Shopify Sales Tax Integration

Achieve seamless sales tax compliance on Shopify with our expert integration solutions. Streamline operations and avoid compliance risks.

Learn MoreProper sales tax integration is not just a legal requirement for Shopify store owners; it’s a strategic asset that can save time and reduce the risk of penalties. When set up correctly, it automates the complex aspects of tax calculation, ensuring compliance without constant oversight.

Beyond compliance, effective sales tax management plays a crucial role in the customer checkout experience. It ensures that the tax displayed is accurate, preventing any surprises that might deter a customer from completing a purchase. A smooth, transparent checkout process increases customer trust and satisfaction, which are pivotal in encouraging repeat business.

Navigating sales tax correctly can be daunting for many, but integrating it effectively into your Shopify store simplifies the entire process. With the right tools and setup, you can turn a potential headache into a seamless part of your business operations, providing peace of mind for you and a better shopping experience for your customers.

Understanding Sales Tax Obligations for Shopify Store Owners

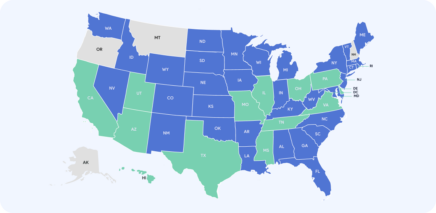

Sales tax regulations can vary dramatically depending on geographic location, and for Shopify store owners, understanding these variations is key to maintaining compliance. Each state and locality may have different tax rates and rules, which can complicate the tax collection process. Failure to comply with these regulations can lead to significant penalties, making it essential for business owners to accurately track where they owe sales tax.

The concept of economic nexus is central to understanding your tax obligations. Nexus is defined as a sufficient physical or economic connection to a state or locality that obligates you to collect and remit sales tax in that jurisdiction. This can be triggered by factors such as having a physical presence, reaching a certain threshold in sales, or even marketing activities.

For Shopify store owners, determining where you have a sales tax nexus will guide your compliance strategy. This includes identifying all the places your business activities give you a tax obligation and ensuring you adhere to each area’s specific tax collection and filing requirements.

Setting Up and Automating Sales Tax on Shopify

Adding sales tax on Shopify is the first step toward automating your sales tax management. Shopify provides tools to help you automatically calculate sales tax based on the customer's location, which is crucial for maintaining accuracy in real-time. This setup not only streamlines the process but also ensures that you’re collecting the correct amount of tax for each transaction.

The benefits of using automated tax software extend beyond simplification. These tools handle complex tax calculations across multiple jurisdictions, minimizing the risk of errors that could lead to non-compliance penalties. Automating these calculations can save considerable time during tax season, reducing the stress associated with manual tax reporting and calculation.

Implementing a robust sales tax solution that integrates seamlessly with Shopify further enhances tax management. Sales tax platforms automate the tax compliance process by keeping up-to-date with the latest tax laws and rates, providing peace of mind and allowing you to focus more on other areas of business development.

Book a call today

30-minute call

sales tax expert

off your plate

Complex Sales Tax Challenges

Managing sales tax for transactions across multiple states or different tax jurisdictions presents a complex challenge. Each state has its unique tax laws, and keeping track of these can be cumbersome. Automated solutions that integrate with Shopify help simplify this complexity by ensuring that all tax calculations are accurate and comply with the respective state’s regulations.

Handling tax exemptions and navigating sales during tax-free periods or promotions requires additional attention. Shopify store owners must update their systems to recognize when items are tax-exempt or when a tax holiday is in effect. These events need careful handling to ensure that taxes are not mistakenly charged to customers, which could harm customer trust and satisfaction.

To effectively manage these complexities, store owners should develop strategies that include using advanced tax management tools and staying informed about tax regulations in every state where they operate. This proactive approach helps minimize the risk of errors and ensures smooth operations during special sales events and promotions.

Ongoing Compliance and Managing Updates

Changes in tax rates, regulations, or nexus requirements can happen frequently, and it’s important to keep your Shopify store’s tax settings current. Shopify’s platform can assist in this process by providing tools that help automate updates and compliance checks.

Regular auditing of your sales tax settings is also essential to ensure that everything remains accurate over time. These audits can help identify any discrepancies in tax collection or reporting before they become significant issues. Implementing routine checks safeguards your business by confirming that you are still in full compliance with all applicable laws.

Shopify store owners should make a habit of regularly reviewing and updating their sales tax processes. This ongoing diligence ensures that your store remains compliant with changing laws and that your tax settings are always optimized for current conditions.

Enhancing Your Shopify Experience Through Efficient Tax Management

Integrating a thorough Shopify sales tax automation into your store’s operations does more than just keep you compliant; it also boosts your business’s efficiency. Proper tax management ensures every transaction is processed correctly, which provides a smooth shopping experience for your customers and protects your business from compliance issues.

It’s important to keep learning and adapting your sales tax strategies to match legislative updates and business growth. As your business grows, so will your tax responsibilities. Keeping up-to-date and adjusting your strategies ensures that your tax systems can handle your expanding business needs.

By following these practices, Shopify store owners not only meet their legal requirements but also build a stronger, more customer-friendly business. This commitment builds trust with your customers and lays a strong foundation for future success in the competitive world of e-commerce.

Why Choose Zamp?

Zamp offers Shopify store owners a comprehensive managed solution for sales tax, taking care of everything from initial setup to adapting to changes in tax laws. Our automated services mean you can focus on running your business while we handle the complexities of sales tax compliance.

Book a demo with Zamp today and discover how our solutions can streamline your operations. With Zamp managing your sales taxes, you can forget about the complexities and focus on your Shopify store. Contact our team of sales tax experts today and start experiencing the ease of comprehensive tax management.

Book a call today

30-minute call

sales tax expert

off your plate

Shopify Sales Tax Integration: FAQ

Non-compliance risks penalties and audits, potentially damaging your business’s reputation and finances.

Sales tax rates and rules vary based on your business’s location and customer base, necessitating careful compliance management.

Yes, using automated tax software like Zamp can simplify calculations and ensure accuracy across regions.

Sales tax nexus determines where you must collect and remit sales tax, impacted by factors like physical presence, affecting compliance obligations.

Keep informed via Shopify’s tax guides, industry publications, and consulting with tax professionals to ensure ongoing compliance.