9 Best TaxJar Alternatives for 2025

In our research, we found that the top TaxJar alternatives for efficient sales tax management are Zamp, Avalara, Anrok, HOST, and Numeral.

Learn MoreZamp Learnings:

- Based on customer reviews, businesses are considering TaxJar alternatives due to customer support, overpayment, and the fact that it is not a completely managed solution.

- Our research shows that the TaxJar alternatives worth considering are Zamp, Avalara, Anrok, HOST, and Numeral.

If you’re running an online store, you know how difficult it is to keep track of sales tax for every item sold in your store. That's where sales tax software tools like TaxJar come into play, making it easier for store owners to manage this part of their business. TaxJar can automatically calculate, report, and file the sales tax collected, saving business owners considerable time.

Before we jump into alternatives to TaxJar, let’s learn more about this sales tax software.

Book Your Consultation

30-minute call

sales tax expert

off your plate

TaxJar Overview

TaxJar is a cloud-based platform that automates sales tax solutions for e-commerce businesses. The company uses sales tax automation software to track physical and economic nexus thresholds, handle tax reporting and filing, and more.

The company was acquired in 2021 by Stripe and can also help with tax preparation, including product taxability. It supports integrations for e-commerce platforms like Shopify and works with bookkeeping services like QuickBooks Online.

The sections below will look into how TaxJar works, support, and pricing.

How Does TaxJar Work?

TaxJar works similarly to other automated sales tax solutions in terms of functionality. This is how it works:

- Integrates with platforms. TaxJar integrates with most e-commerce platforms to handle real-time sales tax calculations. It will adjust the tax rates depending on where your customers live, where you have nexus, and consider any exemptions.

- Nexus tracking. TaxJar (like most other platforms) will track nexus thresholds for you, alerting you when you reach nexus in a new state.

- Sales tax filing and remittance. TaxJar handles multi-state filing to ensure your taxes are filed and paid on time.

TaxJar Pricing

TaxJar offers a tiered pricing model that adjusts based on the scale of a business and its specific needs, depending on the volume of transactions and the complexity of tax compliance requirements. Each plan typically provides features such as automated tax calculations, filings, and reports, with higher-level plans including additional functionalities like international tax calculations and API access for custom integrations.

TaxJar Customer Service

TaxJar’s customer service team provides troubleshooting support and educational content to inform users about sales tax compliance best practices. This approach aims to equip businesses with the knowledge to handle their tax obligations independently.

However, while TaxJar offers robust services, it isn't the only option. Different businesses have different needs, like budget constraints, special features, or better integration with other tools they use. That's why it's essential to look around and consider other solutions available in the market.

Reasons Customers Consider TaxJar Alternatives

While TaxJar is an option for many businesses, customers have reported several pain points in TaxJar reviews. The issues below may be what causes them to explore TaxJar alternatives and competitors.

- Lack of customer support: One review on the Shopify app states, “Consider this review a serious caution. I wish it were possible to rate this app with zero stars. The support team is virtually non-existent, and on the rare occasion you do receive a response, it's clear they lack any real understanding of their own service.”

- Issues with integrations: A review on Capterra mentions, “Unclear or illogical API logic that results in under collections and overpayment. Senior software engineers with decades of backend billing systems integration experience confused by the way it functions.”

- Not a completely managed solution: Another Capterra review discusses the lack of a managed service. It states, “Terrible. We were looking for a deep dive into the Amazon configuration and setup, and support told us they have no configuration assistance anymore. It's only self-service. This company only cares about profits, not quality products/services.”

