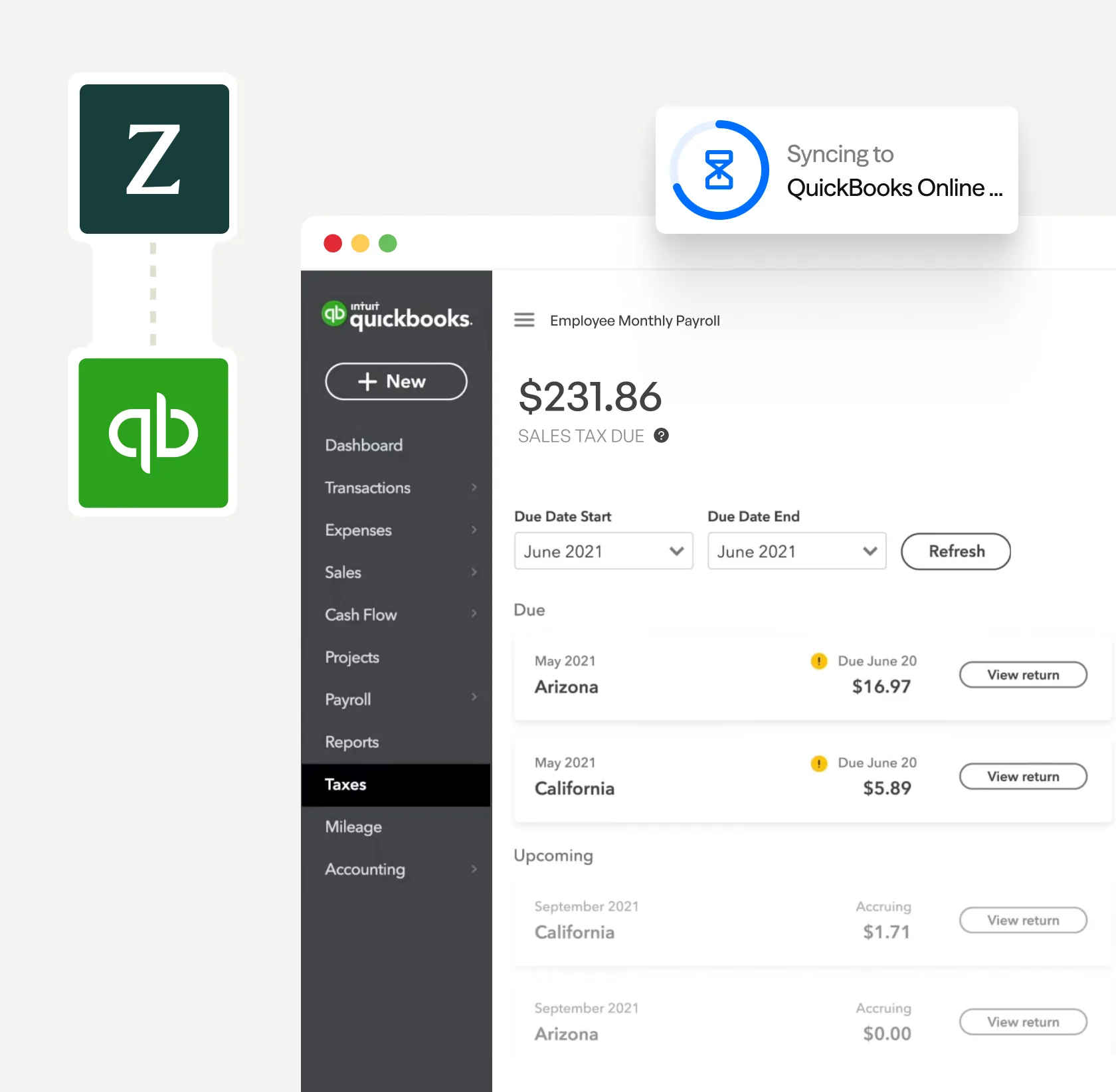

Calculate sales tax more accurately and eliminate manual compliance work with Zamp's integration to QuickBooks Online – included with your Zamp account.

