Calculate sales tax accurately, sync transactions, and automate compliance across your systems.

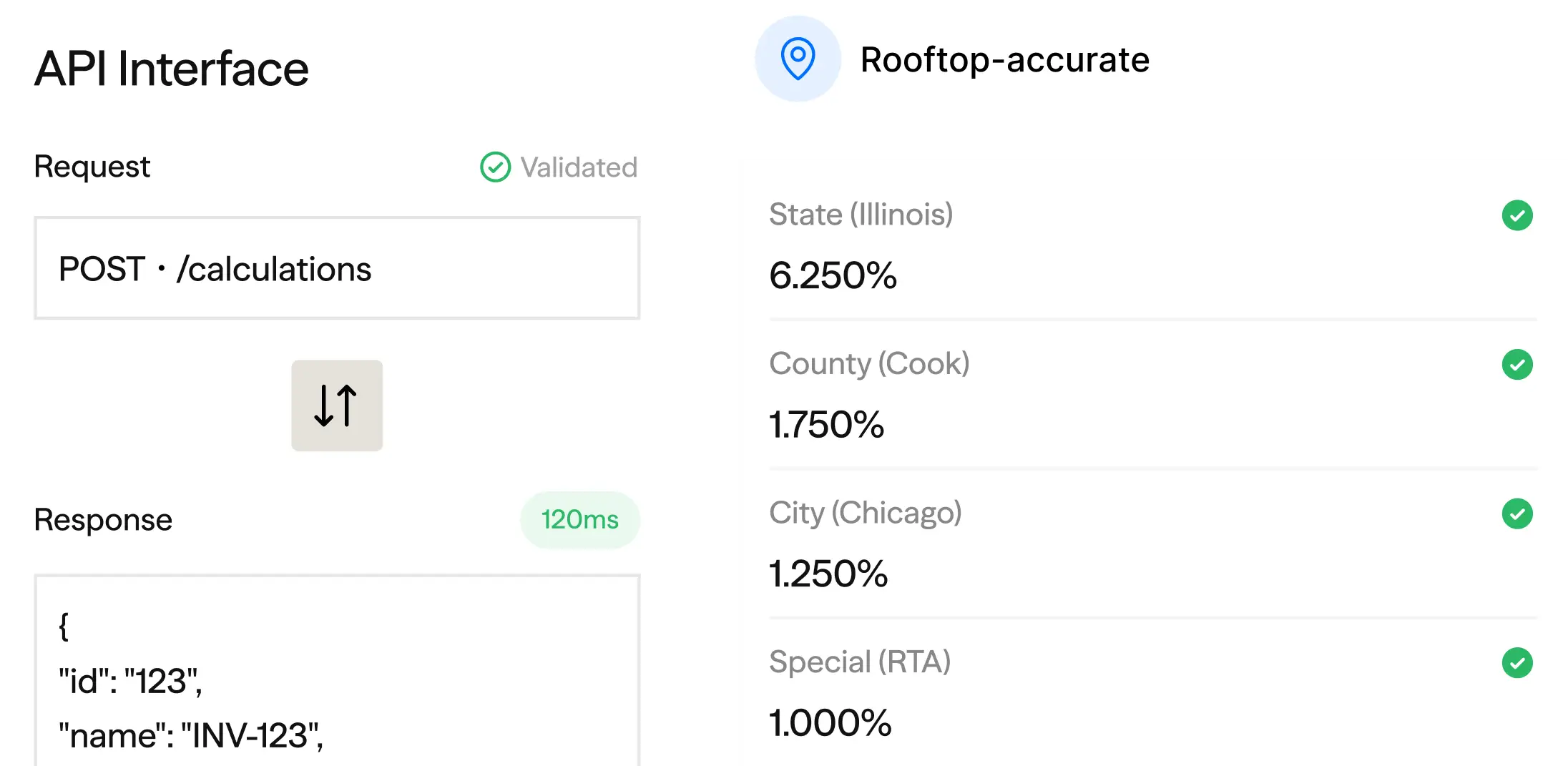

Apply jurisdiction-level sales tax calculations in real-time across U.S. and international markets.