Evaluating TaxJar Alternatives

Now, let’s get into the specifics of various TaxJar alternatives to help you evaluate which option might best suit your business needs. Here’s what you should look for:

| Accuracy in Sales Tax Calculations | First and foremost, the tool must be super precise. A small mistake in sales tax calculations can lead to big problems, so we need a system that gets the numbers right every single time. |

| Integration Capabilities with E-commerce Platforms | A sales tax solution should easily connect with the e-commerce platform you use, whether that’s Shopify, BigCommerce, Stripe, or any other. Smooth integration means less hassle and more time to focus on selling. |

| Ease of Use and User Interface | A good sales tax tool should be easy to use with a straightforward and friendly interface. |

| Customer Support and Service Quality | Good support means having friendly and helpful people ready to quickly answer your questions and fix problems. |

| Cost-Effectiveness | Last but not least, the tool should not only fit your needs but also your wallet. It should offer good value for the price, without hidden fees or surprises. |

By considering these criteria, you can make a well-informed decision and choose the right alternative to TaxJar that best fits your online store’s needs. Let’s keep moving and explore some of the top alternatives out there.

Free Download: Sales Tax Guide for E-Commerce

9 Sales Tax Software Alternatives to TaxJar

1. Zamp

Let’s start our overview with Zamp, a standout option in the sales tax management sector, known for its innovative approach and customer-focused solutions.

Overview of Zamp vs TaxJar: Zamp is designed to simplify the often overwhelming process of sales tax compliance for businesses of all sizes. With a clear focus on innovation and ease of use, Zamp offers an automated solution that takes care of everything from tax calculation to filing and compliance.

Key Features:

- All-in-One Compliance Dashboard: Zamp features a comprehensive dashboard that gives users a full overview of their tax status at a glance. This helps businesses stay on top of their obligations with minimal effort.

- Advanced Tax Rule Engine: Zamp’s platform comes equipped with an advanced tax rule engine that can handle complex tax scenarios, adapting to various jurisdictions and tax laws effortlessly.

- Proactive Compliance Updates: Stay constantly updated with the latest tax laws as Zamp proactively updates its systems to reflect changes, ensuring that your business remains compliant without you needing to manually track legislative changes.

Pricing Information: Zamp offers competitive pricing based on the scale of your business operations and specific needs. They provide a transparent pricing model with pricing displayed on their website to allow businesses to predict their costs without worrying about hidden fees or surcharges.

Integration Capabilities:

- Zamp integrates smoothly with many different e-commerce platforms and accounting software, including industry giants like Shopify and QuickBooks. This integration ensures a seamless flow of information and maintains accuracy in tax calculations across different sales channels.

Customer Case Studies and Feedback:

- Businesses often highlight Zamp’s user-friendly interface and the efficiency it brings to their tax processes in customer testimonials. They appreciate the time saved (20 hours per month on average) and the reduction in errors thanks to Zamp’s automated solutions.

- Customers receive unmatched customer support thanks to help from dedicated onboarding specialists and the team at Zamp. The average customer support response time is under an hour.

- Case studies on their site showcase a variety of success stories, from small startups to large enterprises, that have significantly improved their compliance and efficiency using Zamp’s services.

