US Sales Tax Amnesty Explained

In brief:

- From time to time a state might offer a sales tax amnesty. This allows non-compliant taxpayers to become compliant without paying much or all of the penalties and interest usually associated with non-compliance.

- These amnesties are few and far between, so taxpayers shouldn’t count on their state offering an amnesty as a surefire way to eliminate fines and penalties for non-compliance.

- Fortunately, other options, such as Voluntary Disclosure Agreements (VDAs), exist for non-compliant businesses who discover sales tax compliance obligations.

| Further reading: • Take a close look at the sales tax rules in Texas, including taxable items and exemptions in 2023. • Explore how sales tax rules in California work and how to stay compliant throughout the filing process. |

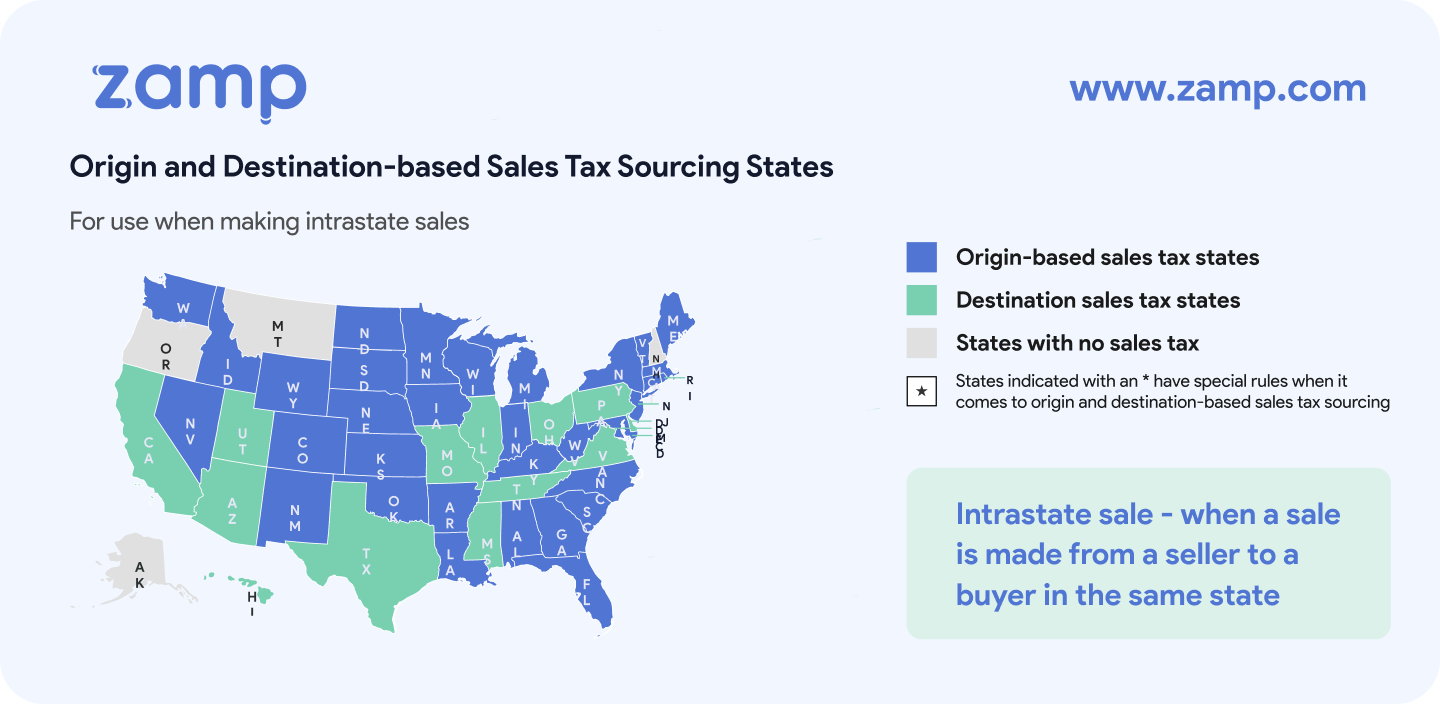

Sales tax is complicated, and sometimes retailers are unaware that they have sales tax liability in a state.