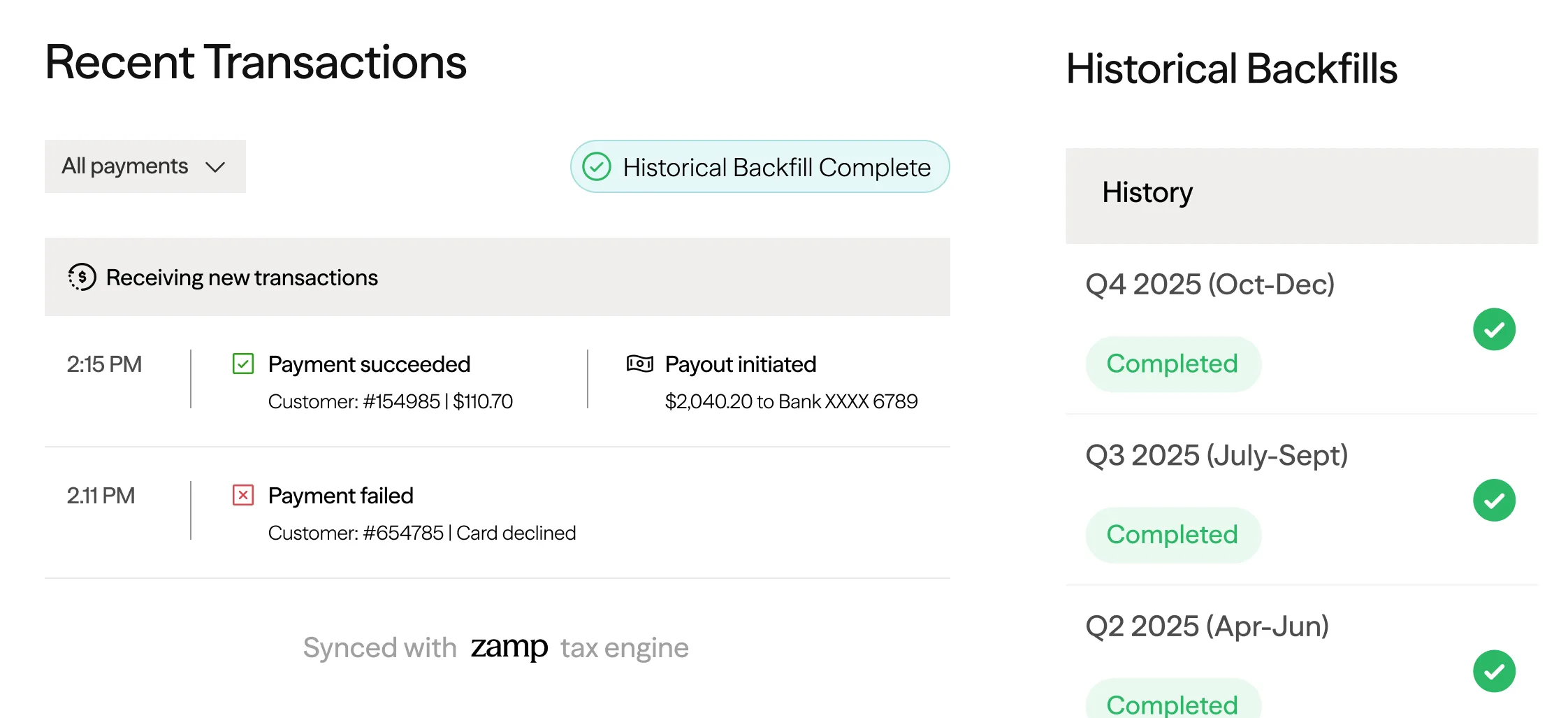

Sync real-time or batch transactions, including historical data, to ensure accurate filings and reporting from day one.