Book Your Consultation

30-minute call

sales tax expert

off your plate

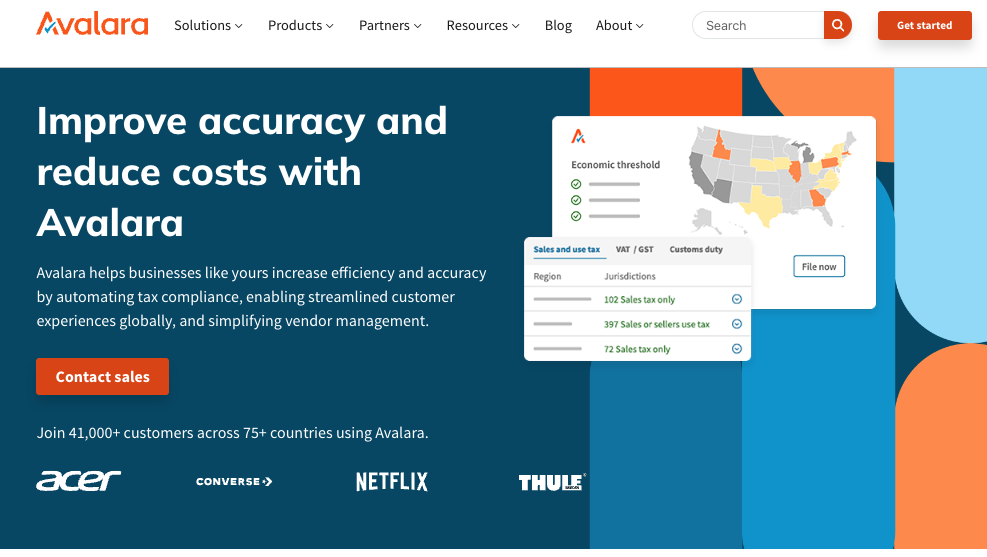

2. Avalara

Overview of Avalara: Avalara is designed for businesses of all sizes, from small shops on Etsy to giant enterprises. Avalara helps automate tax compliance.

Key Features:

- Automated Tax Calculations: Avalara calculates taxes in real-time, ensuring accuracy across thousands of tax jurisdictions.

- Exemption Certificate Management: Manage and store tax exemption certificates within the platform.

- Tax Return Preparation and Filing: Avalara isn't just about calculating taxes; it also helps you prepare and file them with the proper authorities.

Pricing Information: Avalara offers several pricing tiers, which typically depend on the volume of transactions your business handles and the specific features you need. Their pricing is not visible on the website, but they can provide a custom quote based on your business’s specific needs.

Integration Capabilities:

- Avalara integrates with a wide range of e-commerce platforms like Shopify, Magento, and WooCommerce and broader business systems like Salesforce and Microsoft Dynamics.

Customer Reviews and Case Studies:

- Customers mention its robust features and reliability. Many highlight how it takes the headache out of tax compliance, especially those operating in multiple states or countries.

- Case studies on their website showcase businesses of various sizes that have streamlined their tax processes and saved time and money with Avalara.

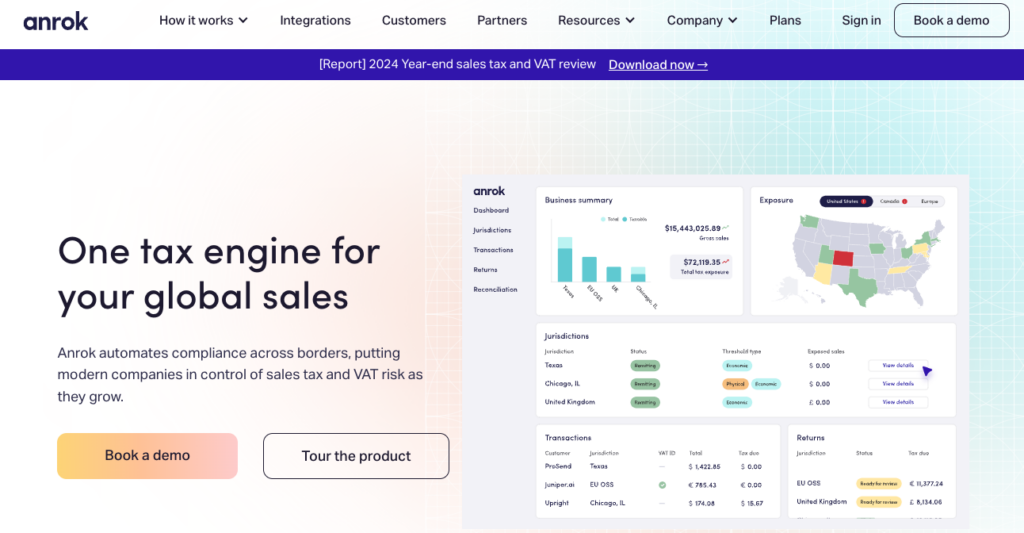

3. Anrok

Overview of Anrok: Anrok focuses specifically on helping SaaS businesses manage sales tax in a digital environment. It's designed to be agile and adaptive, catering mainly to tech-savvy startups that need a flexible and intuitive solution.

Key Features:

- Real-Time Tax Calculation: Anrok provides real-time sales tax calculations, ensuring that the data is always accurate and up-to-date, which is crucial for fast-moving online businesses.

