Calculate rooftop-accurate sales tax and automate compliance for your BigCommerce store with Zamp’s native integration.

Tax calculation, exemptions, registrations, filings, remittance, and audit reporting are handled on a single platform. .

Support DTC, wholesale, marketplaces, returns, and exempt customers in a unified workflow.

Usage is based on committed orders, not API calls, with no hidden overages.

A consistent team supports setup and filings, with no handoffs and no re-explaining.

1

2

3

4

Add Zamp from the BigCommerce App Marketplace and connect it to your store.

Define where you collect tax, assign product tax codes, and manage exempt customers with guided onboarding to ensure accuracy.

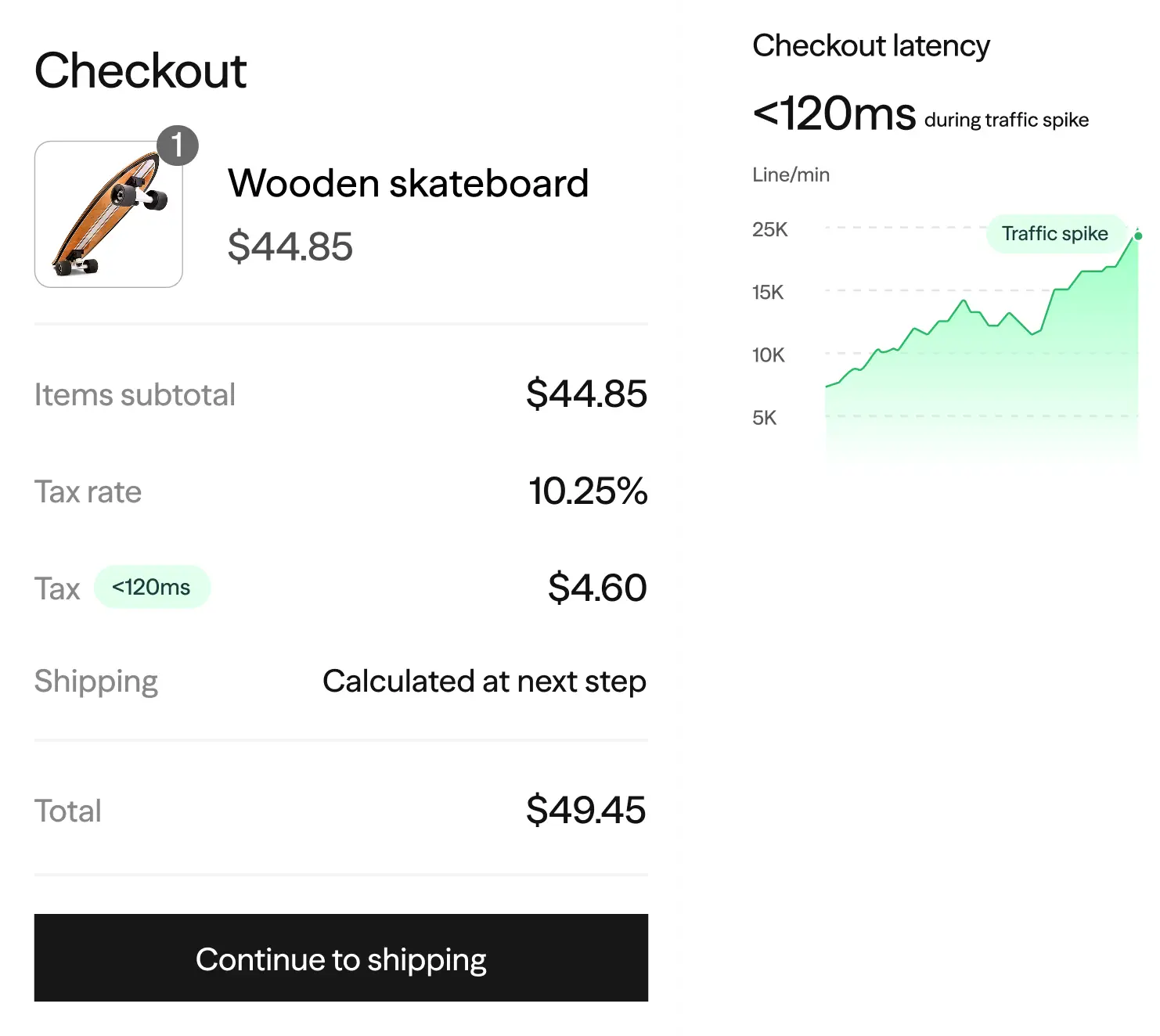

Apply rooftop-accurate tax at checkout with sub-second response and order-level syncing.

Sync historical orders, confirm liability and reporting, and activate managed compliance.

Still have questions? Call us at 1-866-438-9267

or email us at support@zamp.com.

BigCommerce supports fallback tax settings that can be configured as a continuity measure, ensuring orders can still be processed.

Exempt status is applied at checkout and carried through to jurisdiction-level reporting and state filings.

Yes. External channel transactions can be unified in Zamp for consolidated reporting and compliance.

Zamp recalculates and reports tax accurately for full and partial refunds, returns, and line-item adjustments.

Yes. Zamp supports Canadian tax regimes with jurisdiction-level reporting and compliance workflows.

Zamp provides line-item, jurisdiction-level reports aligned to filing forms and audit requirements.

Usage is based on committed orders, not API calls, providing predictable and reconciliation-friendly billing.

Your team reviews nexus, product taxability, exemptions, and initial liability reports before production compliance is activated.

We connect where you sell. Explore the platforms we integrate with to see how Zamp simplifies your sales tax compliance.

0 Platforms