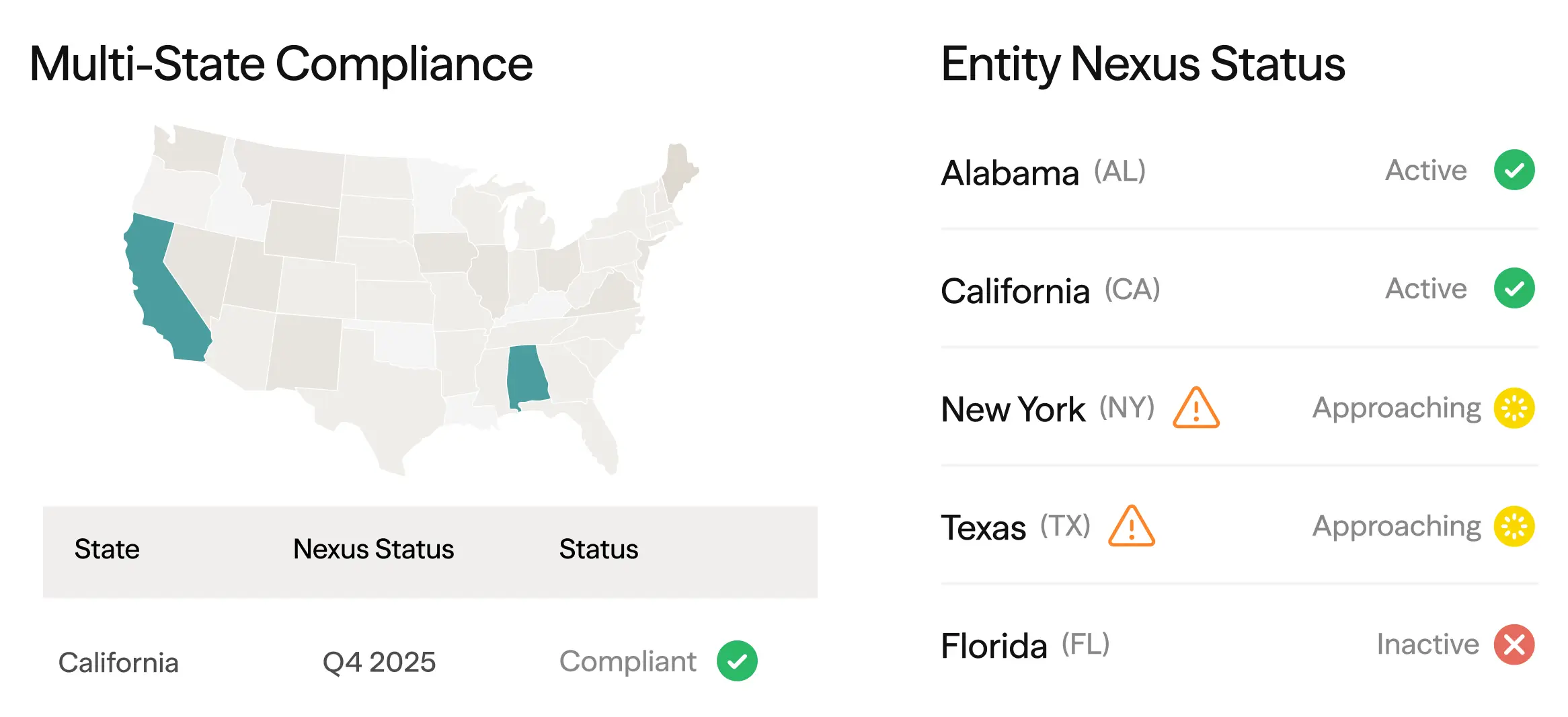

Maintain a complete view of economic and physical nexus as activity expands across states and countries.

Transaction data is structured to support state filing schedules, remittance requirements, and audits.

1

2

3

4

Create an API token and securely configure access.

Define nexus and product taxability to match your business with support from your dedicated onboarding team.

Calculate tax in real time at checkout or sync completed transactions in batches.

Access detailed logs, transaction histories, and calculation outputs. No manual action required unless review is needed.

Calculate sales tax on transactions

Support multiple legal entities and EINs

Rooftop-level tax determination

U.S., Canada, and international coverage

Real-time and batch transaction support

Automated refund logic

Sync historical transactions

Transaction-based usage tied to committed orders

Address validation for accurate calculations

Transparent pricing with no usage surprises

Support for refunds and transaction adjustments

Low-latency tax calculations for real-time flow

Generate filing- and remittance-ready data

Data structured to simplify monthly reconciliation

Detailed calculation and sync logs

Production-grade reliability for critical workflows

Jurisdiction-level tax calculations and data that remain reliable through reporting, reconciliation, and filings.

API docs built to get teams live quickly and stay useful as systems evolve.

Work directly with a dedicated tax engineer who understands your integration and compliance needs.

The API connects directly to registrations, filings, and ongoing compliance workflows—not just calculations.

Still have questions? Call us at 1-866-438-9267

or email us at support@zamp.com.

The free trial allows teams to explore the Zamp API in a sandbox environment with rate-limited access. The environment is preconfigured for testing, and all trial data is automatically deleted after 30 days.

Zamp uses bearer token authentication. All API requests must include a valid token in the HTTP Authorization header.

Yes. The API supports syncing historical transactions by date range, allowing teams to backfill prior activity for accurate reporting, reconciliation, and filings.

The API supports refunds and transaction adjustments. Tax is recalculated based on the adjusted transaction data, and refund activity is reflected accurately in reporting and compliance workflows.

Yes. The Zamp API supports multiple legal entities and EINs within a single account, making it suitable for multi-entity and complex organizational structures.

Usage is based on committed transactions sent to Zamp, not API calls. This aligns pricing with actual business activity rather than request volume.

In addition to U.S. sales tax, Zamp supports Canada, the United Kingdom, the European Union, and other international jurisdictions, depending on use case.

Yes. Many teams begin by using the API for tax calculations and transaction syncing, then extend into registrations, filings, and managed compliance as their needs evolve.

We connect where you sell. Explore the platforms we integrate with to see how Zamp simplifies your sales tax compliance.

0 Platforms