- Automated Nexus Determination: Anrok automatically helps businesses determine if they have a tax obligation (nexus) in different states. This is great for e-commerce businesses that sell to customers in multiple locations.

- Data Security: With security measures in place, Anrok ensures that all your sensitive tax data is protected against threats.

Pricing Information: Anrok offers a variety of pricing plans tailored to different business sizes and needs. They usually start with a starter plan (currently $499/month + 0.40% per taxable transaction) that scales up based on the number of transactions and complexity of tax requirements. They also offer custom pricing for larger enterprises that need more specialized services.

Integration Capabilities:

- Anrok integrates with e-commerce platforms such as Shopify and BigCommerce, making it easy to plug into your existing setup and start managing sales tax.

Customer Reviews and Case Studies:

- Users highlight Anrok’s user-friendly interface and customer support. They appreciate the platform's ability to simplify complex tax issues, making tax compliance less intimidating.

- Testimonials also commend Anrok for its innovative approach to handling sales tax, particularly praising its real-time updates and accuracy in tax calculations.

Free Download: Sales Tax Guide for SaaS

4. HOST

Overview of HOST: HOST has carved out a niche by offering tailored tax solutions that focus on both flexibility and power. Their systems are designed to cater specifically to dynamic businesses that need robust yet adaptable tax-handling capabilities.

Key Features:

- Customizable Tax Rules: HOST stands out with its highly customizable tax rules, allowing businesses to configure tax settings that perfectly match their specific requirements.

- Advanced Reporting Tools: With HOST, you can manage taxes and also dive deep into analytics with advanced reporting tools.

- Multi-Currency Support: HOST offers multi-currency support for businesses selling internationally, making it easier to manage sales tax across different countries and currencies.

Pricing Information: HOST does not display pricing on its website, but it explains that various tiers accommodate businesses of all sizes. They start with a basic package suitable for smaller companies and scale up to more comprehensive options, including additional features like international tax management and advanced analytics.

Integration Capabilities:

- HOST integrates with e-commerce platforms and accounting systems, including newer market entrants and established leaders like Amazon, eBay, and QuickBooks.

Customer Reviews and Case Studies:

- Customers appreciate HOST for its adaptability and the control it offers over tax settings. Businesses particularly favor it with complex tax handling needs requiring customization.

- Feedback also highlights the effectiveness of HOST’s customer service team, noting their responsiveness.

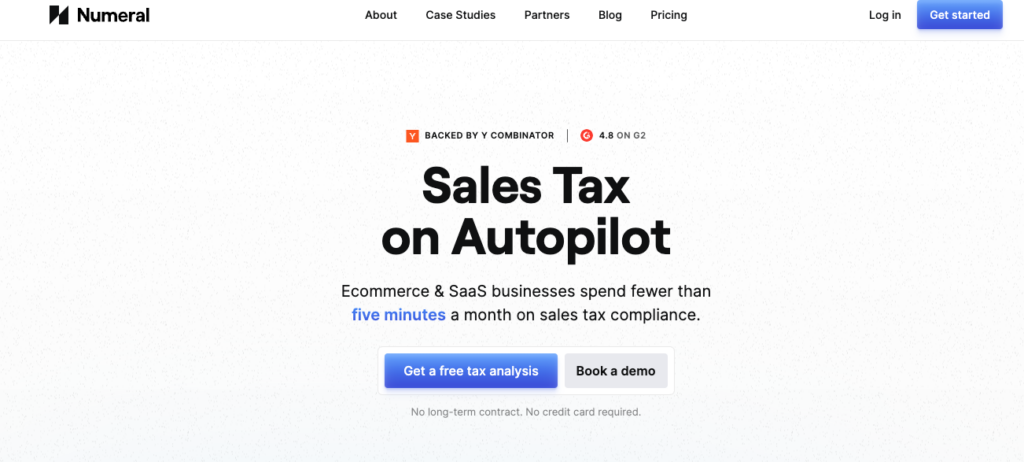

5. Numeral

Overview of Numeral: Numeral focuses on simplifying the complexities of sales tax for small to medium-sized businesses. With an emphasis on accuracy and ease of use, Numeral aims to demystify tax compliance, making it accessible for businesses without extensive accounting departments.