However, failing to comply–by collecting and remitting sales tax–can lead to substantial interest and penalties.

Fortunately, some states understand this. And from time to time, states offer sales tax amnesty to retailers who were unaware of their tax obligation.

What is sales tax amnesty?

From time to time a state (or sometimes a local government) will announce a sales tax amnesty. Though the rules of amnesties vary, for the most part this means that a state will allow someone who is not compliant to get compliant without some or all the penalties and interest that would normally go along with coming clean to the state.

Not all states offer sales tax amnesty, and for those that do they often limit amnesty to specific time periods or specific taxpayers.

Why do states offer sales tax amnesty?

States and local areas use sales tax revenue to pay for budget items like roads, schools and hospitals. And every state has a tax gap–the gulf between tax they are owed and tax that is actually paid into state coffers.

States will occasionally offer amnesty to businesses as a way to incentivize businesses to comply with sales tax laws. For states, amnesty is a way to encourage delinquent taxpayers to come forward and start collecting and remitting sales tax from now on. This also saves them the trouble of performing audits and discovering delinquent taxpayers themselves.

Though we can’t count on every state taxing authority to be kind and benevolent, most understand that having healthy businesses that haven’t been buried under huge fines and penalties is a good thing. And for that reason, they offer amnesty as a carrot to entice businesses to comply.

Why do taxpayers take advantage of sales tax amnesty?

For retailers, sales tax amnesty is an opportunity to become sales tax compliant with a state without paying the full amount you owe in penalties and interest.

All too often a merchant such as an e-commerce seller realizes that they had sales tax nexus, and thus an obligation to collect sales tax, in a state but have not been doing so. When they go back and calculate how much past due sales tax they would owe to that state, they realize that their tax bill would be damaging to the business’s bottom line.

Some retailers ignore the sales tax compliance problem and hope it goes away. Unfortunately, that old saying about death and taxes tends to come true and states find the seller, perform an audit, and assess penalties and interest.

Sales Tax Amnesty Example

Jay is the owner of a mid-sized e-commerce furniture store and he completely missed the news about South Dakota v. Wayfair and economic nexus. Jay did not realize that even though all of his physical business activities are located in his home state of Pennsylvania, he now has nexus in ten other states because of the amount of sales he makes into those states.

This means that Jay should have been collecting tax on transactions to buyers in all of his new nexus states. Jay only discovers this when he receives the dreaded notice of an audit from the state of Louisiana. Unfortunately, being caught in an audit means it’s already too late for Jay to voluntarily comply with Louisiana sales tax laws. But because he now understands that he has sales tax nexus and an obligation to collect sales tax in other states, he can look around for compliance options.

One common option is to take advantage of a state’s voluntary disclosure program. In this case, Jay would hire a state and local tax expert (SaLT) to negotiate with the state. In this option, the sales tax expert negotiates anonymously with the state to alleviate fines and penalties as long as Jay registers and becomes sales tax compliant going forward.

But if Jay is very lucky, he’ll discover that the department of revenue in one or more of the states he has been non-compliant in is offering a sales tax amnesty. If this is the case, he can determine if his business qualifies, apply for the state’s amnesty program, and discharge some of the fines and penalties that otherwise could have threatened the health of his business.

Sales tax amnesties, however, are few and far between. If you discover that you are non-compliant in a state where you have sales tax nexus, it’s best to speak with a sales tax expert about your options rather than hoping that a fortunately-timed sales tax amnesty appears on the horizon.

Sales Tax Amnesty Programs by State

There are currently no active sales tax amnesty programs for 2023. We’ll update here as states announce new amnesty programs.