Shopify Integration

Achieve seamless sales tax compliance on Shopify with our expert integration solutions. Streamline operations and avoid compliance risks.

Get Expert Help- Zamp Learnings:

- Sales Tax for Shopify Sellers

- Does Shopify Collect Sales Tax?

- How Sales Tax Works for Your Shopify Store

- Sales Tax Nexus and Your Shopify Business

- Sales Tax Thresholds

- Zamp Tip

- Determining Product Taxability

- How to Set Up Sales Tax in Shopify

- Options to Calculate With Shopify

- Integrating Zamp With Shopify

- Filing Sales Tax for Shopify

- Sales Tax Compliance Practices for Shopify Sellers

- Shopify Integration: Conclusion

- Why Choose Zamp?

Zamp Learnings:

- Shopify doesn’t remit or file your sales tax returns for you unless you use Shopify Tax and set up automated filing.

- You must determine your sales tax nexus to find out whether you will need to charge sales tax.

Shopify is an e-commerce platform that powers over 5.54 million storefronts. Unlike most platforms, Shopify allows sellers to automatically manage tax rates used to calculate sales on taxes and set up tax overrides for products with special tax rates.

But as a store owner, you’re still responsible for knowing when you’ve reached nexus in a state and registering for a sales tax permit. This permit will allow you to collect sales tax in states where you’ve hit nexus. It can also get even more confusing dealing with different rules and regulations by state, and that’s where Zamp comes in to handle it all for you.

This article will explore what you need to know about Shopify sales tax integrations.

Book a call today

30-minute call

sales tax expert

off your plate

Sales Tax for Shopify Sellers

Sales tax regulations can vary dramatically depending on geographic location, and for Shopify store owners, understanding these variations is key to maintaining compliance. Each state and locality may have different tax rates and rules, which can complicate the tax collection process. Failure to comply with these regulations can lead to significant penalties, making it essential for business owners to accurately track where they owe sales tax.

Does Shopify Collect Sales Tax?

Shopify sellers must decide where and when to collect sales tax. The platform won’t start collecting sales tax on your behalf until you set it up. However, you have options — Shopify Tax is built into your store’s admin, and Zamp integrates directly with your storefront to offer sales tax rate calculations, collection, and more.

How Sales Tax Works for Your Shopify Store

Failing to file sales tax returns can result in hefty penalties and audits for your business, potentially setting you back. As a Shopify store owner, you must know when to collect, remit, and file sales tax returns for any orders you sell when you reach nexus.

Sales Tax Nexus and Your Shopify Business

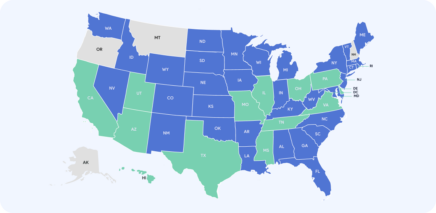

The concept of economic nexus is central to understanding your tax obligations. Nexus is defined as a sufficient physical or economic connection to a state or locality that obligates you to collect and remit sales tax in that jurisdiction. This can be triggered by factors such as having a physical presence, reaching a certain threshold in sales, or even marketing activities.

For Shopify store owners, determining where you have a sales tax nexus will guide your compliance strategy. This includes identifying where your business activities give you a tax obligation and ensuring you adhere to each area’s tax collection and filing requirements.

Sales Tax Thresholds

Each state has the right to set its own thresholds for economic nexus. Some states have a dollar amount that triggers nexus, and when you have to charge sales tax, others may look at the number of sales transactions.

Zamp Tip

Staying on top of changing sales tax laws can be challenging, which is why online businesses must be alert. You’ll need to monitor for updates and ensure your systems are functioning correctly for tax collection.

Determining Product Taxability

As a Shopify merchant, you must research the products on which you must collect sales tax. Each state has a taxable goods list, and certain items may be exempt.

Most states do not tax food, clothing, or textbooks. However, managing sales tax exemptions is a crucial component of keeping sales taxes in order.

How to Set Up Sales Tax in Shopify

Shopify understands that sales tax is complex. It has a built-in sales tax engine that calculates and collects sales tax based on the nexus conditions you provide.

However, Shopify doesn’t handle remittance and filing, which is where Zamp comes in. If you don’t know where you have physical or economic nexus, it can be challenging to configure Shopify’s sales tax engine correctly.

But Zamp is here to help. We bring a strong customer experience with a fully managed solution. With our integration, we take in your transaction data and build out summary reports by state, which enables you to:

- Build a complete nexus picture

- Perform sales tax reconciliation

- Be ready for state sales tax filing and remittance based on your filing frequencies.

Options to Calculate With Shopify

While Zamp offers an API for calculations, Shopify has its own sales tax engine, which we recommend using. However, Shopify merchants must configure it accurately.