Key Features:

- Automated Sales Tax Compliance: Numeral automates the process of sales tax calculation, collection, and remittance.

- Seamless Updates on Tax Laws: Stay up-to-date with the latest tax laws with automatic updates, which help ensure you're always compliant with current regulations.

- Simplified Tax Filing: Numeral simplifies the tax filing process with automated returns and filings, reducing the likelihood of errors and saving time.

Pricing Information: Numeral’s pricing model starts at $75 per filing. The pricing is based on the volume of transactions, making it affordable for smaller businesses.

Integration Capabilities:

- Numeral integrates with e-commerce platforms such as Shopify, WooCommerce, and Magento. This integration ensures that sales tax is accurately calculated and applied at the point of sale, making it easy for businesses to manage their online sales.

Customer Reviews and Case Studies:

- Case Studies: Numeral's website features several case studies highlighting how businesses from various industries have streamlined their tax operations. These studies showcase the tangible benefits in terms of time saved and reduced compliance issues.

- User Reviews: Users have mentioned its straightforward user interface that makes setup and daily use easy to navigate.

6. Sattar & Associates

Overview of Sattar & Associates: Sattar & Associates began as a tax consultancy firm. Recognizing the shift towards digital solutions in tax management, they developed their own software to bring their deep tax knowledge directly to businesses of all sizes, focusing on personalized service and accuracy.

Key Features:

- Expert-Driven Tax Advice: One of the core features of Sattar & Associates is their combination of software with expert tax advice.

- Custom Tax Solutions: Sattar & Associates offers customized tax solutions that are tailored to the specific demands of different industries and business sizes.

- Audit Support: They provide audit support and expert help if the tax authorities come knocking.

Pricing Information: Sattar & Associates fees vary based on the level of service and customization required. Pricing is not visible on the website but they typically offer a tiered pricing structure that starts with basic compliance software and scales up to include comprehensive advisory services and audit defense.

Integration Capabilities:

- The software integrates well with various accounting and ERP systems, allowing businesses to maintain workflows across financial management tasks.

Customer Reviews and Case Studies:

- Customers appreciate the access to expert advice and custom solutions that fit their specific business challenges.

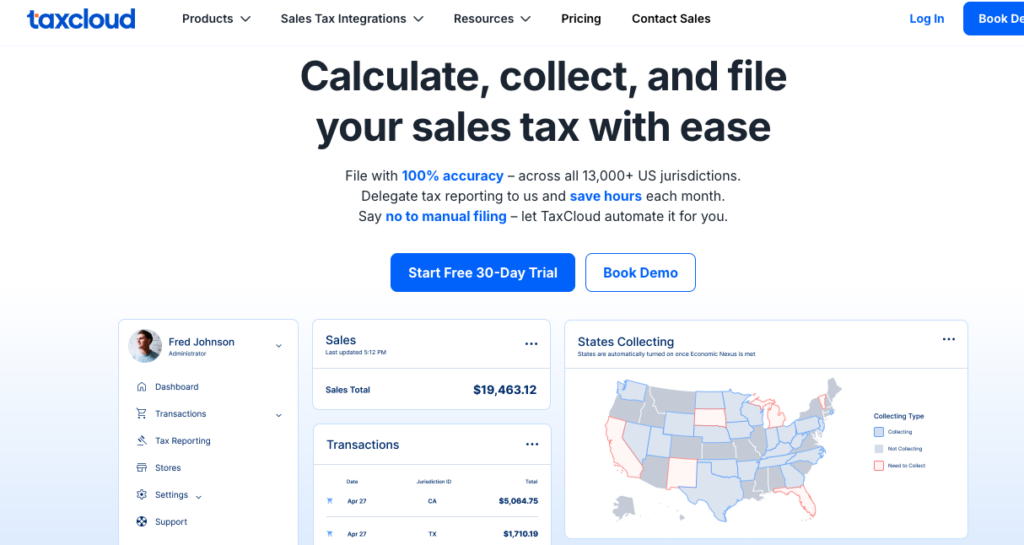

7. TaxCloud

Overview of TaxCloud: TaxCloud provides cloud-based tax compliance services to online retailers. Established to make the world of e-commerce taxation accessible and manageable, TaxCloud serves merchants across the U.S.

