Do you need to charge sales tax when dropshipping?

- What is dropshipping?

- Dropshipping and Sales Tax

- 4 Common Dropshipping Sales Tax Scenarios

- Scenario 1: Neither the Retailer nor the Supplier has sales tax nexus in the Buyer’s state

- Scenario 2: Retailer makes a dropshipping sale to a customer in a state where the Retailer has sales tax nexus but the Supplier does not

- Scenario 3: Retailer makes a dropshipping sale to a customer in a state where both the Retailer and Supplier have sales tax nexus

- Scenario 4: Retailer makes a dropshipping sales to a customer in a state where the Retailer does not have nexus but the Supplier does have nexus

- Dropshipping and Resale Certificates

- Common Dropshipping Sales Tax Questions

In brief:

- Dropshipping and sales tax is complicated because there are actually at least two transactions involved. This means there are at least two instances where you and your vendor must ask “Should I charge sales tax here?”

- Don’t ignore sales tax when dropshipping. This is one of the most common scenarios auditors look at when scrutinizing your tax history.

- Find your dropshipping scenario in our “4 Common Dropshipping Sales Tax Scenarios” section below for more guidance.

Dropshipping is an increasingly common e-commerce business model and a great way to ensure your customers get the items they need, even if you don’t have them in stock.

But figuring out who charges sales tax in a dropshipping situation can turn something that should be fairly simple into a huge headache.

Let’s look at how dropshipping and sales tax works.

What is dropshipping?

In an e-commerce scenario, you, the Retailer, sell an item to a Buyer. There are only two parties involved. In this scenario, as long as you have sales tax nexus in the Buyer’s state, it’s your responsibility to collect sales tax from the Buyer.

Dropshipping includes three (or more!) parties in a single transaction.

The most common dropshipping scenario occurs when you, the Retailer, receive an order for an item from a Buyer, but don’t actually have that product in stock. Instead, you buy the item from your vendor, the Supplier, and then have the Supplier ship the item directly to the Buyer.

How sales tax is treated in this scenario depends on which jurisdictions are involved in the transaction and where the parties involved have sales tax nexus.

Don’t worry if you need to read the above paragraphs a couple of times to untangle how dropshipping works. We totally get it.

But now we’re going to demystify dropshipping and sales tax for you once and for all.

Dropshipping and Sales Tax

Because three (or more) parties are involved in a dropshipping transaction, the answer to “who collects the sales tax?” isn’t always obvious.

But the bottom line is that if a tax is imposed on a transaction, the state is owed the sales tax. If the items sold are taxable, somebody has to collect and/or pay that sales tax.

When using the dropshipping fulfillment method, the entity who collects the sales tax and remits it to the state can be any one of the three parties–the Retailer, the Supplier or the Buyer.

So for every dropshipping transaction, your business needs to make some determinations:

