indiana | North Carolina | Washington |

| Kansas | North Dakota | Wisconsin |

| Kentucky | Ohio | West Virginia |

| Michigan | Pennsylvania | |

| Minnesota | Rhode Island |

States That Do Not Charge Sales Tax on Shipping

| Alabama | Illinois | Nevada |

| Alaska* - depends on jurisdiction; non-taxable if separately stated | Iowa | Oklahoma |

| Arizona | Louisiana | Utah |

| California | Maine | Virginia |

| Colorado | Maryland | Washington DC |

| Florida | Massachusetts | Wyoming |

| Idaho | Missouri |