Key Features:

- Automated Sales Tax Calculation: TaxCloud automatically calculates the sales tax amount at checkout based on the latest tax laws and rates.

- Filing and Remittance Services: TaxCloud files them and remits the collected tax to the appropriate state and local jurisdictions.

- Audit Response and Indemnification: TaxCloud offers to assist and even indemnify businesses in the case of a state sales tax audit, providing an extra layer of security.

Pricing Information: TaxCloud pricing is available on its website and it offers its services either for free or at a low cost for eligible merchants, thanks to partnerships with various states. For others, it provides a pay-as-you-go model, which means you only pay based on your use.

Integration Capabilities:

- TaxCloud integrates with e-commerce platforms, shopping carts, and accounting systems, including prominent names like Shopify, Magento, and QuickBooks.

Customer Reviews and Case Studies:

- Customers commend TaxCloud for its ease of use. Reviews highlight how TaxCloud simplifies the tax compliance process.

- Others appreciate the affordability of TaxCloud, particularly noting the value it provides through its free and low-cost plans.

See Zamp in action

8. TaxValet

Overview of TaxValet: TaxValet’s approach is providing a “done-for-you” service, where rather than just offering software, they handle almost every aspect of sales tax compliance on behalf of their clients.

Key Features:

- Full-Service Management: TaxValet distinguishes itself by managing the entire sales tax process. This includes registrations, filings, and handling audits.

- No-Fine Guarantee: If you receive a fine due to an error on their part, TaxValet covers the cost.

- Dedicated Account Manager: Each TaxValet client is assigned a dedicated account manager who knows the specifics of their business and can provide tailored support.

Pricing Information: TaxValet’s pricing is available on their website and starts at $75/month. It is subscription-based, with different tiers depending on the level of service required.

Integration Capabilities:

- While TaxValet focuses less on software integration and more on service, they work with businesses using any e-commerce platform.

Customer Reviews and Case Studies:

- Clients appreciate the customer service and the time saved on sales tax issues.

- Success stories on their website showcase various businesses, from small startups to large enterprises, that have benefited from TaxValet’s approach.