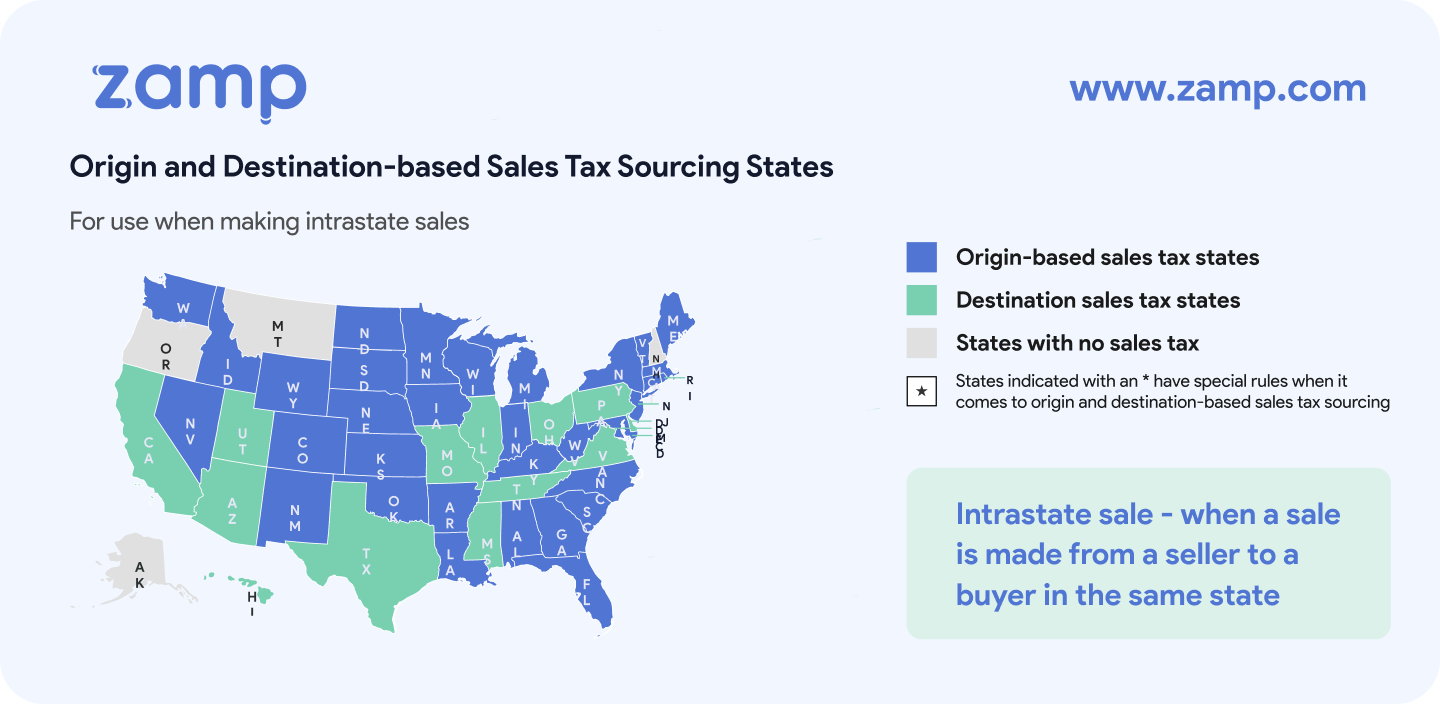

- You must determine if you, the Retailer, and/or your Supplier have sales tax nexus in the state to which the order is sourced. (Sourced is just a fancy sales tax way of saying “to where the item ships.”)

- If you, the Retailer, has sales tax nexus in the Buyer’s state, you must determine how much sales tax to collect, and then collect it from the buyer.

- If you don’t have sales tax nexus in your Buyer’s state, but the Supplier does, then they must either receive a Resale Certificate from you, or determine how much sales tax to charge you. (Remember, you are buying the item from them to ship to your customer.)

- If neither you, the Retailer, nor the Supplier has sales tax nexus in the Buyer’s state, then it’s up to the Buyer to pay “use tax” on the items to their state. This is because nobody was obligated to collect sales tax, yet the state still wants their tax.

Still confused? Let’s look at the most common dropshipping situations and how sales tax is treated in each one.

4 Common Dropshipping Sales Tax Scenarios

Find your own sales tax scenario here to discover how to handle sales tax with dropshipping.

A quick refresher:

- Retailer - the store ostensibly selling the product to the Buyer

- Supplier - the store where the Retailer buys the product that will be sent to the Buyer

- Buyer - the purchaser who will use the product

- Resale certificate (AKA exemption certificate) - A document that allows a Retailer to purchase products without paying sales tax as long as they plan to resell those products

Scenario 1: Neither the Retailer nor the Supplier has sales tax nexus in the Buyer’s state

This is one of the simpler dropshipping scenarios. In this case, both the Retailer and the Supplier are not required to charge sales tax on the product. Instead, the Buyer is required to pay use tax to the state (generally filed as part of their state income tax return).

Example: Jess (Buyer), who lives in North Dakota, purchases her favorite Colorado-based basketball team’s branded water bottle from an online store (Retailer). But the Retailer dropships water bottles from a water bottle manufacturer in Kentucky (Supplier.) In this case, neither the online Retailer nor the Kentucky-based Supplier have sales tax nexus in Colorado, they are not required to charge sales tax to Jess on her water bottle. Instead, Jess should pay use tax on her North Dakota state income tax return.