As a starting point, Shopify’s Help Center has a manual on taxes that explains tax liability, nexus, and registrations.

Integrating Zamp With Shopify

Part of Zamp’s focus is getting you integrated as quickly and efficiently as possible. Our Onboarding and Account Managers will walk you through setting up Shopify and ensuring your transactions flow into our system.

There are just three things we need to connect to your Shopify storefront, including:

- Your Shopify Store URL

- An Admin API access token

- The API Secret Key

We’ll walk you through the API scopes and permissions that Zamp needs to set up the access token.

Once connected to your Shopify store, Zamp will automatically backfill historical transactions so we can do an accurate nexus analysis to determine your economic nexus exposure.

We’ll also ensure that any marketplace transactions are appropriately marked (such as those from Amazon or TikTok Shop) and map your products to Zamp’s tax codes.

Filing Sales Tax for Shopify

Once your Shopify store is integrated with Zamp, our software will build state summary reports. Our team uses these reports to inform you of each state's liability and then files and remits.

Any time there is an upcoming filing, we’ll inform you what amounts we have on record. This allows you to reconcile and verify everything before our filing team handles the rest.

If you’re a Shopify merchant and having trouble navigating the sales tax space, contact our sales tax experts.

Book a call today

30-minute call

sales tax expert

off your plate

Sales Tax Compliance Practices for Shopify Sellers

Managing sales tax for transactions across multiple states or different tax jurisdictions presents a complex challenge. Each state has unique tax laws, and keeping track of these can be cumbersome. Automated solutions integrating with Shopify help simplify this complexity by ensuring that all tax calculations are accurate and comply with the respective state’s regulations.

Here are some things you can do to ensure sales tax compliance for your Shopify storefront:

- Stay up to date on sales tax changes. Check for updates on tax regulations and sign up for notifications from states where you operate.

- Use an automated sales tax solution. As an online seller, it’s up to you to know when to register, charge, collect, and remit sales tax. Having an automated solution ensures your calculations are correct and the right amount of money is remitted to the state during filing.

- Review your tax settings regularly. Come up with a schedule to review your tax settings in Shopify regularly. This could be on a bi-weekly, monthly, or quarterly basis. You can make it coincide with your company’s sales patterns or your filing frequency.

- Keep detailed records. You should maintain accurate records for all transactions, tax calculations, and filings. This comes in handy if you are ever audited by tax authorities.

- Get professional advice. Consulting a tax professional is vital if you ever have a complex tax situation or make significant changes to your business.

Shopify Integration: Conclusion

Integrating a thorough Shopify sales tax automation into your store’s operations does more than just keep you compliant; it also boosts your business’s efficiency. Proper tax management ensures every transaction is processed correctly, which provides a smooth shopping experience for your customers and protects your business from compliance issues.

It’s important to keep learning and adapting your sales tax strategies to match legislative updates and business growth. As your business grows, so will your tax responsibilities. Keeping up-to-date and adjusting your strategies ensures that your tax systems can handle your expanding business needs.

By following these practices, Shopify store owners not only meet their legal requirements but also build a stronger, more customer-friendly business. This commitment builds trust with your customers and lays a strong foundation for future success in the competitive world of e-commerce.

Why Choose Zamp?

Zamp offers Shopify store owners a comprehensive managed solution for sales tax, taking care of everything from initial setup to adapting to changes in tax laws. Our automated services mean you can focus on running your business while we handle the complexities of sales tax compliance.

Book a demo with Zamp today and discover how our solutions can streamline your operations. With Zamp managing your sales taxes, you can forget about the complexities and focus on your Shopify store. Contact our team of sales tax experts today and start experiencing the ease of comprehensive tax management.

Book a call today

30-minute call

sales tax expert

off your plate

Shopify Sales Tax Integration: FAQ

Non-compliance risks penalties and audits, potentially damaging your business’s reputation and finances.

Sales tax rates and rules vary based on your business’s location and customer base, necessitating careful compliance management.

Yes, using automated tax software like Zamp can simplify calculations and ensure accuracy across regions.

Sales tax nexus determines where you must collect and remit sales tax, impacted by factors like physical presence, affecting compliance obligations.

Keep informed via Shopify’s tax guides, industry publications, and consulting with tax professionals to ensure ongoing compliance.

- Zamp Learnings:

- Sales Tax for Shopify Sellers

- Does Shopify Collect Sales Tax?

- How Sales Tax Works for Your Shopify Store

- Sales Tax Nexus and Your Shopify Business

- Sales Tax Thresholds

- Zamp Tip

- Determining Product Taxability

- How to Set Up Sales Tax in Shopify

- Options to Calculate With Shopify

- Integrating Zamp With Shopify

- Filing Sales Tax for Shopify

- Sales Tax Compliance Practices for Shopify Sellers

- Shopify Integration: Conclusion

- Why Choose Zamp?