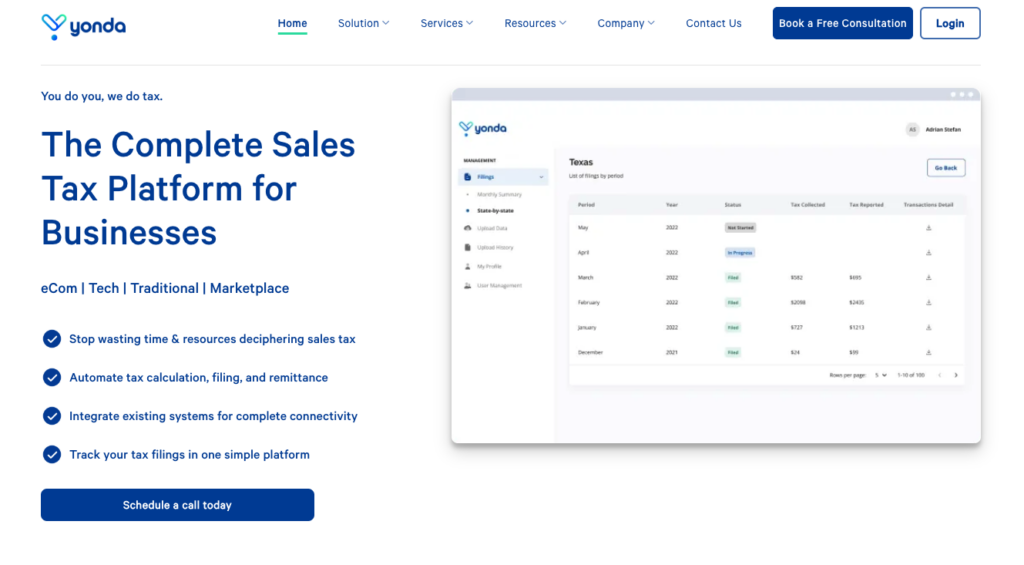

9. Yonda

Overview of Yonda: Yonda is geared towards modernizing the sales tax experience for businesses of all sizes. With a focus on technology-driven solutions and real-time data processing, Yonda aims to streamline the complexities of tax compliance through automation and intuitive design.

Key Features:

- Automated Tax Compliance: Yonda automates the process of sales tax calculation, filing, and remittance.

- Real-Time Data Analytics: Yonda offers real-time analytics and reporting.

- Customer-Centric Support: Yonda offers dedicated customer support to help businesses navigate tax compliance challenges.

Pricing Information: Yonda provides a flexible pricing model based on the volume of transactions and the specific services needed. Pricing is not available on their site, however, they offer basic plans for smaller businesses and more advanced packages that include additional features like advanced analytics and personalized support.

Integration Capabilities:

- Yonda integrates with major e-commerce platforms such as Shopify, WooCommerce, and BigCommerce.

Customer Reviews and Case Studies:

- Users typically commend Yonda for its ease of use and clarity in the sales tax process. Positive feedback highlights the support team's ability to use the features effectively.

Why Zamp Is the Best TaxJar Alternative

Following our exploration of various sales tax solutions, it becomes clear that Zamp stands out for several compelling reasons. Zamp is the first provider in the industry to offer a white-glove, managed sales tax solution that takes the entire burden of managing sales tax off your shoulders. This service ensures that not only is the task handled by experts, but it’s done correctly and efficiently without requiring you to interact with the software directly.

Why a Managed Sales Tax Solution?

The reality for many businesses is that managing sales tax is complex and time-consuming. Most people don’t have the time or interest to learn all the intricacies of sales tax regulations, nor do they want to manage a software platform daily. Even with the best intentions, setting up and configuring tax software or APIs can be daunting, and maintaining confidence that everything is set up correctly is challenging. With constant changes in tax laws, the system requires continuous updates and monitoring, which can be a significant drain on resources.

Zamp addresses these challenges by combining the benefits of automation, scalability, and technology accuracy with tailored guidance and ongoing support. This unique blend ensures that businesses can successfully handle their sales tax needs without becoming experts. Zamp does all the heavy lifting - configuring, updating, and managing the sales tax processes - so you can focus on growing your business.

Zamp Pricing

Zamp offers an all-inclusive, predictable pricing model. Unlike competitors such as Avalara, whose pricing may vary based on usage or added services, Zamp’s pricing is comprehensive. It includes everything from calculations and onboarding to product taxability mapping, unlimited registrations, and state filings - all bundled under the umbrella of Zamp's premium managed service. This approach ensures no surprises, hidden fees, or pesky overage charges, making it a highly predictable and budget-friendly option.

Zamp Customer Support

Zamp’s customer support goes beyond traditional helpdesk services. With their managed service model, you receive personalized attention from a dedicated team that understands your business and its specific needs. This level of service ensures that any issues or questions are handled promptly and by someone who is familiar with your account, making the support experience seamless and effective.

Impact of Zamp on Businesses

To see the real-life impacts of Zamp’s managed services, consider their case studies, where various businesses outline their experiences before and after adopting Zamp. These stories highlight significant reductions in time spent managing sales tax, errors in filings, and overall stress, demonstrating Zamp’s effectiveness and the tangible benefits it brings to its customers.

Book Your Consultation

30-minute call

sales tax expert

off your plate

Alternatives to TaxJar: FAQ

Yes, Stripe acquired TaxJar in 2021. While it has been acquired, they are run as two separate products to address sales and use tax needs.

TaxJar’s prices depend on the plan you choose. There is both starter and professional pricing, and it also depends on the number of orders per month.