Scenario 2: Retailer makes a dropshipping sale to a customer in a state where the Retailer has sales tax nexus but the Supplier does not

In this case, the Retailer is required to collect sales tax from the Buyer, as they would in any other e-commerce transactions. But because the Supplier doesn’t have sales tax nexus in the Buyer’s state, they are not obligated to collect sales tax nor a resale certificate from the Retailer, even though it is the Retailer who ultimately pays them for the product.

Scenario 3: Retailer makes a dropshipping sale to a customer in a state where both the Retailer and Supplier have sales tax nexus

In this scenario, both the Retailer and the Supplier are obligated to collect sales tax. In this case, the Supplier should collect sales tax from the Retailer unless the Retailer can provide the Supplier with a resale certificate. A resale certificate allows the Supplier to sell to the Retailer tax free, since the Retailer will then go on to resell the product to the Buyer.

What happens if the Retailer does not provide a resale certificate or, of some reason, the Supplier chooses not to accept the resale certificate?

For this transaction, the Supplier will charge sales tax to the Retailer on the purchase of the Product. The Retailer is still obligated to collect sales tax from the Buyer, too.

In this case, the Retailer will collect and remit sales tax from the buyer. But the Retailer can request a credit on their state sales tax return for the sales tax they paid to the Supplier.

Scenario 4: Retailer makes a dropshipping sales to a customer in a state where the Retailer does not have nexus but the Supplier does have nexus

In this scenario, the Retailer is not required to collect sales tax from the Buyer, but the Supplier is required to collect sales tax from the Retailer. This is because sales tax is sourced to the Buyer’s ship-to address and the Supplier has an obligation to collect sales tax on sales to the buyer’s state.

For this transaction, the Retailer is not required to collect tax from the Buyer, but the Supplier is required to collect sales tax from the Retailer. Because the Retailer is purchasing the product from the Supplier for resale, they can provide the Supplier with a resale certificate to avoid paying sales tax.

If, for some reason, the Supplier will not accept the Retailer’s resale certificate when fulfilling customer orders, the Retailer can request a credit on their next sales tax filing.

Dropshipping and Resale Certificates

In an ideal world, a Retailer would always be able to provide their dropshipping Supplier with a resale certificate and have it readily accepted.

But resale certificates can be tricky. For one, ten states do not allow any vendors to accept an out-of-state resale certificate. California is one such state. In order for a Retailer to buy items for resale from a California vendor, they require that the Retailer be registered for a California sales tax permit.

If you, a Retailer, are not based in California and do not have sales tax nexus there, then you may not be registered to collect and file sales tax in California. But this also means that California vendors can’t accept your resale certificate. So if you make a purchase from a Supplier located in California then that supplier will not accept your resale certificate… unless you register to collect and pay sales tax in California.

As a Retailer, it’s up to you to determine if using a California-based dropshipper is worth the time and effort of complying with California sales tax laws. If you do decide to sign up for a California sales tax permit in order to take advantage of buying items tax free for resale from California vendors, just remember that this means you’re also now obligated to collect sales tax from all California customers.

Common Dropshipping Sales Tax Questions

Do I need a sales tax ID to dropship?

If you are selling items at retail then you are required to register for a sales tax permit and collect sales tax in states where you have sales tax nexus. (This includes your home state, but also states where you have a location, employee, or other business activity, such as economic nexus.) Learn everything you need to know about US sales tax here.

How does dropshipping work when my Supplier is not in the US?

Dropshipping still works the same. If your Supplier is not in the US and has no sales tax nexus in the US state where your Buyer is located, then you’d still treat this transaction as Scenario 1 or 2 above.

- What is dropshipping?

- Dropshipping and Sales Tax

- 4 Common Dropshipping Sales Tax Scenarios

- Scenario 1: Neither the Retailer nor the Supplier has sales tax nexus in the Buyer’s state

- Scenario 2: Retailer makes a dropshipping sale to a customer in a state where the Retailer has sales tax nexus but the Supplier does not

- Scenario 3: Retailer makes a dropshipping sale to a customer in a state where both the Retailer and Supplier have sales tax nexus

- Scenario 4: Retailer makes a dropshipping sales to a customer in a state where the Retailer does not have nexus but the Supplier does have nexus

- Dropshipping and Resale Certificates

- Common Dropshipping Sales Tax Questions