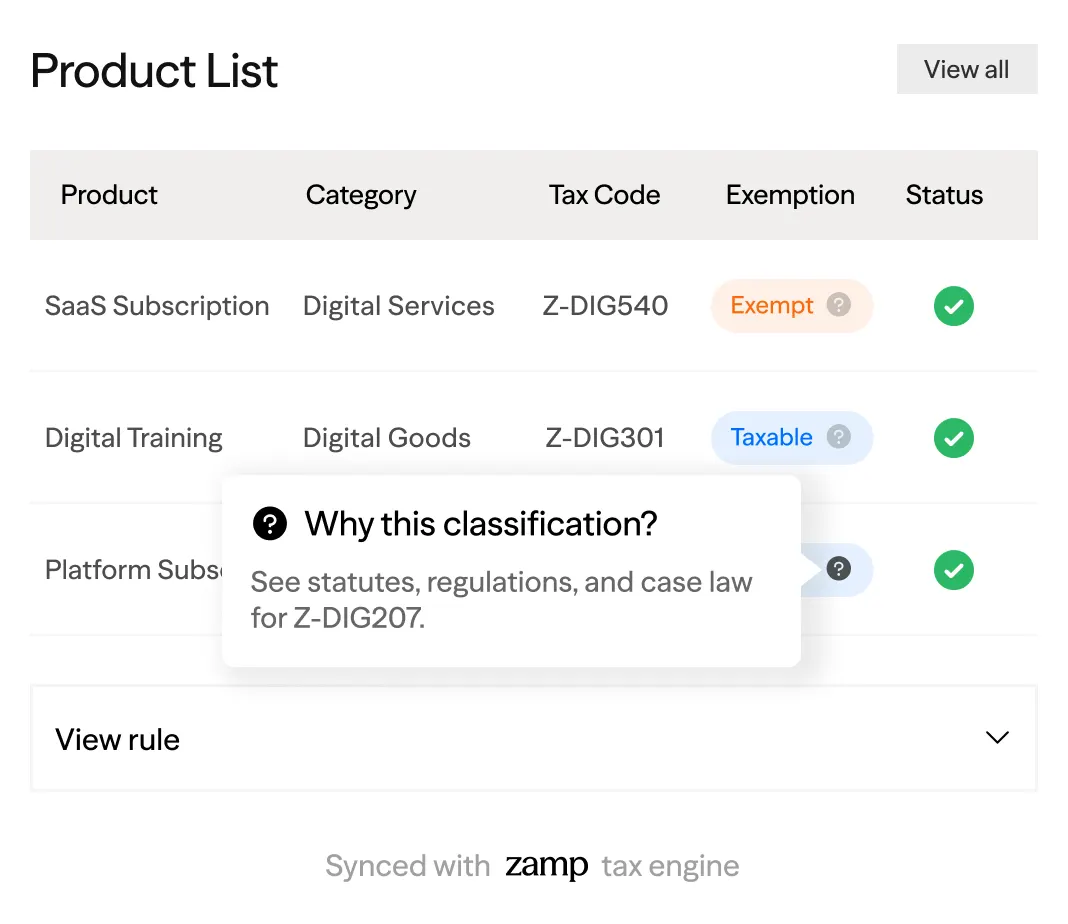

AI and human experts work together to monitor changes, reduce errors and keep you compliant without adding work for your team.

A consistent team that understands your business and supports you from onboarding through ongoing filings. No re-explaining. No handoffs.

Connect and sync all historical data at no additional cost.

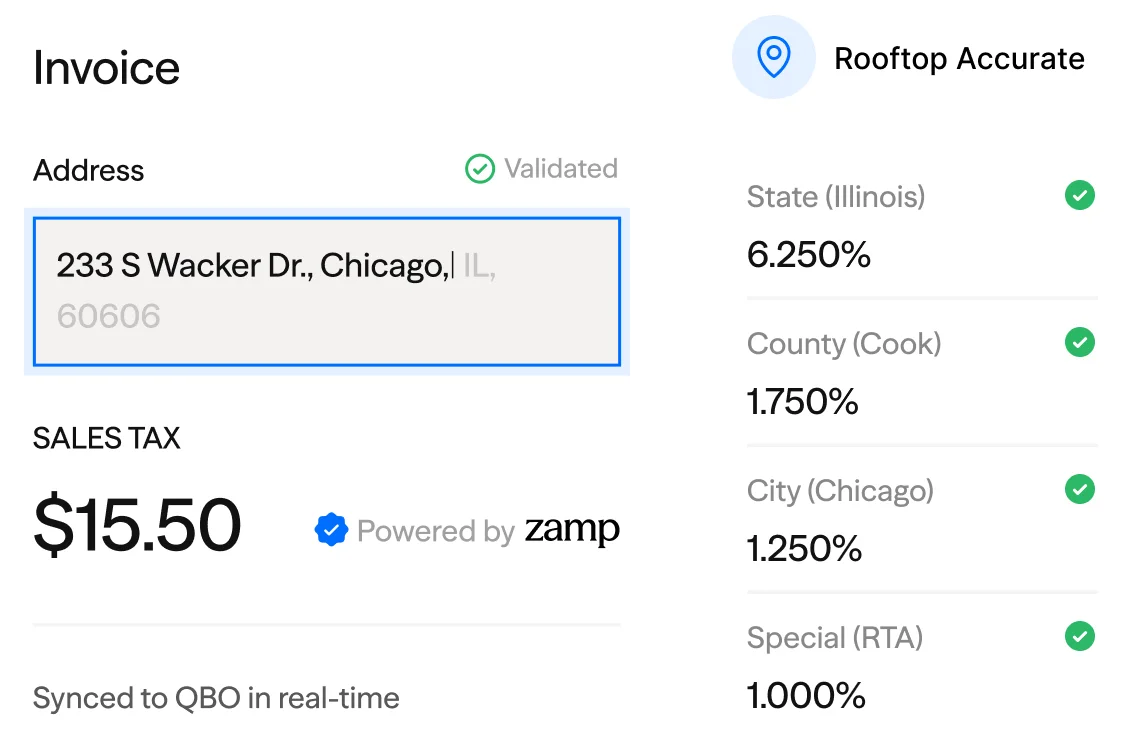

Line-item level tax calculations keep your data accurate, reduce reconciliation work, and help you close faster.

1

2

3

4

Find and install the Zamp Tax app directly from the QuickBooks marketplace.

Find and install the Zamp Tax app directly from the QuickBooks marketplace.

Find and install the Zamp Tax app directly from the QuickBooks marketplace.

Find and install the Zamp Tax app directly from the QuickBooks marketplace.

Still have questions? Call us at 1-866-438-9267

or email us at support@zamp.com.

Once connected, Zamp takes over all tax calculations. Your existing tax settings won’t interfere, Zamp’s calculations override them to ensure accuracy.

Yes. During setup, you can select a date range to import past sales. This ensures complete filing coverage for prior periods.

Absolutely. Your Onboarding Manager will help you transition from your current provider, including migrating registrations and historical data.

Yes. Zamp integrates with Shopify, Amazon, BigCommerce, Magento, and more. All channels sync into QuickBooks alongside your direct sales for unified compliance.

Yes, we’ve got your back with our Zamp Commitment which covers calculation and filing accuracy.

We connect where you sell. Explore the platforms we integrate with to see how Zamp simplifies your sales tax compliance.

0 Platforms